The DeGen Bible to Financial Freedom - Vol.42

$CNY is under a two-front war. If this situation is mirrored in DeFi, all the traders now would heavily be shorting $CNY as per on-chain movement of the central bank selling US bonds to support the currency value.

Week 18 August - 25 August 2023

What's wrong with the East? - Mars Captain

🧠 Observations

- The expression of the elephant in the room describes the best the economic situation in China. $CNY is under a two-front war. The People's bank of China has a difficult time to decide between protecting real estate (by increasing interest rate) and protecting export (by devaluing the currency). So far, we can see the CCP has opted for the latter and as we see these Chinese real estate giants falling down one by one.

- Captain has expressed his concern over $CNY in SEAN Times vol.37 using the Curve analogy. If this situation is mirrored in DeFi, all the traders now would heavily be shorting $CNY as everyone sees the on-chain movement of the central bank attempting to sell US bonds to support the currency value... Oops, not financial advice, guys. Please don't, it's fiat, it's not crypto. (Well, we were told that fiat is real? LOL!) I hope no traditional finance people read this post.

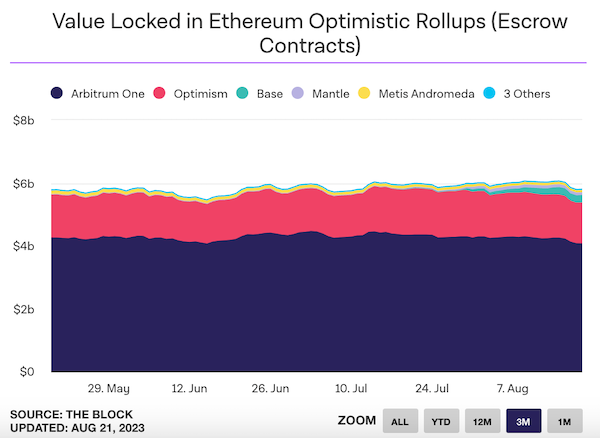

- The market is so dry that a fabricated friend.tech thing can shoot up the baby phase of Base to the moon. Come on. Arbitrum has the most organic retail traffic on L2, Optimism has the most enterprise level adoption (even Base is based on OP Stack). Are we that sure about friend-to-earn? We have seen StepN, and multiple similar failures. This is a good tactic to kick off the ecosystem, but DeFiLama isn't saying there is any other thing going on on Base... Watch your steps, Base Degenz.

- Yeah, SpaceX sold, but it was last year and some regular listed company practice. So, we see the size of Elon is size whether it's past or present tense. Did Singapore's stable framework or Hong Kong's Hashkey taking retail investors FOMO the market? Sorry, their size is not size, we are in crypto, not in TradFi, not in banking. Understand this will help us navigate opportunities more easily.

💵 Stablecoin & Market Landscape

- Stablecoin market share remains high in reference to the total crypto market capitalization. 11.36% of stablecoin (124B) on 1.09T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 11ish% with a 1ishT total MC.

