The DeGen Bible to Financial Freedom - Vol. 21

Week 1 Mar - 7 Mar 2023

DYOR is work-out, it has to be daily, monthly, yearly. - Mars Captain

🧠 Observations

- This should be a transitional week before another downturn, as US CPI, FOMC, Silvergate crisis, SEC iron and blood policy ahead in the next few weeks. 🩸

- Can Chinese FOMO sustain? People’s Daily has officially spoken to (soft) support Hong Kong to be the regional crypto hub. But, has it been too late, or crypto isn’t sexy anymore? People are onto ChatGPT and AI, sorry. LOL. 🇨🇳

💵 Stablecoin & Market Landscape

Stablecoin market share remains EXTREME high in reference to the total crypto market capitalization. 12.67% of stablecoin (136B) on 1.07T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 15ish% with a 1ishT total MC.

- Now at 1.07T. Still hanging around on the 1T level. Going steady. 🤔

Reminder: June & Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

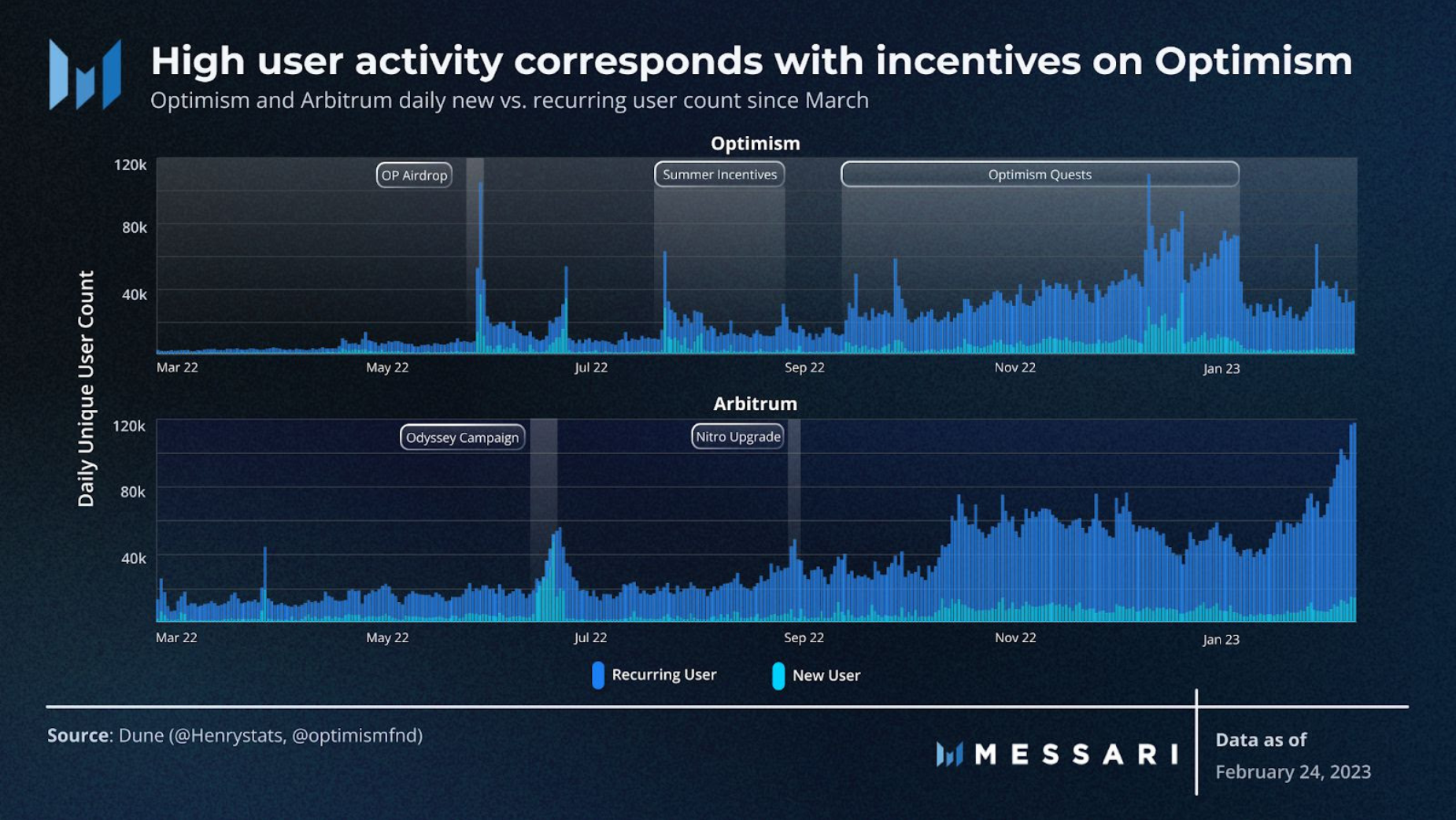

- Wait, if you take into account that Arbitrum hasn’t released their token yet, then we already know who’s gonna go further in that regard. 👀

