The DeGen Bible to Financial Freedom - Vol.37

Think DeFi will make you understand more the currency war among big economies. Imagine a 3pool of JPY-CNY-USD as if it is a USDT-USDC-DAI one. Now we are seeing USD proportion lowered to 10% while everyone is dumping $CNY and $JPY to the pool.

Week 1 July - 8 July 2023

The old world is silently crawling back into the new world. See you at ETHCC Paris - Mars Captain

🧠 Observations

- $CNY is witnessing a declining pattern since post-COVID reopening. Why? Well, look at how fast $JPY is being debased and $USD strength up only in the last 8-10 months. This is very interesting, as if you see a Curve LP pool that one token gets dumped hard, while the other one dominance in the pool keeps rising... Captain always says DeFi is a miniature and lightyear faster version of real world finance. Think DeFi will make you understand more the currency war among big economies. Imagine a 3pool of JPY-CNY-USD as if it is a USDT-USDC-DAI one. Now we are seeing USD proportion lowered to 10% while everyone is dumping $CNY and $JPY to the pool. (Maybe $JPY a bit less severe than $CNY.) Not the best analogy, but describes well the tense situation. There is a lot of implications in this, few people know...

- The Multichain drama is nothing new in bridge security issues. Notice that all the layer zero and relayer narrative has replaced the "old-school" cross-chain mechanisms in the past year. The problem here is that the blockchain economy is "built" with different layer ones as if they were countries. Using this analogy, we will always need ships and planes to travel to another one, and traffic accidents are bound to happen. Choose our transport wisely. ($SEAN has Celer Network, the most battle tested bridge in the industry!)

- Looking forward to meeting buidlers in Paname. Liberté, égalité, fraternité.

💵 Stablecoin & Market Landscape

- Stablecoin market share remains high in reference to the total crypto market capitalization. 10.57% of stablecoin (127B) on 1.21T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 12ish% with a 1ishT total MC.

- Now at 1.2T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

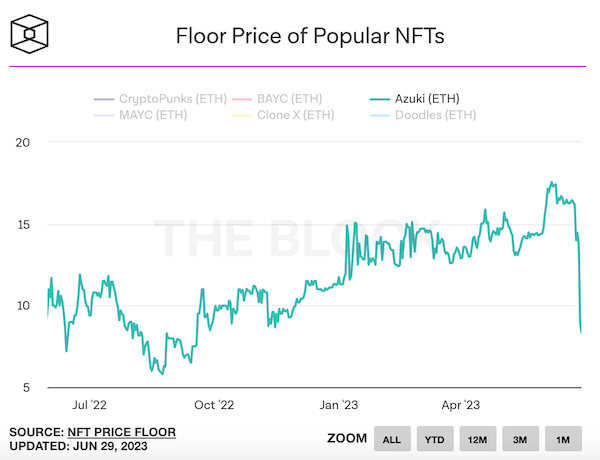

- We don't need to comment on this, we know what's happening...