- Now at 1.09T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

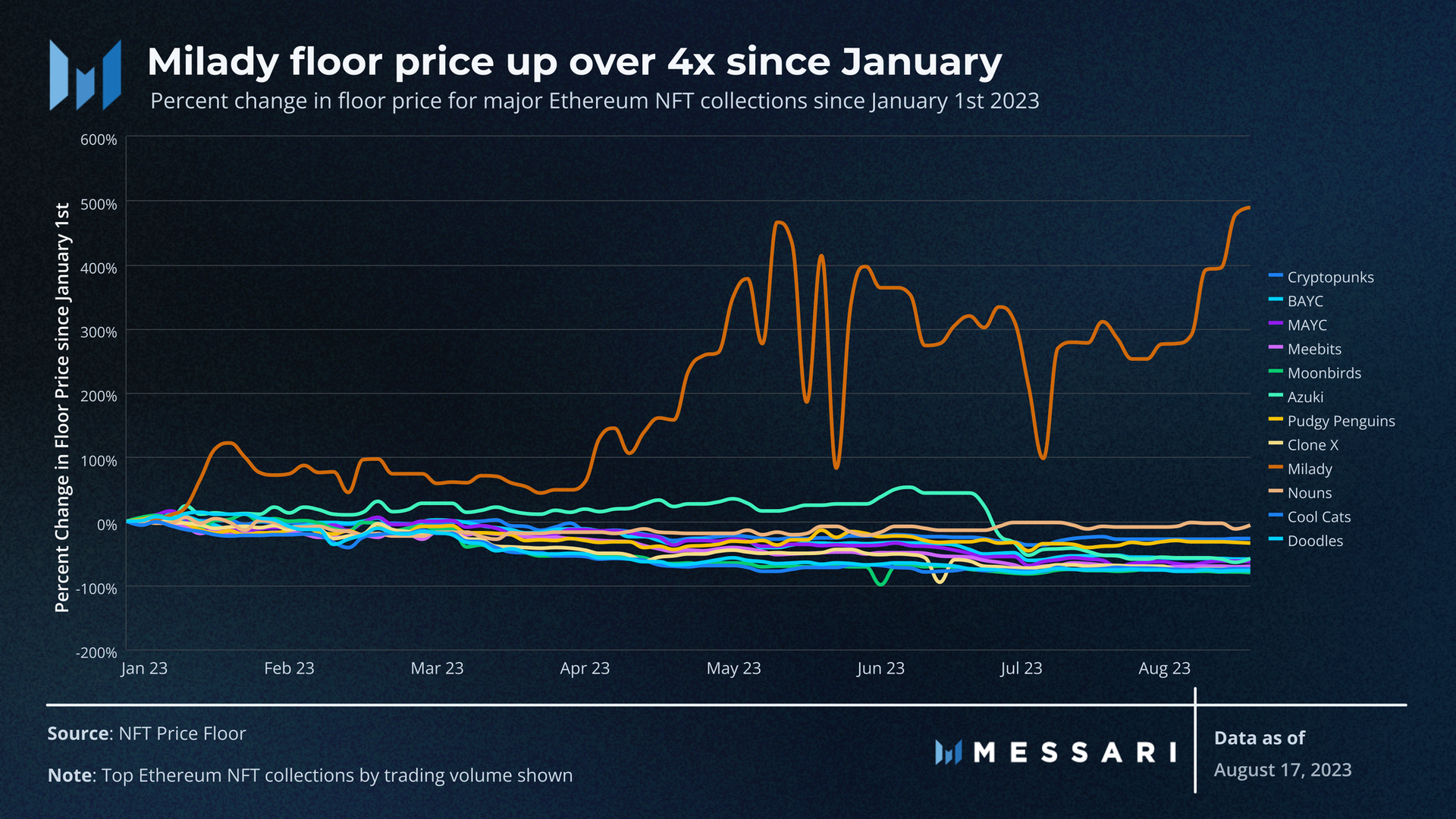

- If we look at the NFT market as an independent crypto cycle, we can see the old blue-chips like BAYC, Crypto Punk, Azuki as BTC, ETH, XRP, then you have Milady as the Dogecoin.

- If Captain's analogy makes sense, that means when Milady crashes, the other NFT OGs will still crash more. Memecoin is the last category to lead and crash. So NFT's abyss hasn't bottomed yet.

- Looks like we have some movements to keep a close eye on.

- Not that Captain is not convinced with Base. But, crypto is a grassroots movement. If some billionaire backed stuff can fight organic traffic, I mean, please do. Did you ever see human controlling the nature win? Arbitrum is where you see the nature, not Base. Sorry, Captain is just emotional about corporate monopoly, despite he has good feelings towards Coinbase.

- Look, if we have faith in Base, we might as well look at the upcoming opBNB. The queen of EVM is fostering a princess or a price at least for layer 2.

- NFT isn't Captain's most favourable, though we do acknowledge its value. Looking at stats like this one simply reflects how difficult a nobody would be able to fight against corporate monopoly given the same technology.

- Winning isn't just about your having the sharpest sword. There is an invisible and intangible context, culture, history that your sword can never fight. This is what we think about NFTs, it's gonna make brands more profitable but not too much the grassroots.