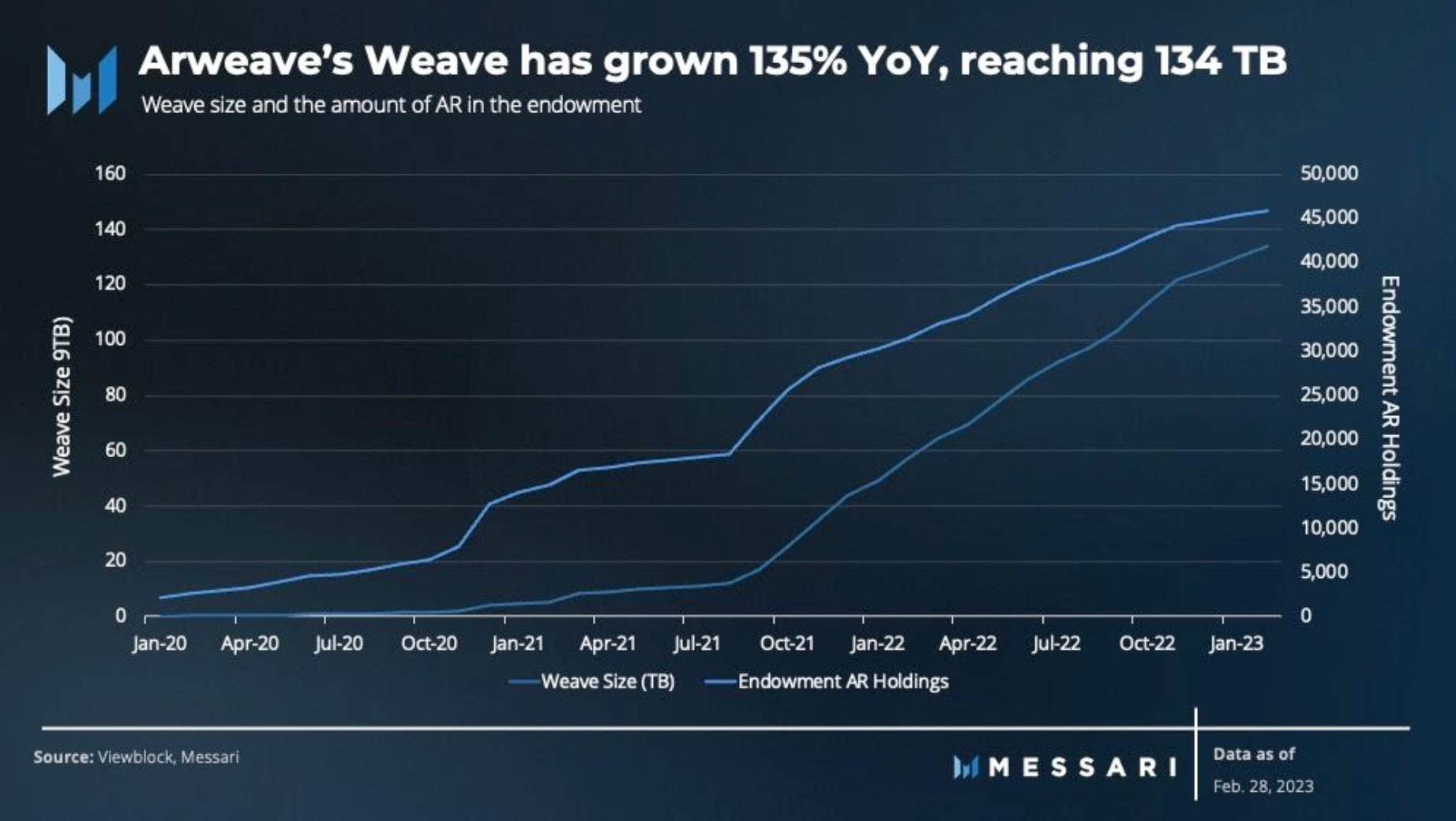

- Real usage drives real demand. Arweave is leading its storage in a classy and decentralised manner. 🉑️

- Let me quote Bitcoin Magazine’s statement here:

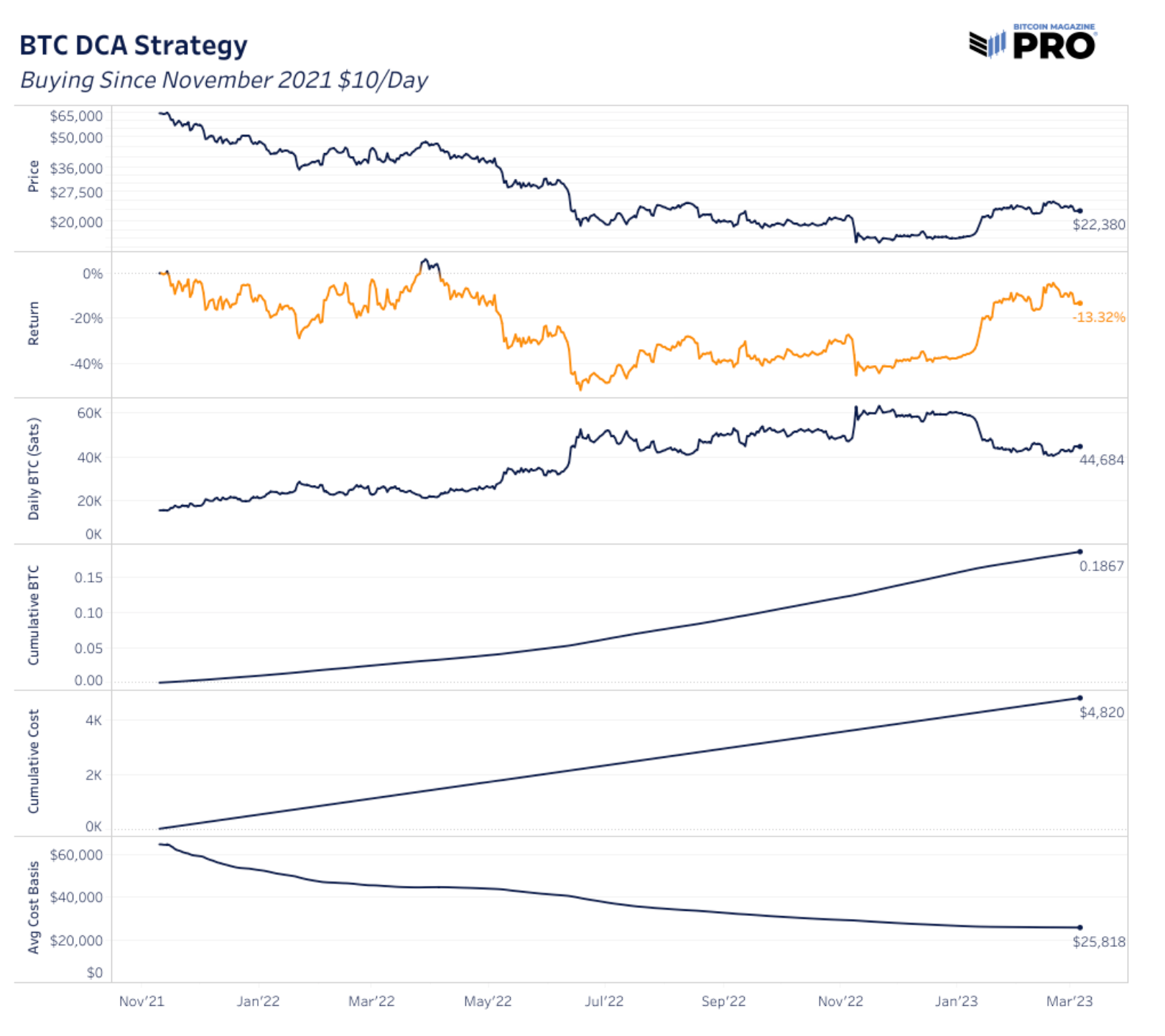

“While bitcoin’s current -67% drawdown from all time highs garners all the headlines, a passive approach to bitcoin investment often yields more optimal results. Hypothetically, if one bought $10 of bitcoin every day since the exact $69,000 market peak, the cumulative $4,820 invested would leave you with 0.1867 BTC, for a current return on investment of -13.32%. While a negative return is by no means optimal, it shows the difference between cherry picking headlines and the actual reality that many passive bitcoin investors/HODLers actually experience.” 💪

🔢 Index

Bitcoin Fear and Greed Index is 49 — Neutral

— Bitcoin Fear and Greed Index (@BitcoinFear) March 7, 2023

Current price: $22,084 pic.twitter.com/K9r7Q4KAev

- Amidst Silvergate crisis, this is still holding ok, not a good sign for the next few weeks if the sentiment’s that good.. 🤔

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) March 7, 2023

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 1️⃣5️⃣

🗓 Mar 7th, 2023

The price of #Bitcoin is $22,413 pic.twitter.com/Wje2X5w17q

- Small drop, but holding 2 digits. 🧊

📰 Current affairs

Starfish Finance:

Bitcoin:

Nothing much this week.

Ethereum:

Layer 1s & DeFi:

NFTs & Metaverse:

Macro Economy & Regulations:

Interesting Tweets:

早安朋友, going to EthDenver? 🇺🇸

— SushiSwap (@SushiSwap) February 21, 2023

🎰 Come join us at the Derivatives Casino!

The twist?

No Cash, No Limit barter blackjack where you can bet anything in the world except money.

🔍 Reexamine the meaning of true value while discussing the future of DeFi - register now 👇🏼 https://t.co/fyMi86NxLy

Account abstraction is extremely powerful.

— John Rising (@johnrising_) February 25, 2023

Here are a few of the things you can do to make the most of it: pic.twitter.com/jWavGLzBhE

As Boson continues its path of adoption, Boson’s highly anticipated roadmap update is here.

— Boson Protocol (We're Hiring!) (@BosonProtocol) February 24, 2023

Let’s take a look and break down this journey below 👇 pic.twitter.com/3nalJKsi5D

Research reports/videos (DYOR) :

https://archive.ph/eQ78m#selection-317.0-322.0