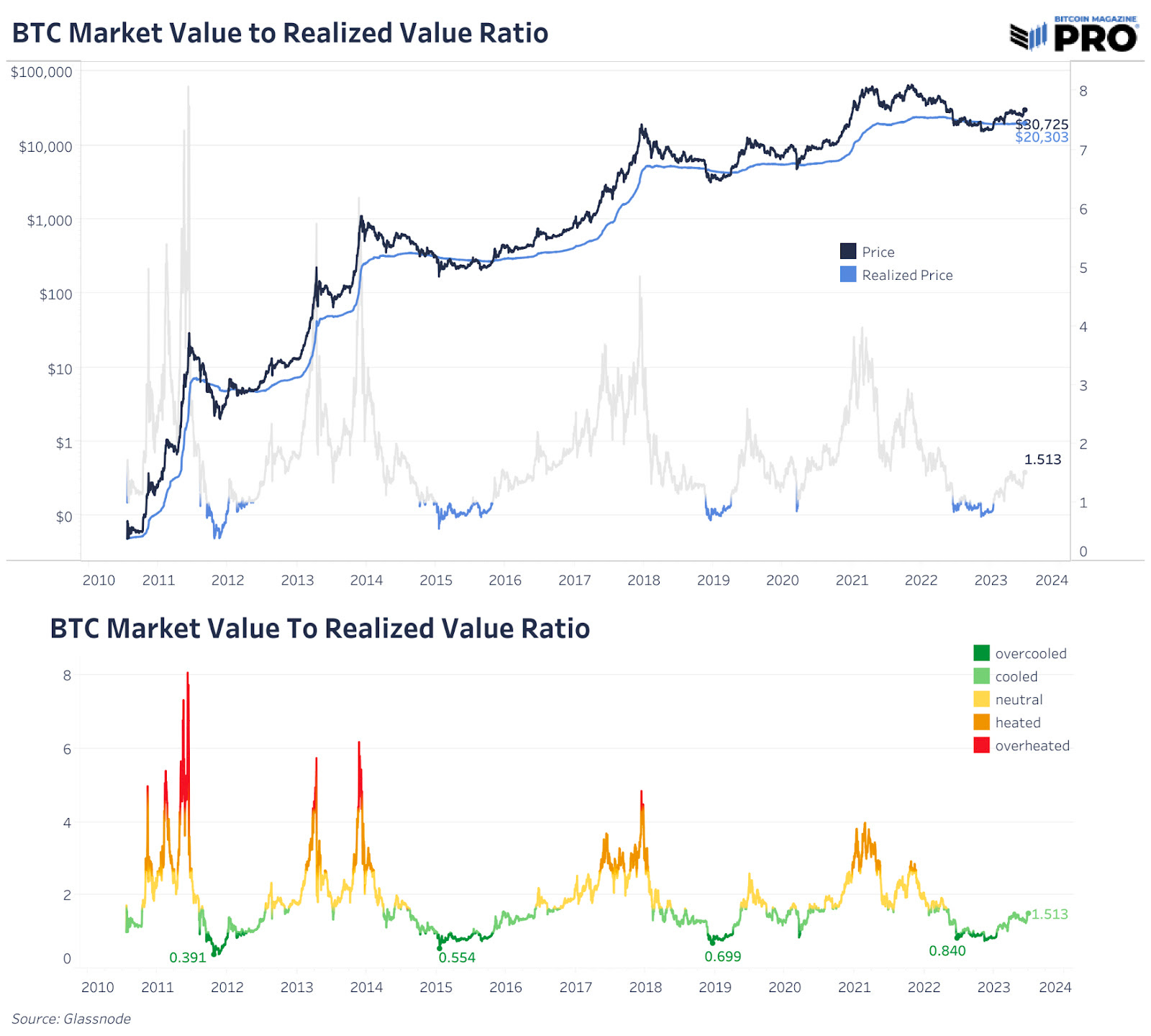

- It's recovering, and we will need this to reach higher before the altcoin season begins, if the rotation thesis still works.

