The DeGen Bible to Financial Freedom - Vol. 4

Week 4 July - 8 July 2022

We will not surrender - Mars Captain

🧠 Observations

- Total horizontal development data-wise. But total MC briefly moved back to 1T. 👀

- Quiet week, if we don’t follow Voyager bankruptcy, or 3Arrows brothers’ disappearance. 😪

- Pay attention to Sri Lanka’s default, Russo-Ukrainian war, and further inflation attacking major economies. Looks like crypto doesn’t care about macro unrest anymore, which is a good thing. ❤️

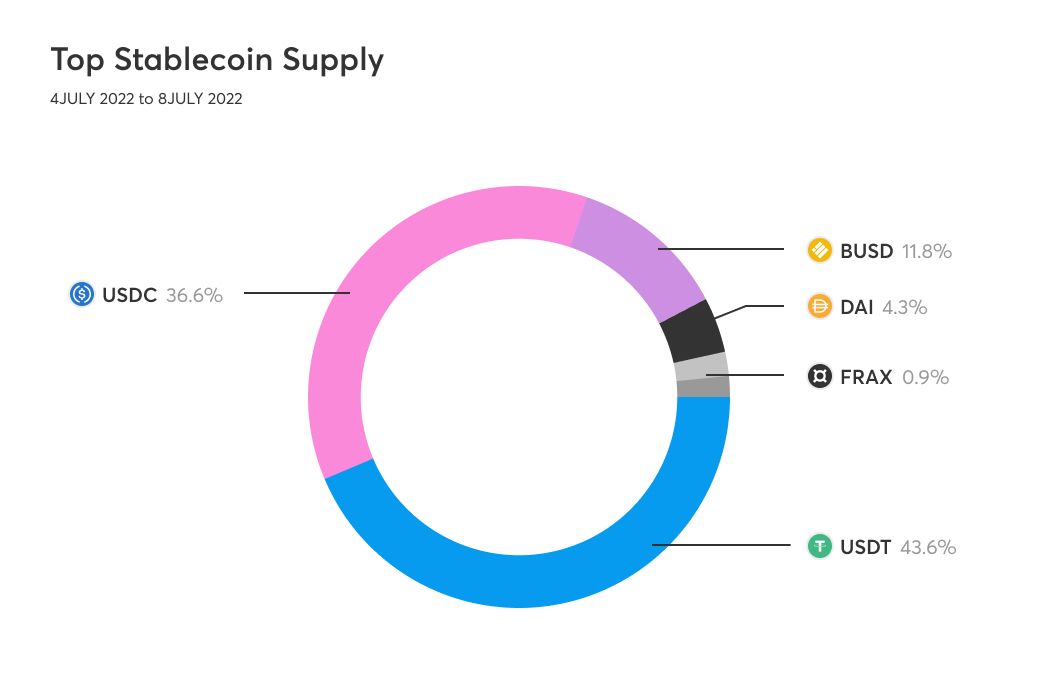

💵 Stablecoin & Market Landscape

(Last 7 day average) Stablecoin market share remains EXTREME high in reference to the total crypto market capitalization. 15.68% of stablecoin (151.7B) on 0.95T crypto market.

Stablecoin % stayed high throughout the last 7 days, now at 15.68%. Flattening trend continues 🤔

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 15ish% with a 0.99ishT total MC.

Now at 950B, regained a bit the MC, but we still have some macro events ahead, most notably the FOMC on 25-26 JUL. 🤮

Reminder, we are at the lowest point in the last 365 days for the whole month of July.

Extreme high correlation US Stock x Crypto by CaptainMars on TradingView.com

Can’t decoupling continue? This week moved back up to 0.8ish. I really hate investors taking crypto as stock. Why crypto if it’s just another stock? Come on! 😠

Layer 2 summer? Both Arbitrum and Optimism are doing good. Bankless is pumping L2 Summer if you look for speculating narratives. 🎄