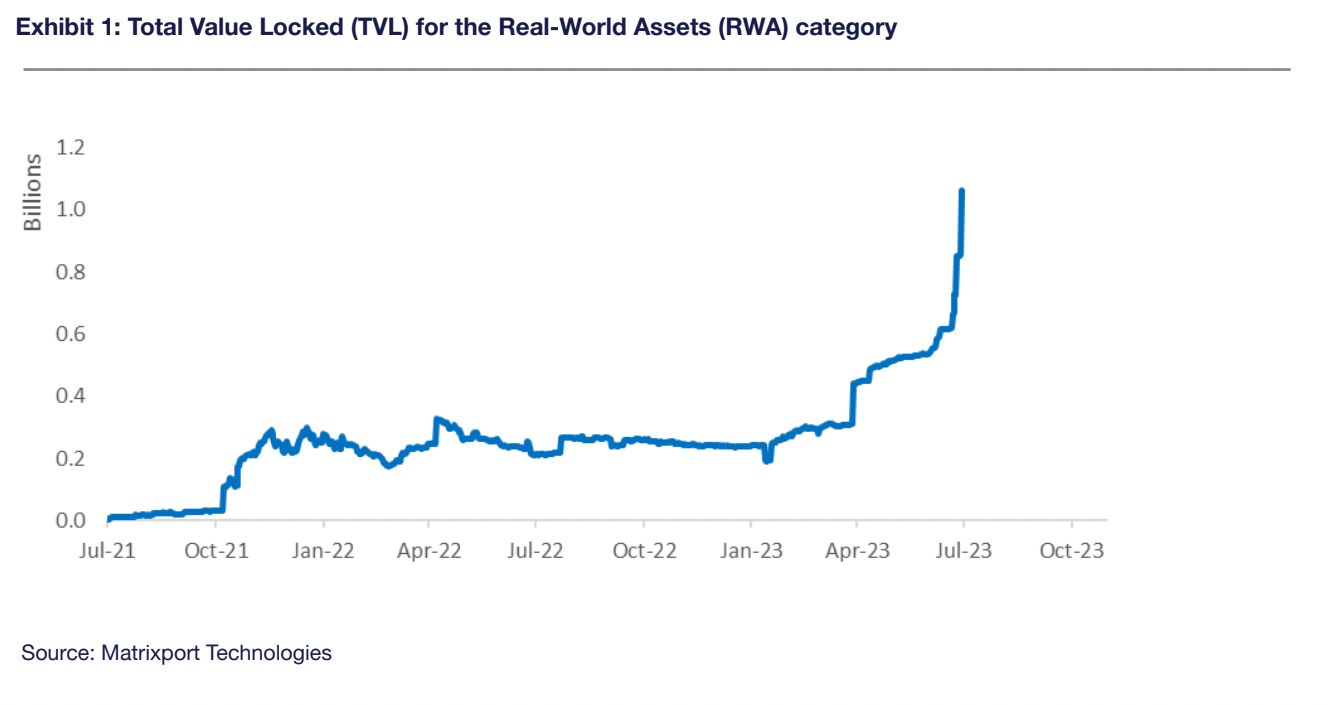

- Basically, these RWAs are short term T-bills right...

- Data cosmetics, we like some graph and fancy visualisation, but we also needa question what is represented.