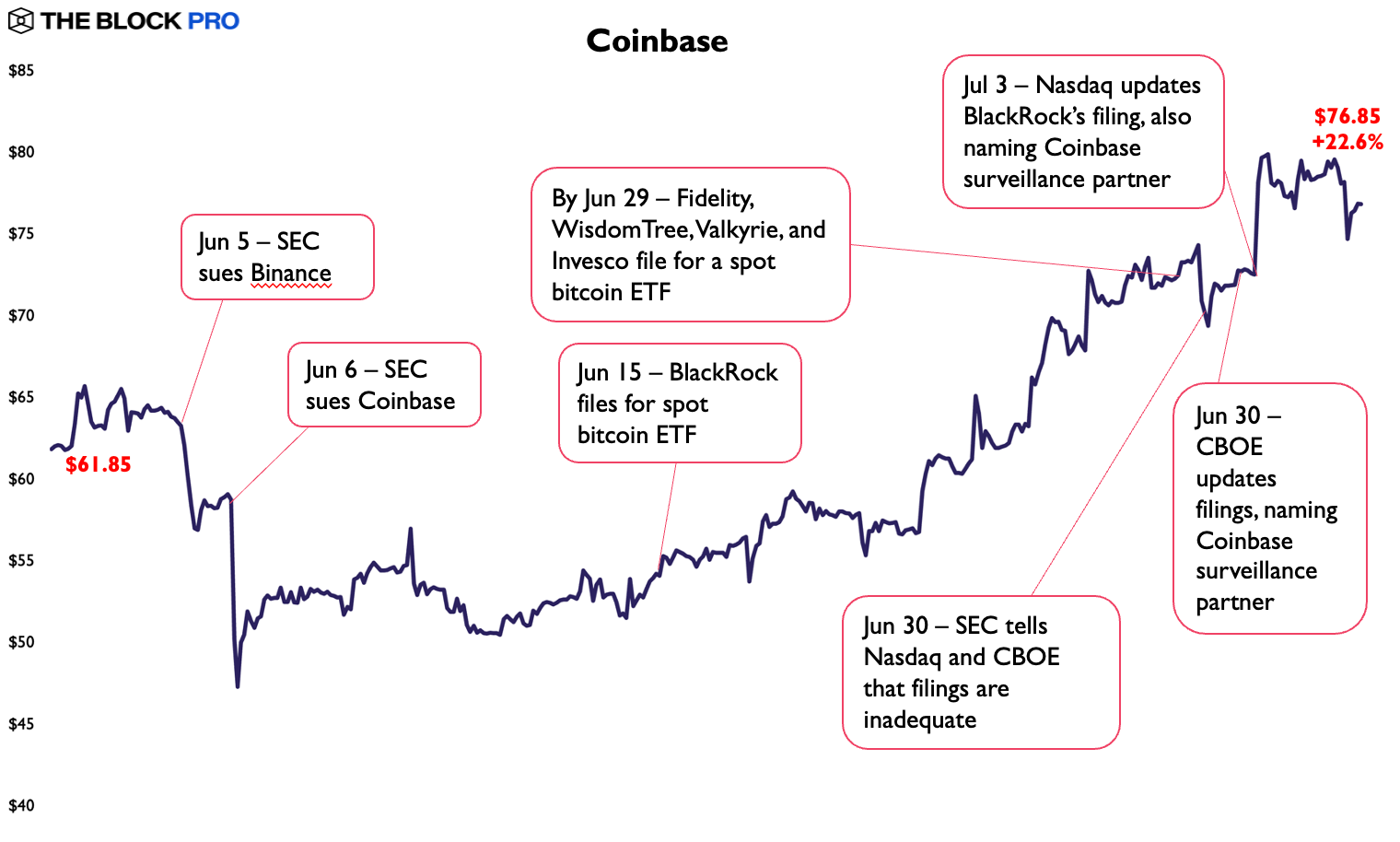

- TA gurus explain this...

- Captain always thinks a tweet from Elon is worth 1000 hours of TA analysis. I guess in the $COIN scenario, it is still very relevant.

🔢 Index

Bitcoin Fear and Greed Index is 58 — Greed

— Bitcoin Fear and Greed Index (@BitcoinFear) July 8, 2023

Current price: $30,233 pic.twitter.com/efQHaWEUyc

- The moment this newsletter is published, this index is close to 65. Captain thinks that people shouldn't forget there is high profile potential DCG liquidation on the horizons.

- Captain is bullish, though still in the belief that it needs to go lower before it gets higher to finish 2023.

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

Introducing the Bitcoin Script Project, an idea.

