The DeGen Bible to Financial Freedom - Vol.38

From multi-chain to multi-layer, market participants seem to have put behind the 2021 heydays of alternative L1s, Solana, Near, Avalanche, Cosmos, Polkadot, how are you? Indeed, L2s are having an epic battle among themselves. $XRP shouldn't be overjoyed for such a landscape.

Week 9 July - 22 July 2023

GM ETHCC Paris, au revoir Paris - Mars Captain

🧠 Observations

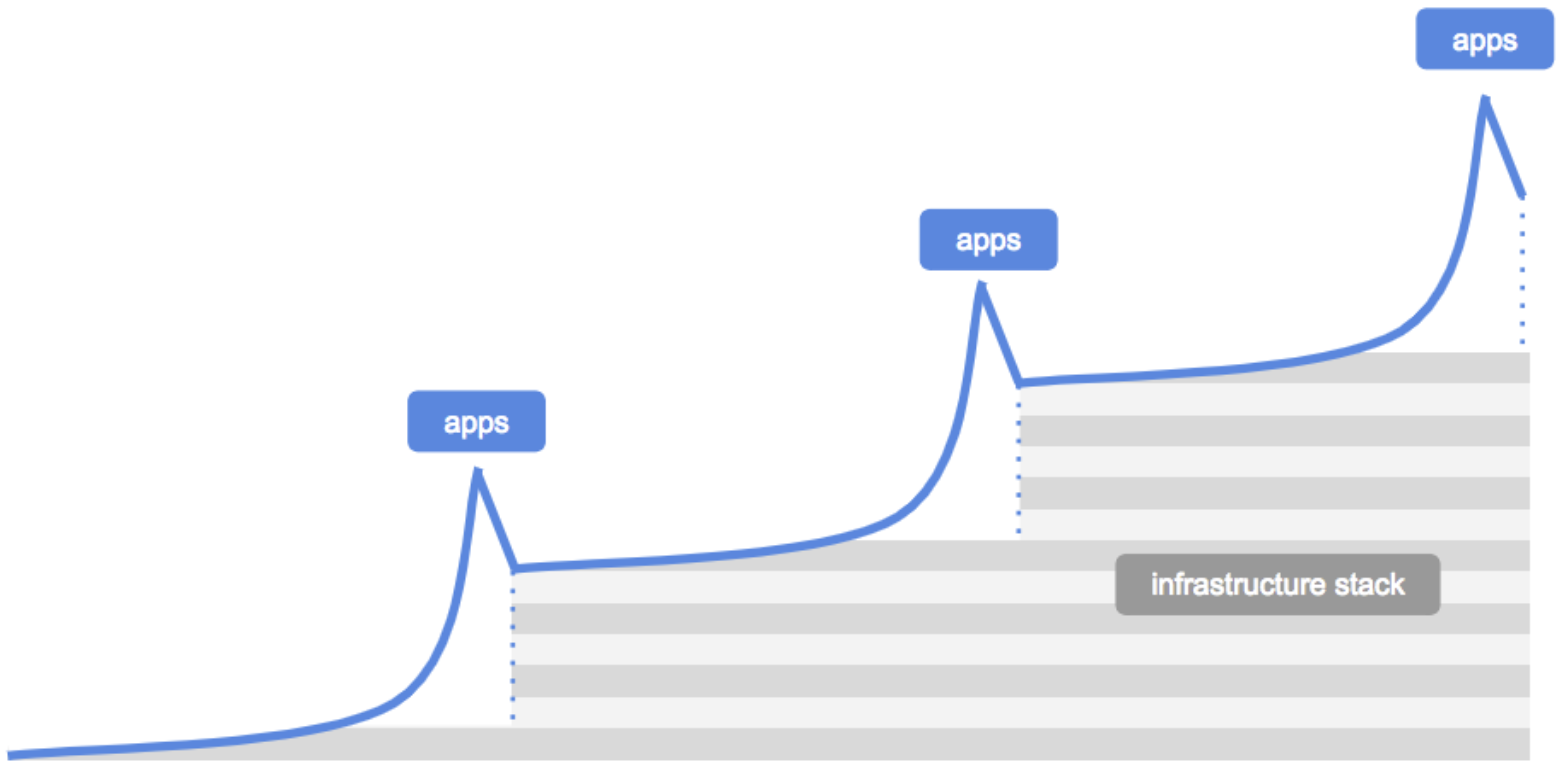

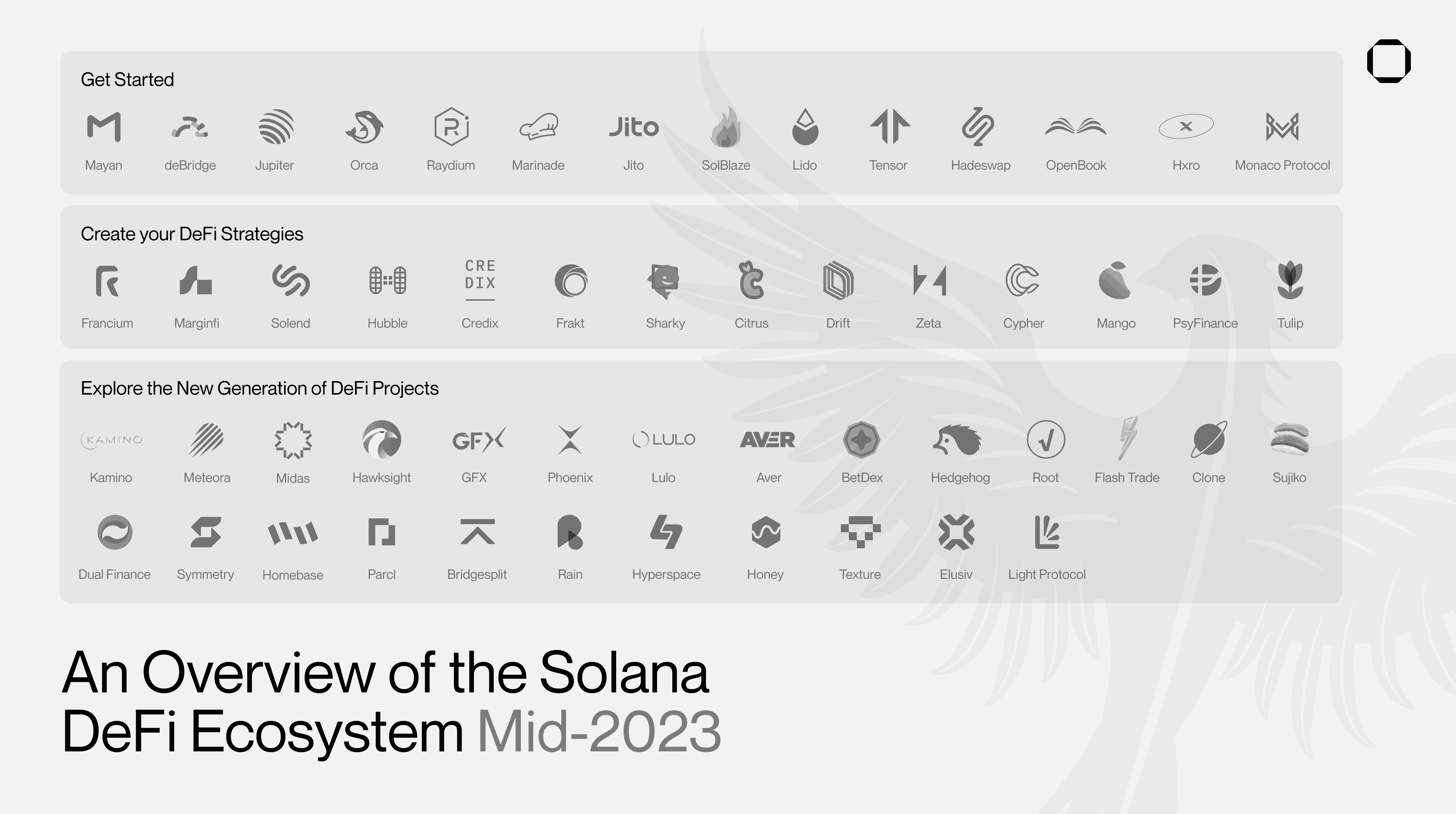

- From multi-chain to multi-layer, market participants seem to have put behind the 2021 heydays of alternative L1s, Solana, Near, Avalanche, Cosmos, Polkadot, how are you? Indeed, L2s are having an epic battle among themselves, and the Starfish team is closely following the trends. Captain still believes wen the bull comes, Ethereum & L2s and maybe L3s will still be gentrified and new traffic will flow to alternative L1s. Leaders of the blockchain nations, hang on and attract buidlers please. (The Starfish team is here.)

