The DeGen Bible to Financial Freedom - Vol.39

The Curve crisis contagion has been stopped early before going out of control. The meme economy is an essence of the crypto world. As the multichain Layer 1 narrative dims, we should revisit high TVL EVM ecosystems for growth.

Week 25 July - 1 August 2023

LTC halving to BTC halving - Mars Captain

🧠 Observations

- The Curve crisis contagion has been stopped early before going out of control. In the last 365 days, we have seen the charm of DeFi for its on-chain transparency and potential to fix or break the protocol preemptively. There is something worrying though, the on-chain data and transparency in TVL & price oracle make it easy for whales to calculate the costs to fix/break. We have seen this in LUNA and FTT.

- $PEPE, $BEN, $PSYOP, now we have $BALD, though it didn't last for too long. The meme economy is an essence of the crypto world. Let's not jump to the conclusion that they are all rugs. Learning & understanding the soul of a viral and contagious meme distinguishes a native web3 project from traditional web2 ones. The Starfish team has been DYDR-ing a lot and looking forward to applying our research some time soon.

- Captain has been following a lot on BSC and Pancake, the latter is the first blue-chip DEX to share their revenue to the community. Being the queen of EVM, BSC has interesting projects like the latest Hamster GG. As the multichain Layer 1 narrative dims, we should revisit high TVL EVM ecosystems for growth.

💵 Stablecoin & Market Landscape

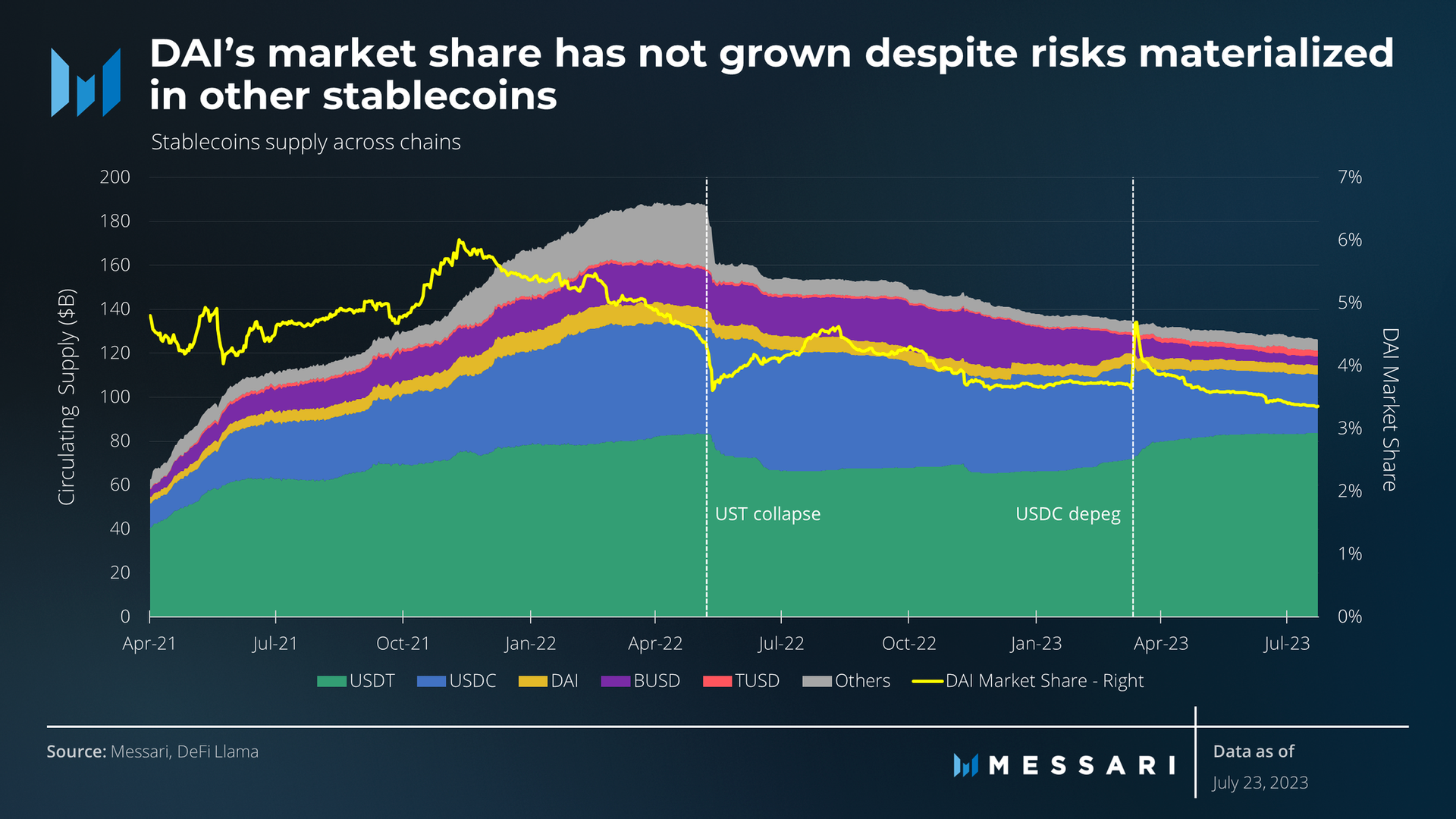

- Stablecoin market share remains high in reference to the total crypto market capitalization. 10.22% of stablecoin (125.8B) on 1.23T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 10ish% with a 1ishT total MC.

