The DeGen Bible to Financial Freedom - Vol.45

FTX liquidation? Friend Tech? CPI? Looks like even the crypto media doesn't care about this market. Key data points are as dead as price actions. We have no more scandals to dig, Binance FUDs are so lame. More DYOR needs to be done in the Solana and Ton ecosystems.

Week 8 September - 15 September 2023

KBW, Token 2049, Arthur Hays is the party king - Mars Captain

🧠 Observations

- Captain doesn't have much to comment on this boring market. FTX liquidation? Friend Tech? CPI? Looks like even the crypto media doesn't care about this market. Key data points are as dead as price actions. We have no more scandals to dig, Binance FUDs are so lame.

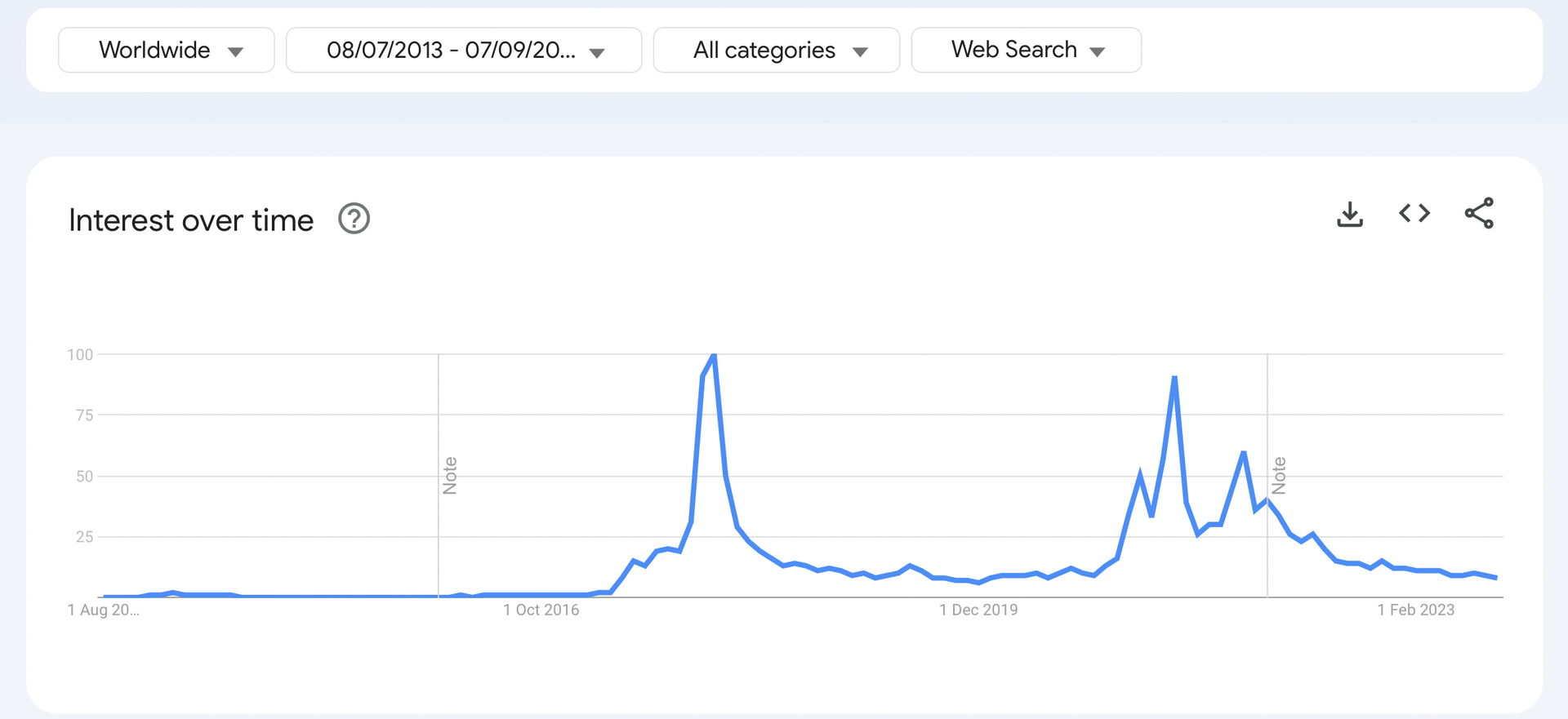

- Ecosystem development-wise we can see interesting trends in Solana and Ton. While layer twos struggle to onboard new users and enter in a cut-throat competition.What Solana and Ton are doing is at least refreshing. More DYOR needs to be done there.

- Big events often rotate to the Asian sphere in the last quarter of the year. We have KBW, Token 2049, and upcoming Hong Kong Fintech week. The only thing that we can see apart from the usual faces everywhere is the come-back of King Arthur and his partying skills. Ultimately that's a key difference compared to the boomer economy.

💵 Stablecoin & Market Landscape

- Stablecoin market share remains high in reference to the total crypto market capitalization. 11.3% of stablecoin (123.9B) on 1.09T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 12ish% with a 1ishT total MC.