- By the time this volume's out, the FOMC should have increased the rate again. Notice that liquidity and macro economy are both gloomy. $XRP shouldn't be overjoyed for such a landscape, after all, no one likes Ripple in the industry. Watch out for the fake pump, Degens!

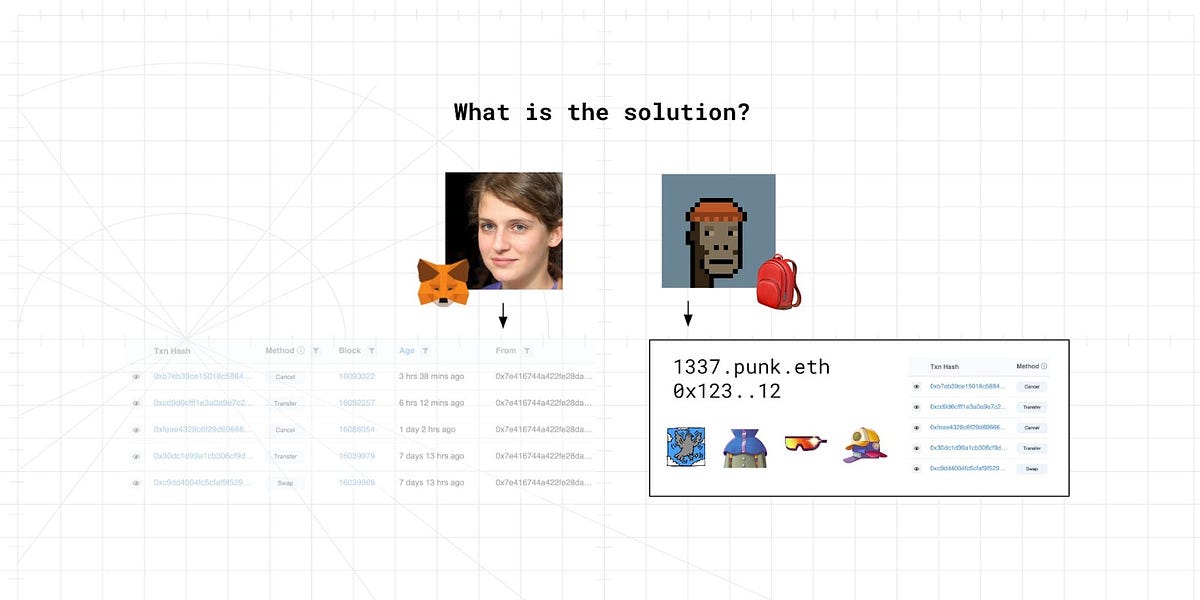

- Captain made many new frens in Paris, both new and old frens shared very insightful opinions on the market and trends. Overall, we are all seeing a maturing DeFi landscape and increasing competition among brains and tech. LSD-Fi? RWA? Follow the difficult concepts to unfollow the easy. (Never heard of anyone talking about Azuki or BAYC or Metaverse for sure, in an entire week.)

- Community is still the core of the success recipe. Look at BNB's hampster race. (Not long ago we had Pepe too.)

💵 Stablecoin & Market Landscape

- Stablecoin market share remains high in reference to the total crypto market capitalization. 10.3% of stablecoin (126.5B) on 1.22T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 10ish% with a 1ishT total MC.

