The DeGen Bible to Financial Freedom - Vol. 1

Week 13 June - 17 June 2022

Getting more furious at boomers laughing at us. I’d rather go to dust than getting laughed and mocked all my life - Mars Captain

🧠 Observations

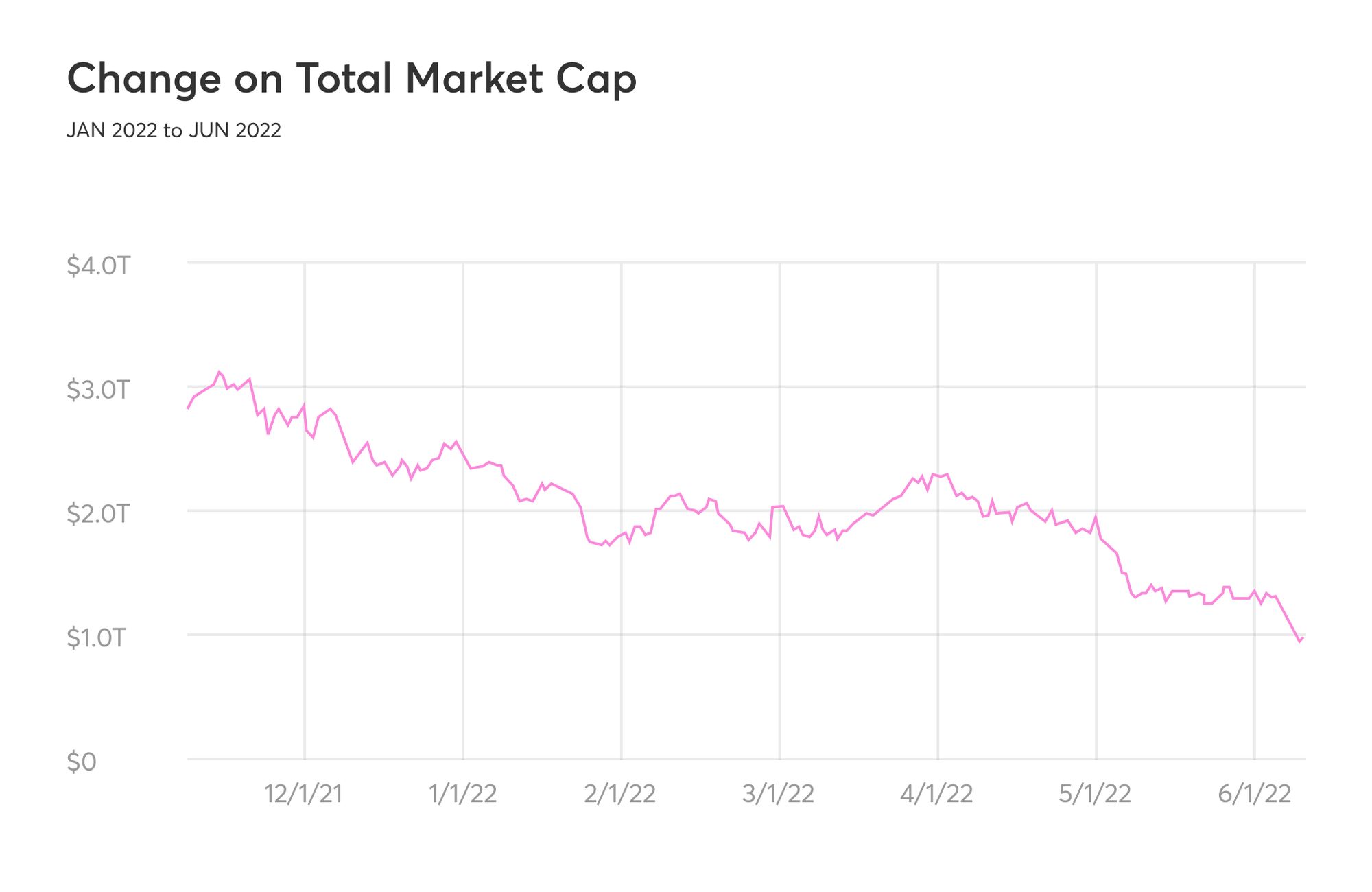

- Total MC broke 1T, going down in extreme bearish sentiments 📉

- ETH-stETH crisis going on with 3AC and Celsius going down hand-in-hand happily together. 💑

💵 Stablecoin & Market Landscape

(Last 7 day average) Stablecoin market share remains EXTREME high in reference to the total crypto market capitalization. 15.64% of stablecoin (154.5B) on 0.99T crypto market.