- Now at 1.09T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

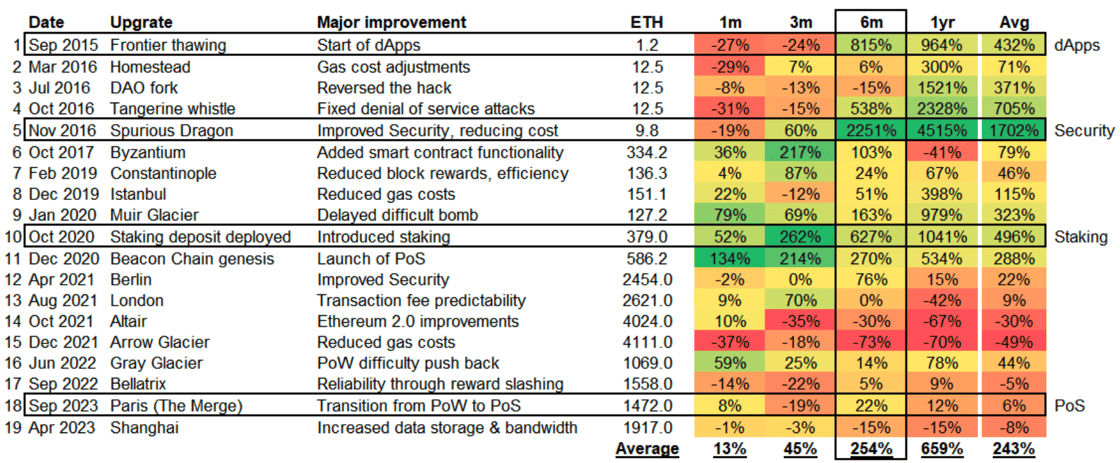

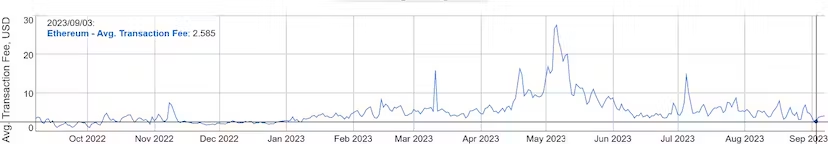

- This is interesting. Captain agrees that Etheruem doesn't have any narratives except becoming faster and cheaper. And indeed, degens wouldn't care about centralisation or whatever. What's crucial is how to moon and lambo.

- So, Matrixport is hinting that the next EIP-4844 upgrade "might" renew the interest of coin value. In a way, there is no other way to fight layer twos given the status quo. Ethereum's going lower gas fee is a corollary for layer twos to generate further adoption.

- NFT bear market, memecoin speculation going down, and layer 2s are lowering the transaction costs. Ethereum's first inflationary moment in the last 9 months. Hein ah, this is deep bear market, boyz.

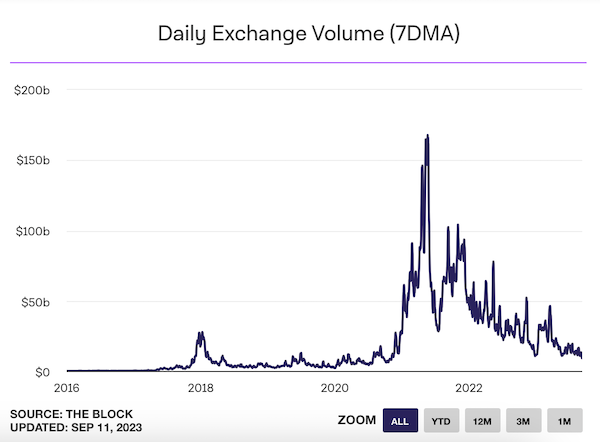

- Trading volume is getting down to the 2019 level while price levels and innovation landscape have evolved significantly over the years. The next 100B level trading volume will be make crypto as solid as Himalayas.

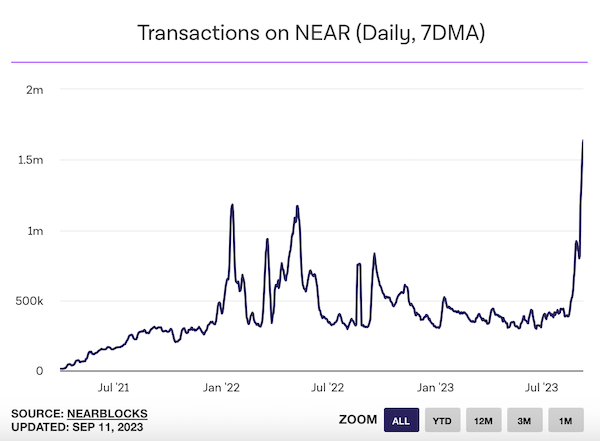

- USDC is coming to NEAR natively.

- Sweat Economy about to land in the US market.

- Mr.Beast's new community consumables are launching on NEAR.

- Is this buy signal?

🔢 Index

- Korean Blockchain Week, Token 2049, and CPI as expected, in a week dipped to 30 and raise back to 45. So is life in crypto.

Perhaps from the next volume onwards, we should just rely on CBBI. Fear Index doesn't seem as good reference these days.

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

2/ I’ve always been a psychology trader myself for a couple of reasons: 1. I started crypto when I was at a very young age with zero finance background 2. Always intrigued by psychology itself + philosophy 3. I just wanted to make money, bad at maths

— Zoomer Oracle (@ZoomerOracle) September 5, 2023

1/ You need to survive three crypto cycles to make it.

— Ignas | DeFi Research (@DefiIgnas) September 5, 2023

One for learning, one for earning, and one for building generational wealth.

As I gear up for my 3rd cycle, this bear market feels like déjà vu, giving a sense of what's coming next: 🧵

1/ On A Bear Market II (Vibes)

— 6529 (@punk6529) September 8, 2023

I have the privilege of having enjoyed two previous crypto bear markets.

Now on my third, it is more interesting to watch because the same feelings emerge, the same discussions happen.

NFTs

Macro econ/ Regulations

Research reports/videos (DYOR)