The DeGen Bible to Financial Freedom - Vol.36

NFT market is heading to a melting point. The market has good signals of recovery. WAGMI!

Week 21 Jun - 30 Jun 2023

NFT NGMI - Mars Captain

🧠 Observations

- SEAN Times celebrates its first year anniversary!

- Significant and coordinated dumping pressure on the blue chip $BAYC NFT series signals the start of the NFT market collapse? (The decline has been on for a year, and now we are at the collapse moment.) Captain is not optimistic about a rebounce moment. Essentially, the NFT narrative is a lightyear speedy way to form an IP and foster a community. What else can you spin off from there? Game-Fi? Metaverse?

- Azuki stabbed the NFT further by draining holders another 40M $USD. Note that we are still in the bear market. Which blue-chip NFT project still has hope? Ummmm, Doodles?

- Stables gonna depeg, it's inevitable.

- Don't forget that we will have another highly anticipated rate hike in July FOMC.

💵 Stablecoin & Market Landscape

- Stablecoin market share remains high in reference to the total crypto market capitalization. 10.49% of stablecoin (1128.9B) on 1.22T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 10ish% with a 1ishT total MC.

- Now at 1.22T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

- In a way, it shows how dominant the market is by the developed West, where the affluent can afford to take the summer off. Captain never buys the ascension of the East thinking.