- Now at 1.21T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

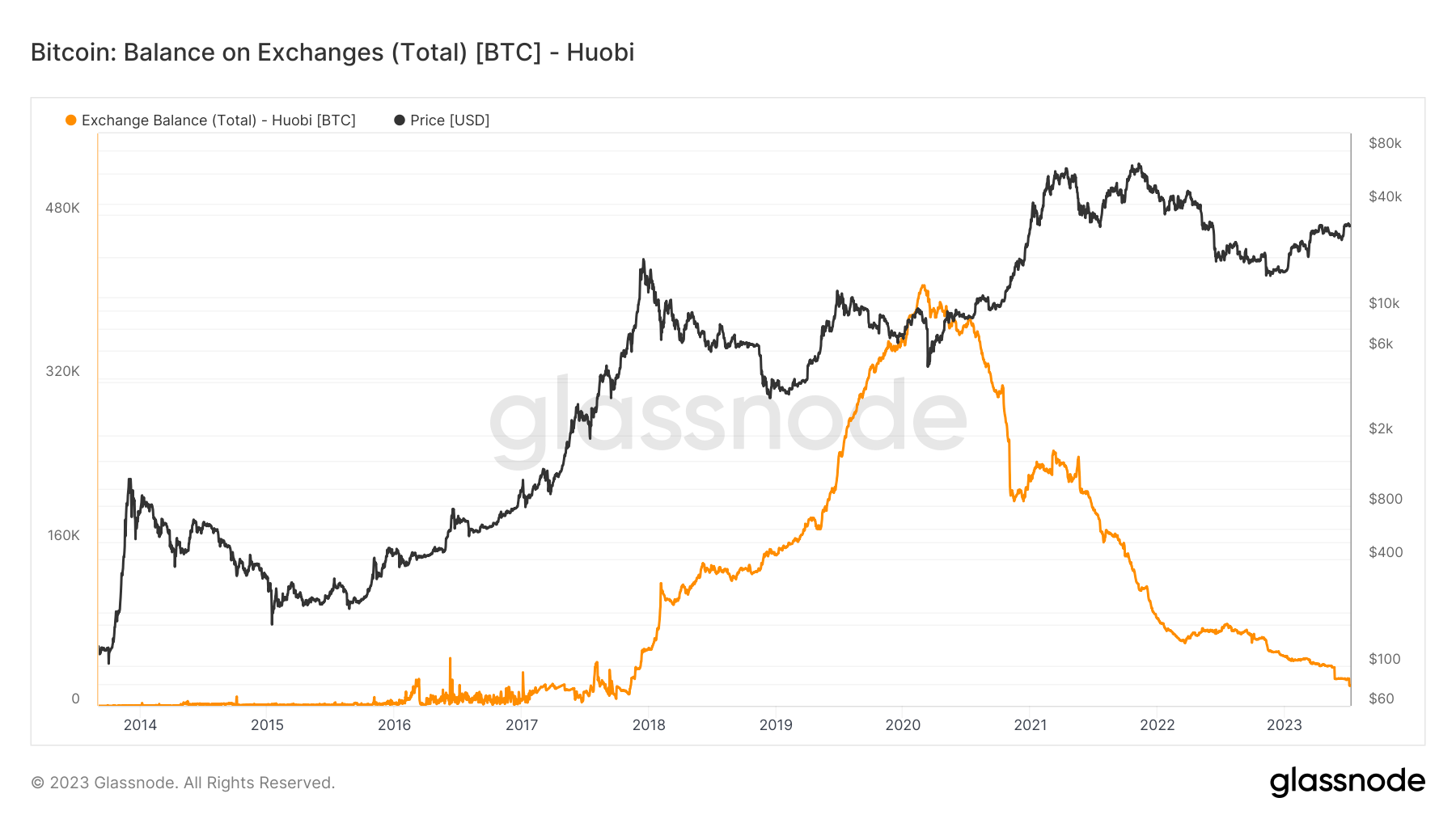

- Huobi might have to do something to rebrand more and improve its reputation. Master Sun is a genius in marketing. But, he might need some rigourous business management to go with his glamour.

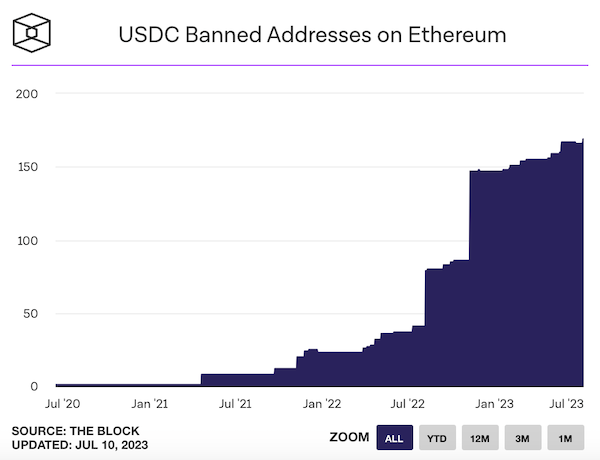

- Centralisation?