- Now at 1.23 T. Still hanging around on the 1 T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

- The problem about stables since the fall of LUNA is that the market now "mis"-understands stablecoins as fiat, and thus, only collateralised stables, AKA, digitised fiat, would investors have confidence. Anything with a value bearing asset minting mechanism would recall the memory of LUNA. WDYT?

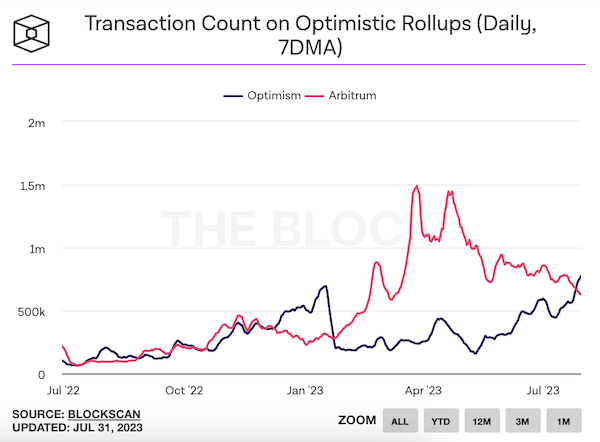

- The king and queen are swapping their position, with the rise of Base?

- The real interest here is to compare retail participation (Arbitrum) vs Optimism (Institution). This time looks like the retail market is very dried up.

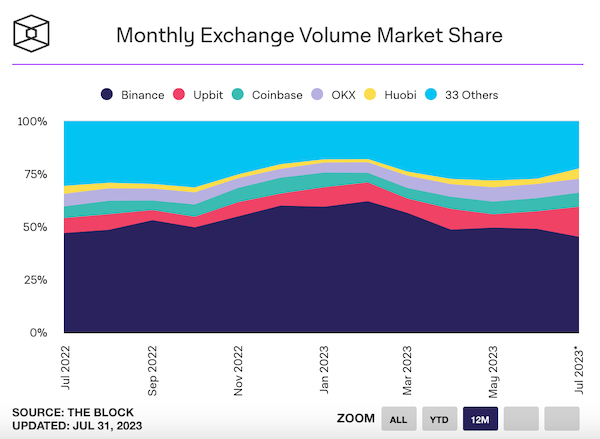

- Essentially, spot market is where everyone is fighting for a slice of the cake. The US underlying dominance, if represented by Coinbase, is much less apparent than most thought...

- The Kimchis, Huobi and OKX are not to be underrestimated, frens.

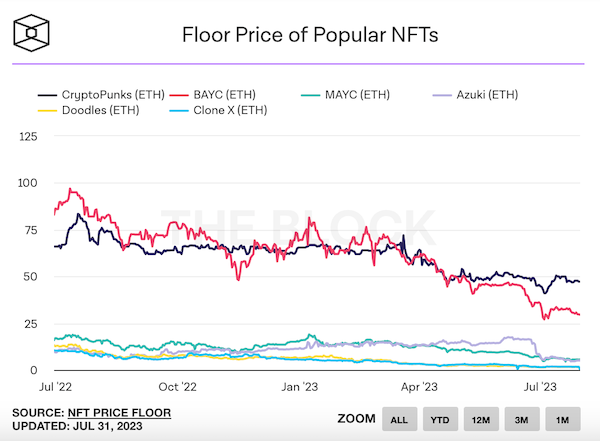

- In a way Azuki's self destruction a couple of weeks ago resembles FTX's dear genius Caroline's infamous saying, "we will be happily buying $FTT at 22."

- Crypto Punk holding relatively steady. In this industry, speaking less is speaking more. Attracting less dumping pressure is already a great bullish signal.