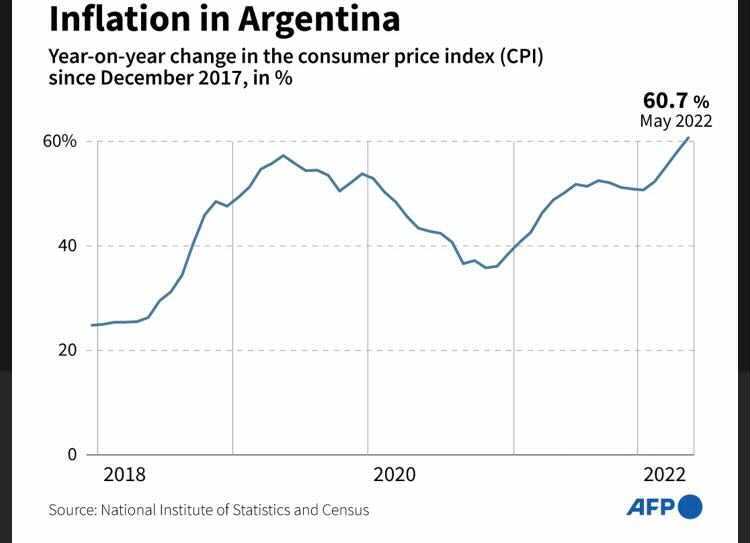

Wen developed world’s folks crying for 8-10% inflation, they just don’t care what’s going on in some other parts of the world. BTC is the holy grail against inflation. 🤦♂️

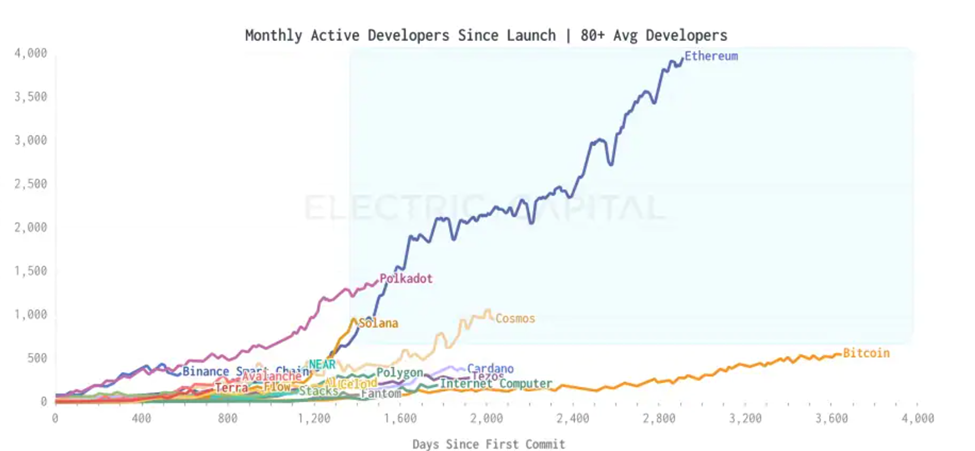

Ethereum is king, Polkadot is queen? This diagram shows us which are bluechips! 💙

🔢 Index

Bitcoin Fear and Greed Index is 20 ~ Extreme Fear

— Bitcoin Fear and Greed Index (@BitcoinFear) July 8, 2022

Current price: $21,383 pic.twitter.com/Ny0BoMV7NJ

Ummm, pumped up to 20ish this week. That’s a lot for a bear market if you compare it to F&G index? Doesn’t look very natural... 🤔

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) July 8, 2022

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 1️⃣1️⃣

🗓 Jul 8th, 2022

The price of #Bitcoin is $21,649 pic.twitter.com/Re043sVKXi

Remain 10ish. That makes sense 🧊

📰 Current affairs

Bitcoin:

Ethereum:

Layer 1s & DeFi:

NFTs & Metaverse:

Macro Economy & Regulations:

https://www1.hkexnews.hk/listedco/listconews/sehk/2022/0703/2022070300118_c.pdf

Interesting Tweets:

Our threat intelligence detected 1 billion resident records for sell in the dark web, including name, address, national id, mobile, police and medical records from one asian country. Likely due to a bug in an Elastic Search deployment by a gov agency. This has impact on ...

— CZ 🔶 Binance (@cz_binance) July 3, 2022

I co-founded another new business in Web 3! (time to BUIDL).

— Raoul Pal (@RaoulGMI) July 3, 2022

ScienceMagic.Studios is a token studio working with the biggest communities and brand in the world. 1/

🧵Thread 1/

— Wall Street Silver (@WallStreetSilv) July 2, 2022

"Bicycle is the slow death of the planet."

A banker made the economists think this when he said:

“A cyclist is a disaster for the country’s economy: he doesn’t buy cars and doesn’t borrow money to buy. He doesn't pay insurance policies. pic.twitter.com/eS4Orcya6i

#Bitcoin has failed to live up to the hype and those institutions that put a toe in the water last year are not likely to take the plunge. This year most will opt to cut their losses and sell. I doubt @saylor and @nayibbukele have enough dry powder to keep the market propped up.

— Peter Schiff (@PeterSchiff) January 18, 2022

Research Reports & Videos (DYOR):