- Ultimately decentralised stablecoin will have to be born at some point. The problem is not about what people doing with the money, but the principle of a decentralised, permissionless blockchain economy.

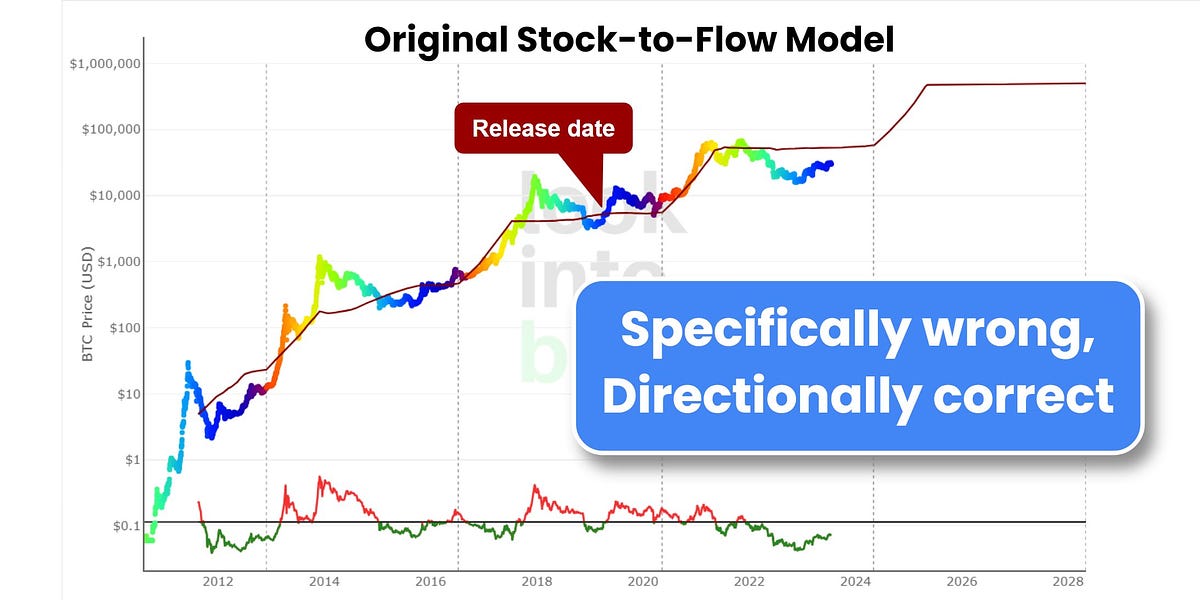

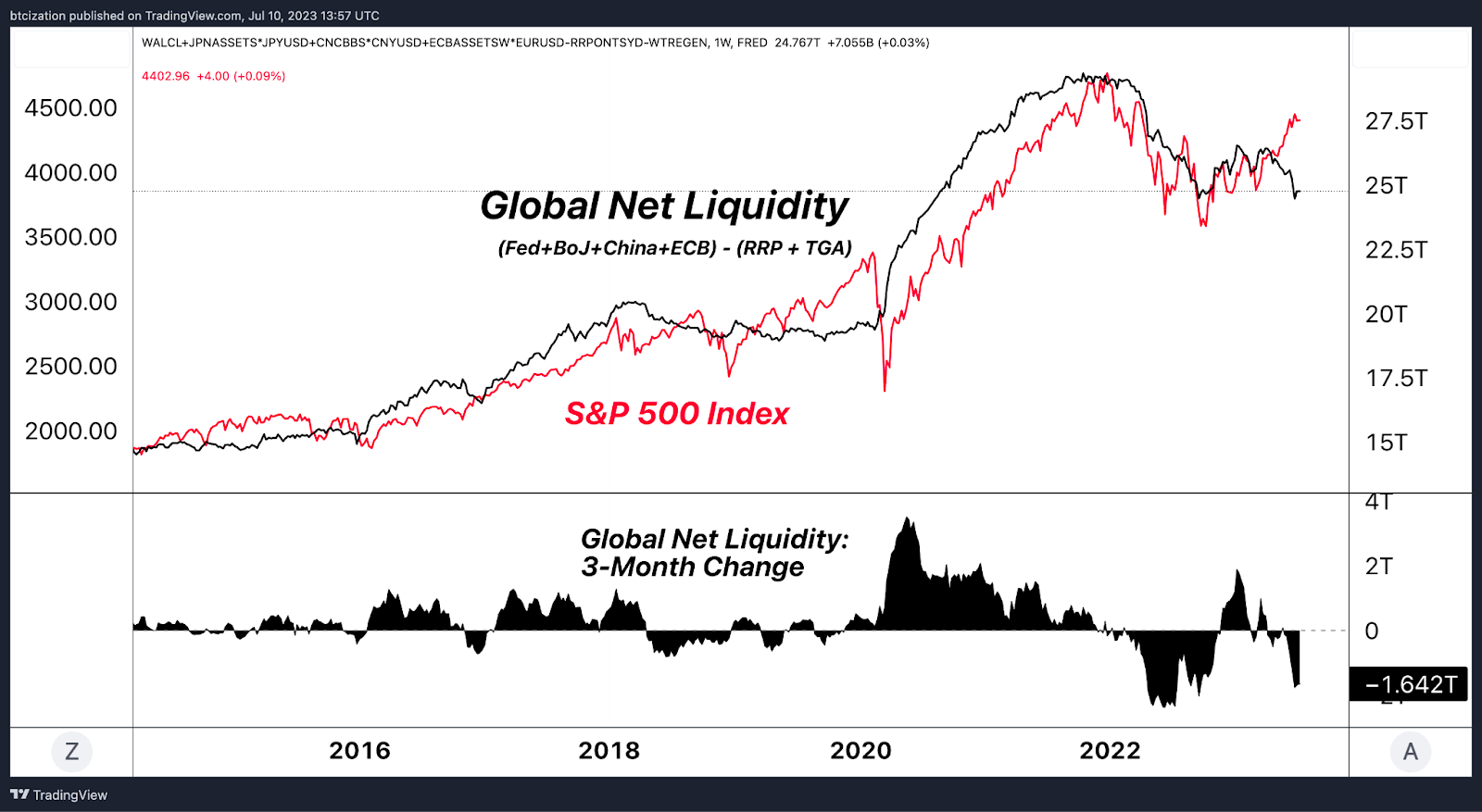

- This goes back to Captain's thesis, the investment markets, be it in crypto or other asset classes, they are dollarised/fiat-ised and nominated in fiat. So, now, something's happening soon as per this graph?

- To quote BTC Magazine's excellent critique, "This recent decline in liquidity amidst near year-to-date highs in equity markets presents an interesting position for equity investors: Does the direction of liquidity not matter in this case, due to strengthening equity market fundamentals and a year to date resurgence in sentiment amongst tech investors? Or will the jaws close between the diverging lines of market liquidity and equity indices?"