Stablecoin % further jumped in the last 7 days, now at 15.64%. A significant uptick compared to last week.

Reminder, in mid-NOV 2021, this percentage was ~4% with a 3T total MC. Now we are at ~15% with a ~0.99T total MC.

There is never the ATH or ATL in crypto, it can always go higher or lower. This week we broke 1T. 😢

Reminder, we are at the lowest point in the last 365 days for three consecutive weeks already.

Extreme high correlation US Stock x Crypto by nang12718 on TradingView.com

Correlation spiked up this week to 0.94. Boomers gaining over control again.

Could it be that US trading activity is crashing the market? 😠

Inhabitants of developing countries are the most optimistic about Bitcoin's future. Even China.

🔢 Index

Bitcoin Fear and Greed Index is 9 ~ Extreme Fear

— Bitcoin Fear and Greed Index (@BitcoinFear) June 17, 2022

Current price: $20,449 pic.twitter.com/fBz4Y4pzSS

Well, what can we expect, single digit all week long. Extreme bearish! 🐻

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) June 16, 2022

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 1️⃣4️⃣

🗓 Jun 16th, 2022

The price of #Bitcoin is $20,964 pic.twitter.com/aS1EaLw6B6

From last week’s early 20ish, waterfall-ly dropped to 14 today. Can it go single digit? 🥶

📰 Current affairs

Bitcoin:

Ethereum:

Layer 1s & DeFi:

NFTs & Metaverse:

Macro Economy & Regulations:

Interesting Tweets:

Uhh… a massive DAO just voted to “refund” one of their investors who was owed a 30x return ($5M+)

— Tim Connors 🎒 101 (@itstimconnors) June 14, 2022

This is an insane story that impacts all builders in web3 and as a founder I need to speak out

Merit Circle DAO vs YGG 🧵

1/ There are 3 stages of a bear market.

— Yano 🟪 (@JasonYanowitz) June 13, 2022

We just entered stage 2 🧵

Research Reports & Videos (DYOR):

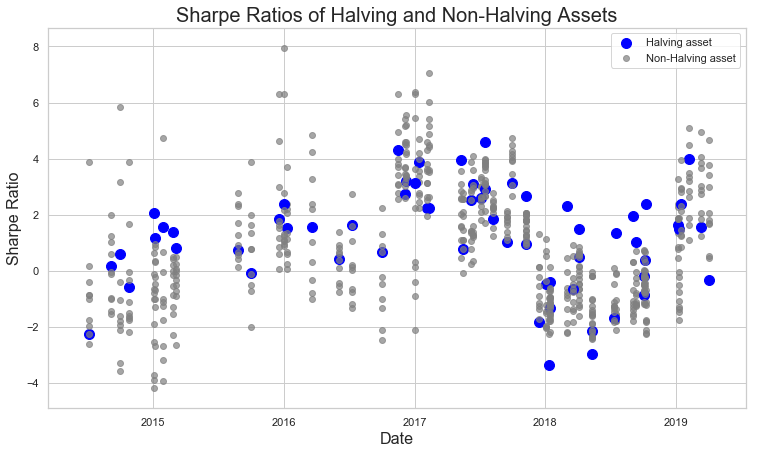

4th Annual Global Crypto Hedge Fund Report 2022:

https://www.pwc.com/gx/en/financial-services/pdf/4th-annual-global-crypto-hedge-fund-report-june-2022.pdf