🔢 Index

Bitcoin Fear and Greed Index is 39 ~ Neutral

— Bitcoin Fear and Greed Index (@BitcoinFear) August 25, 2023

Current price: $26,147 pic.twitter.com/av3FzWcvBc

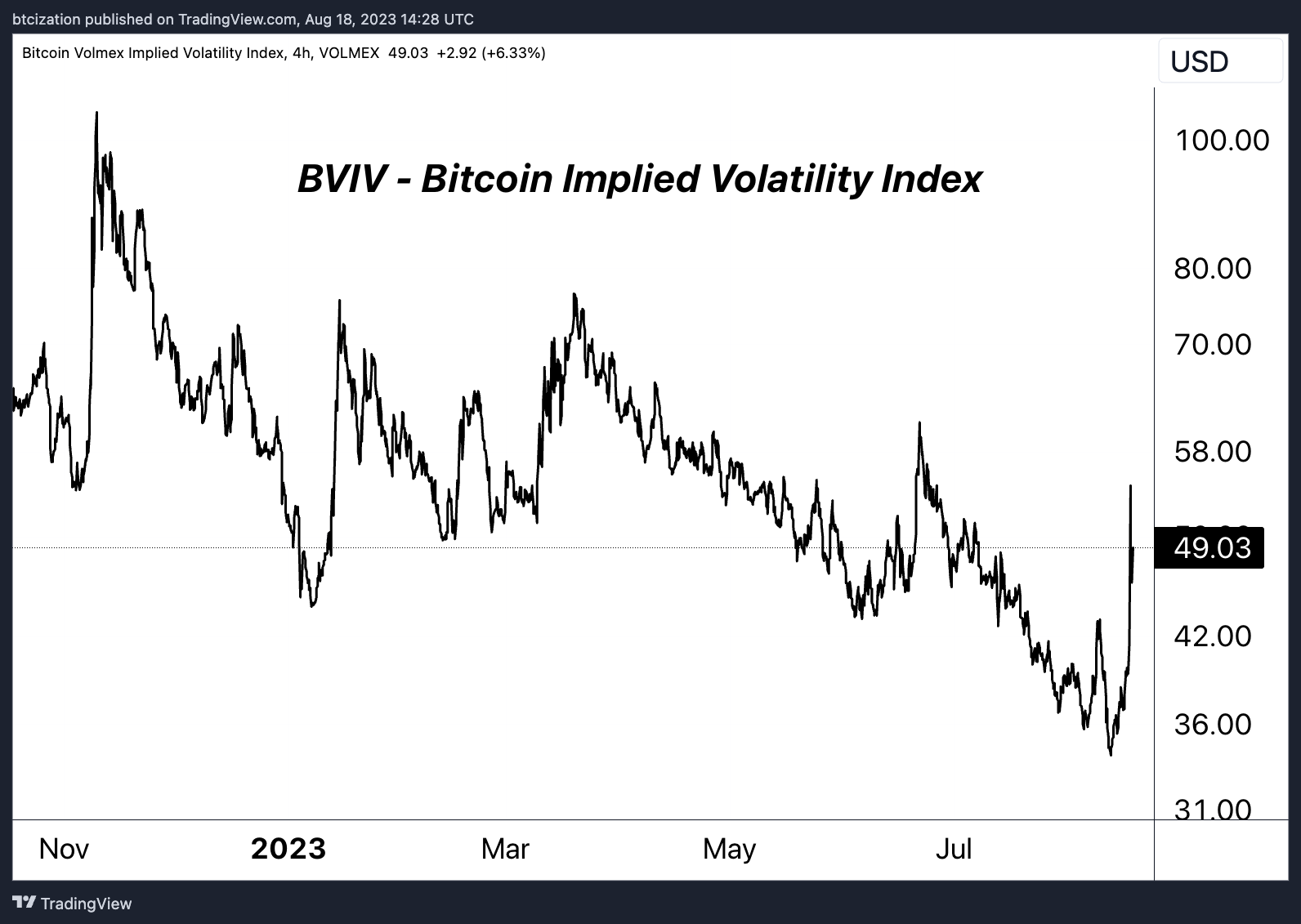

- SpaceX sold BTC old news, + traditional media house amplifier, only pushed down 10ish points + 7% decline in $BTC price.

- The lesson here, is that crypto people should not underestimate the traditional media's power and a lot of us live in echo chambers of decentralisation and data sovereignty. If some WSJ or Bloomberg repost a 1-year old news can push down 7% of the elephant. Think how niche and small our market is for now.

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) August 24, 2023

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 3️⃣6️⃣

🗓 Aug 24th, 2023

The price of #Bitcoin is $26,441 pic.twitter.com/YwudwasikE

- CBBI getting close to Fear index. What is the catch here?

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/dlnews/L4QE47UQRJHDHEJ52KPQQDZSYQ.jpg)

The Stake Must Flow

— Michael Rinko (@mrink0) August 16, 2023

if liquidity mining and new token launches proliferate on solana, degens will need latent capital for leverage to, well, degen

enter: liquid staked tokens (LSTs) pic.twitter.com/TQZbfMzVB6

Maker introduced Enhanced DAI Savings Rate which has completely evaporated its expected profits.

— Kunal Goel (@kunalgoel) August 17, 2023

It was on a run-rate to $80 mn in profits for the next 12 months, but now it will only do $2 mn.

Was it worth it? pic.twitter.com/n8WrKIRF9v

2024/2025 likely to bring Bullrun

— RunnerXBT (@RunnerXBT) August 19, 2023

what are my arguments 👇

Here is how 2019 echobubble played out:

- Massive run up, distribution/chop at top then

- Leg down (we are here)

- Chop for 6-9 months

- 🅿️andemic dump

- Reclaim of some levels & Up Only from there

Where does that put… pic.twitter.com/2nuZHZ6y6j

1/15🧵 Tornado Cash (TC) OFAC Ruling Today

— BawdyAnarchist (@BawdyAnarchist_) August 18, 2023

The govt won on all counts. This case was unfortunate in nearly every way possible, and it was painful reading through it. As always, recommend you read it yourself. I'll summarize here. https://t.co/1cb9tOfi8M

Retail always loses. This is why👇

— Beanie (@beaniemaxi) August 21, 2023

Coinbase insiders dumped hundreds of millions of dollars worth of $COIN. Much of this near the top, over $250 per share.

The co-founder of Coinbase, who is also founder of Paradigm, was a big part of that selling. He also bought the recent… pic.twitter.com/e14eLfoVxz

There are 4 Phases of a Bull market.

— Edgy - The DeFi Edge 🗡️ (@thedefiedge) August 17, 2023

We’re nearing the end of Phase 1. Here's how to play market cycles so you don’t screw up your best chance at generational wealth.

Here’s your playbook for:

1) Navigating each phase of the bull market

2) Maximizing your profits

3) and… pic.twitter.com/8l8za9MjMt

NFTs

Macro econ/ Regulations

/cloudfront-us-east-2.images.arcpublishing.com/reuters/NNTHB24YDRKCDCIUA7W2UJHLYI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/OLJ45Y57TJNQTIGEMTOSWE5HBU.jpg)

Research reports/videos (DYOR)