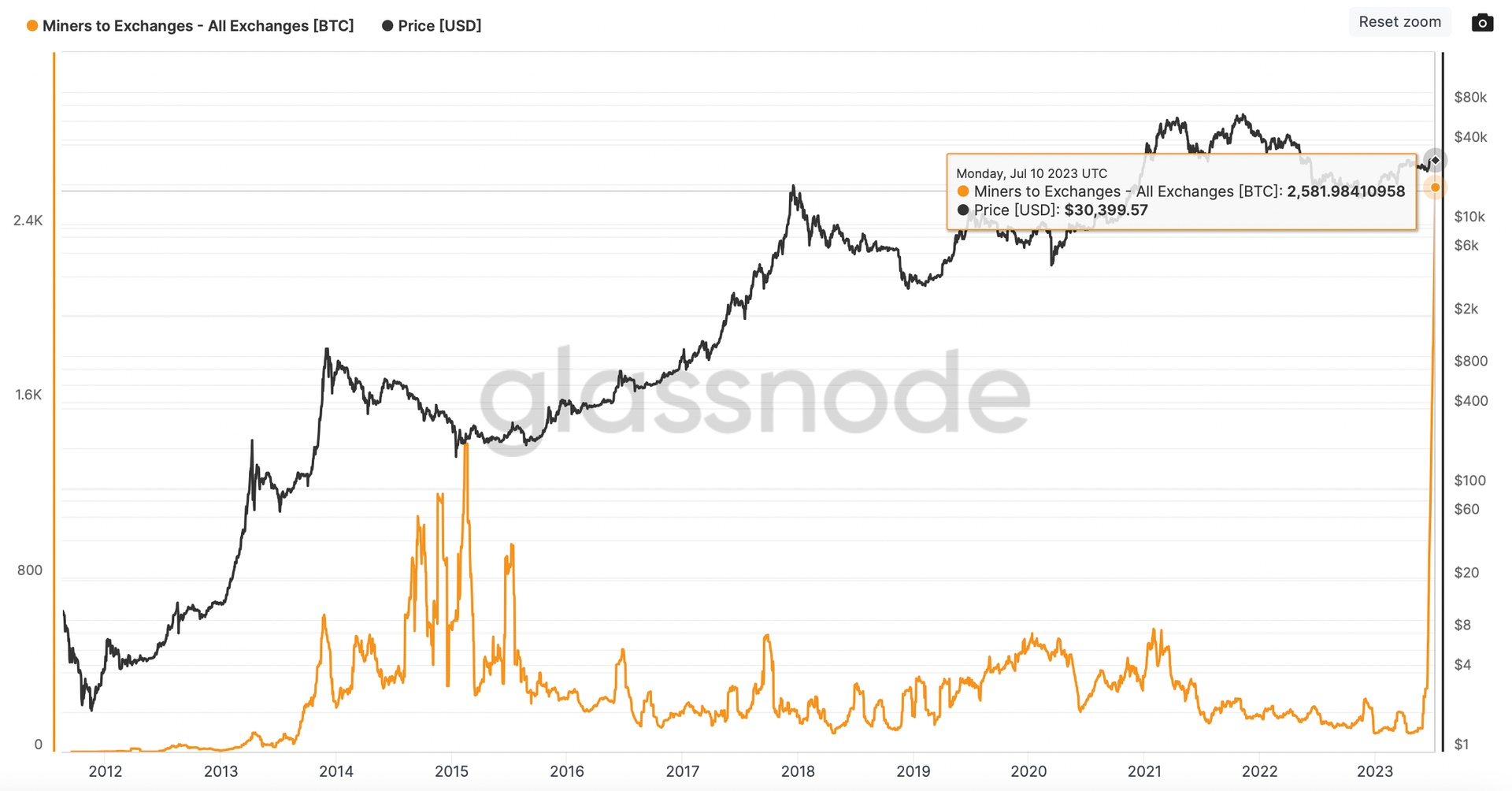

- Miners' selling is a very good indicator with two implications. One is they think the market is hot and needa sell for a profit. The other is that they are at the brink of collapse. Which one is it right now? :)

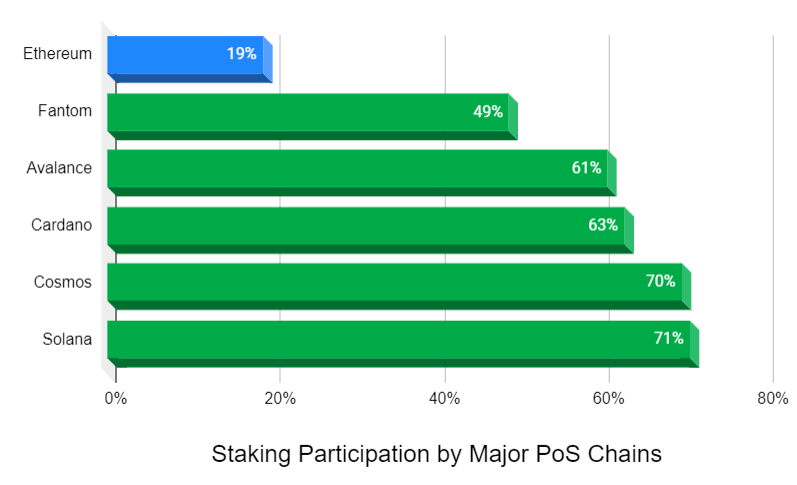

- A nascent theory on LSD-Fi with reference to Ethereum's POS participation. The protagonist here is Solana rather than Ethereum. Wen will the Solana LSD narrative come up? (And wen Cardano can cease to be relevant to the industry...)