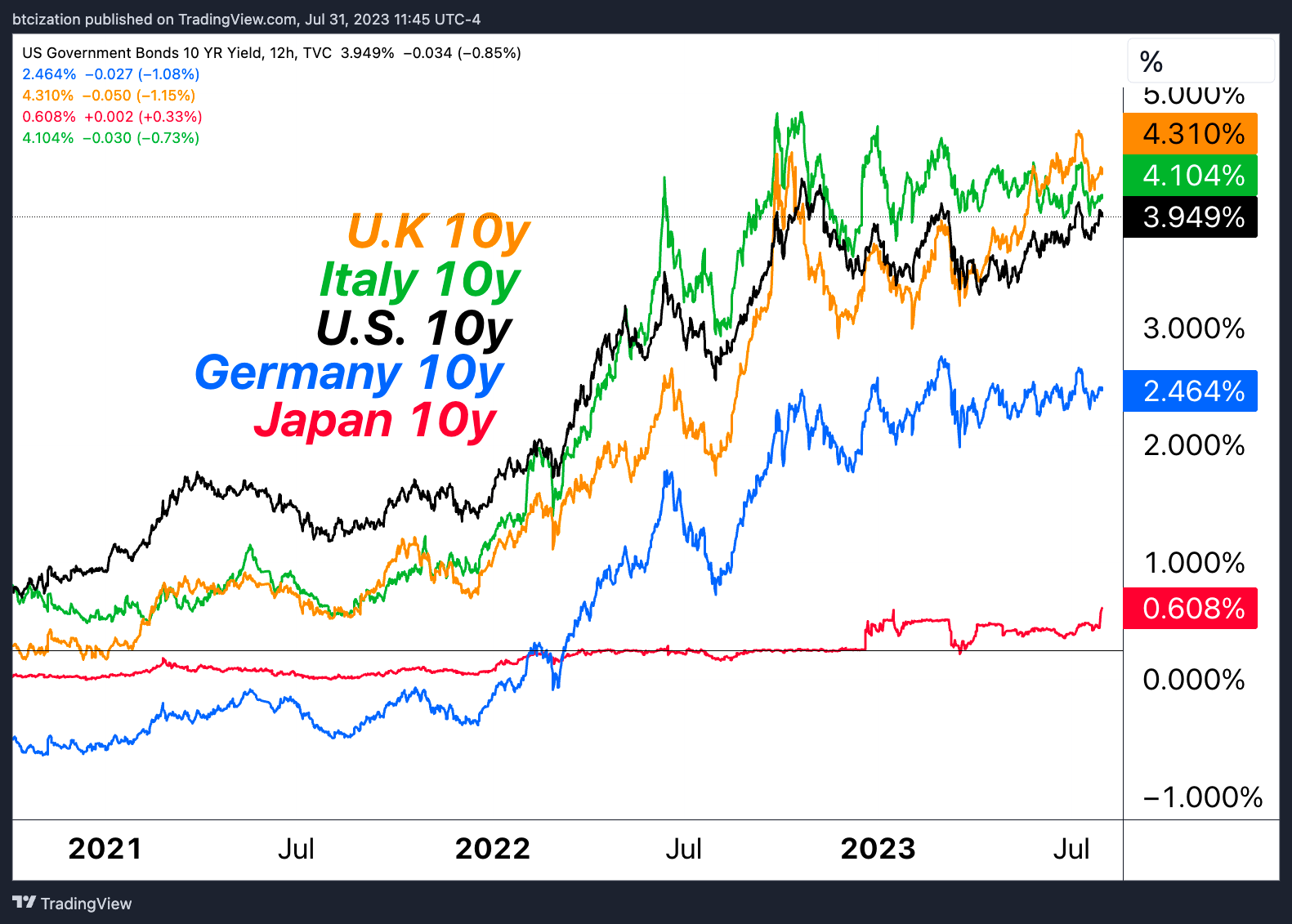

- There is more than we can imagine about $JPY's bond yield. The bank of Japan is literally informing the market that they will not be changing their monetary policy. Does it remind you some DeFi protocols that are modelled on central banks' behaviour? (In Captain's mind, he can think of Pancakeswap for now, despite being a long time fan.)

🔢 Index

Bitcoin Fear and Greed Index is 53. Neutral

— Bitcoin Fear and Greed Index (@BitcoinFear) August 1, 2023

Current price: $29,239 pic.twitter.com/f6BV6bBqPv

- This index hasn't been moving much in the last month. It represents a high BTC dominance and confidence, though doesn't mean the market overall is bullish.

- CBBI has been consistent with the fear index.

📰 Current affairs

Starfish Finance:

BTC

Nothing much this week

ETH

Nothing much this week

Layer 1s/ Major DeFi

One image, 40 bots on Telegram and Discord to ride the wave of a newly formed degen narrative.

— Stacy Muur (@stacy_muur) July 25, 2023

Let's go? pic.twitter.com/qw7h7Mhku4

Here's the basic crypto market manipulation model that produces the $10b+ valuations for start-ups: grant founders and investors the cap table, locked. Airdrop a tiny % of float to retail. Then give mm'ers a multiple of that and incentivize them to set a price floor w/ options, https://t.co/NeKAjrBESU

— Ari Paul ⛓️ (@AriDavidPaul) July 24, 2023

1/17 What's the endgame for Solana?

— Ignas | DeFi Research (@DefiIgnas) July 26, 2023

And how will Solana recover from a 97% drop in TVL?

I interviewed Michelle, DeFi BD at Solana Foundation, to learn her perspective.

Here's what she had to say: 🧵 pic.twitter.com/keqZQd9amW

The Solana Renaissance: Solana 2.0

— francesco (@francescoweb3) July 20, 2023

Are you ready for the most hated rally? 📈 ⬇️ pic.twitter.com/E8MzLTPLyk

1/ Ok let's brainfart a lil bit https://t.co/AWrm6u6kTd pic.twitter.com/h1iZwfpdUM

— vapor (@trading_vapor) July 21, 2023

NFTs

Macro econ/ Regulations

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UIZ6BXRG2ZMK7NJGJAYEW7TP6E.jpg)

Research reports/videos (DYOR)