— Alex B (@bergealex4) June 29, 2023

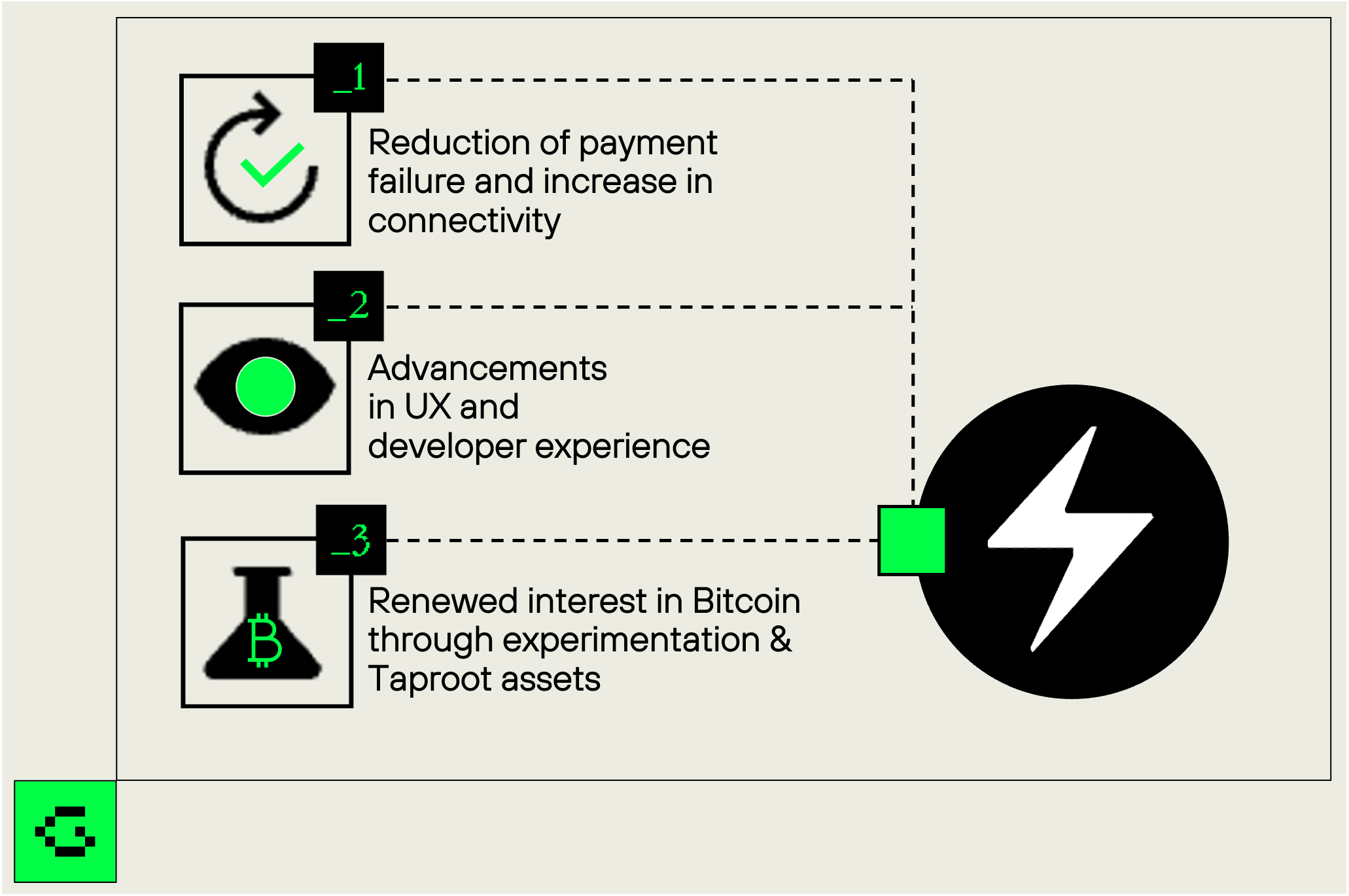

Bitcoin is missing a cohesive technological narrative.

Over last couple of years, Lightning shifted most of the attention towards secondary layers, leaving little exposure to the innovation & progress made around Bitcoin script. pic.twitter.com/t48GjYgnVu

The one comment I'll make is that I feel bad that @solana and other projects are getting hit in this way. They don't deserve it, and if ethereum ends up "winning" through all other blockchains getting kicked off exchanges, that's not an honorable way to win, and in the long term…

— vitalik.eth (@VitalikButerin) June 30, 2023

Would it be possible for ethereum to be a @solana L2? Probably more likely than you might think at first glance. L2s are bridge protocols that provide one way security. In this setup, holders of solana assets on ethereum would have finality guarantees that they can exit back… https://t.co/XE5ETsxGIW

— toly 🇺🇸 (@aeyakovenko) July 2, 2023

Airdrops - ur gateway to the first million

— 𝗰𝘆𝗰𝗹𝗼𝗽 (@nobrainflip) July 4, 2023

Introducing the Ultimate Airdrop Dashboard

Discover best strategies and comprehensive review of all projects 🧵👇 pic.twitter.com/gRix0mTwtV

Today marks a notable day in the history of our industry and for digital assets as a medium of exchange.

— Litecoin Foundation ⚡️ (@LTCFoundation) July 6, 2023

Litecoin $LTC is now the most used cryptocurrency in the world for payments. As tracked by the worlds largest crypto payment processor, Bitpay. pic.twitter.com/xZ4qLF78qj

NFTs

Macro econ/ Regulations

Research reports/videos (DYOR)