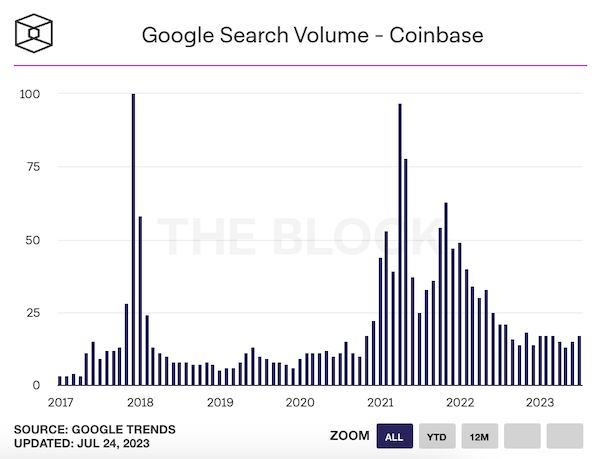

- In a way Coinbase is more representative than Binance in the crypto world, as per its' listing in the US. The implications of this trend could be a rise of coinbase wallet, and Base L2 as a result. Worth watching the trend.

🔢 Index

Bitcoin Fear and Greed Index is 55 - Greed

— Bitcoin Fear and Greed Index (@BitcoinFear) July 24, 2023

Current price: $29,311 pic.twitter.com/bXsx8AojFc

- Holding on a good level. Still, Captain thinks it can go lower and the BTC price should go lower before going higher.

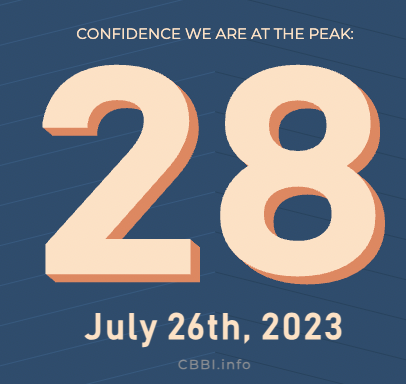

- CBBI is a fairer index, and it keeps steady.

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

Bob Loukas always provides invaluable perspective on how to navigate crypto markets for *free*

— jay (@0xjaypeg) July 8, 2023

For those that don't have the time, here are the key takeaways https://t.co/QvE93OgKqp pic.twitter.com/AkAEEFS3Vd

Pendle have gone from $8M to $127M TVL in the last 12 months.

— Aylo (@alpha_pls) July 5, 2023

I managed to nail down co-founder @tn_pendle for a chat about how they did it.

• Pendle's bear market ascent

• How V2 got it right

• Future growth strategy

Pendle alpha 👇 pic.twitter.com/WQdI3T8SE1

1/ For a very long time, I’ve been thinking about making this thread. After being asked by many to explain my strategies in crypto, I want to highlight my most profitable way. The art of longing cults. pic.twitter.com/aJmmEejR6K

— Zoomer Oracle (ethcc 🇫🇷) (@ZoomerOracle) July 22, 2023

Vietnam has the highest crypto adoption rate in the world.

— Teng Yan ⛩ (@0xPrismatic) July 11, 2023

A 98M population country, with almost 50% of people having used crypto before.

A few things I've learned from my trip to Vietnam 🧵👇 pic.twitter.com/flU7PIIFrg

1/15 Korea, the 3rd largest crypto market, flies under the radar on Crypto Twitter.

— Ignas | DeFi Research (@DefiIgnas) July 19, 2023

After living there for 8 years, I learned about fascinating differences in their crypto mindset compared to the West.

Here's why Koreans are crazy for crypto but not #DeFi 🇰🇷 pic.twitter.com/RqeIb9KklW

Rollbit continues to grow their revenue day by day, but many don't have a grasp of the numbers that they're currently doing beyond a few guesses.

— Ayzhin (@Ayzhin_) July 21, 2023

I've collected significant data on all aspects of Rollbit and will be sharing it in this thread to show how undervalued $RLB is. 1/?

NFTs

Macro econ/ Regulations

Research reports/videos (DYOR)