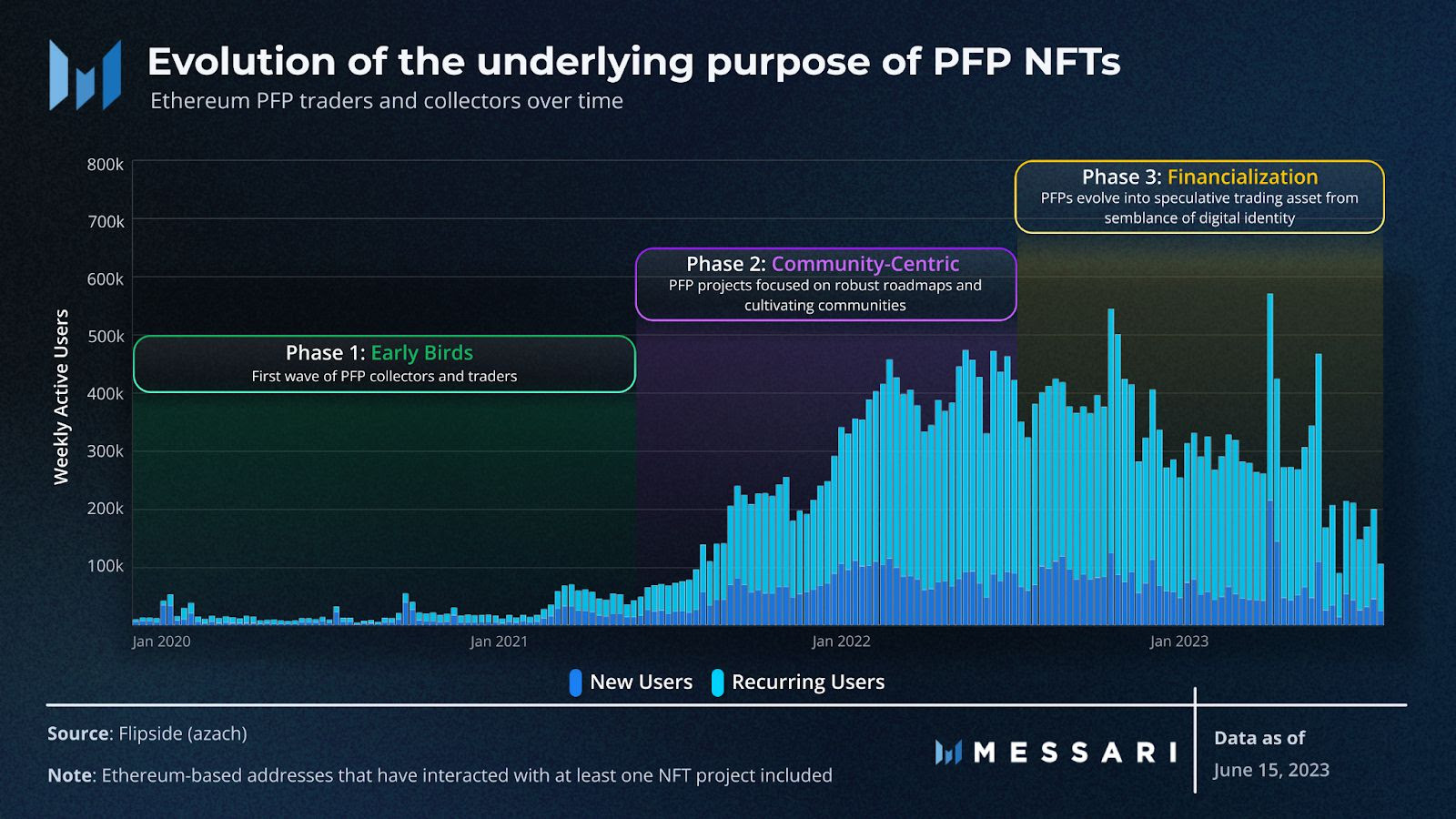

- The interesting thing about this graph is the proportion of recurring users, while we only see a declining of new users. NFT's narrative is in an inertia moment. No new concept, no new users, only same speculative holders.

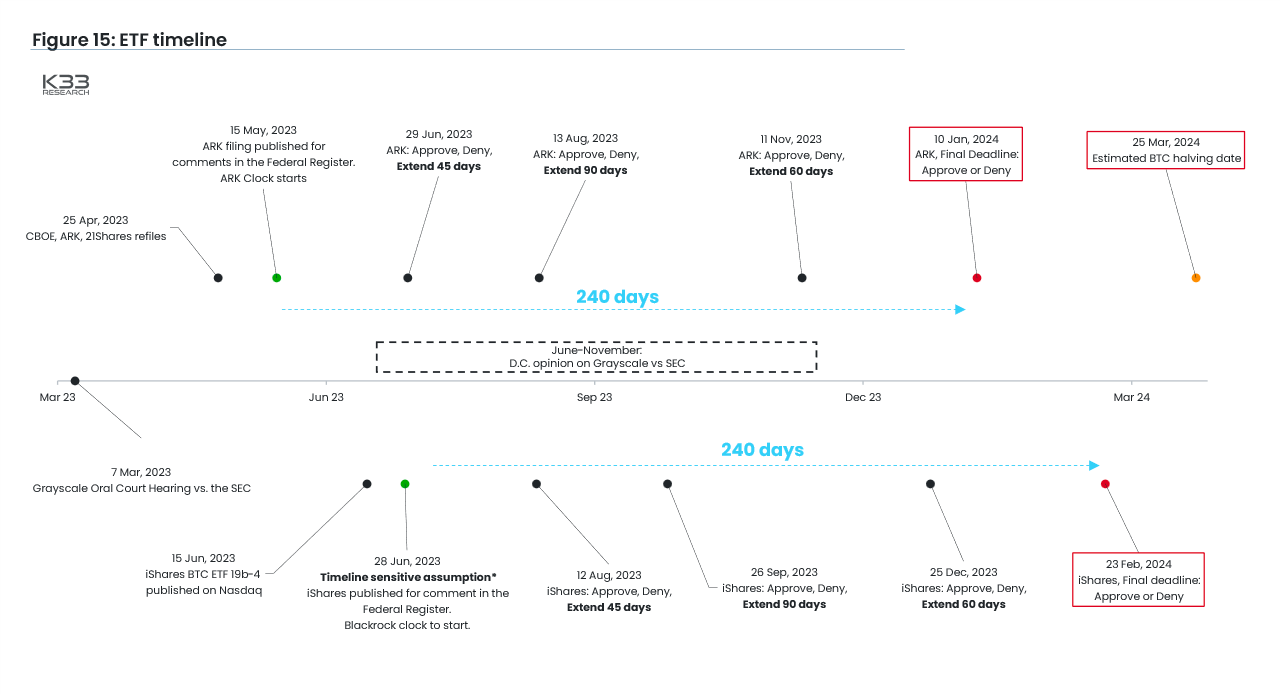

- BlackRock's $BTC ETF application decision making date will coincide with the next halving?

- How long has the deep state been planning this?

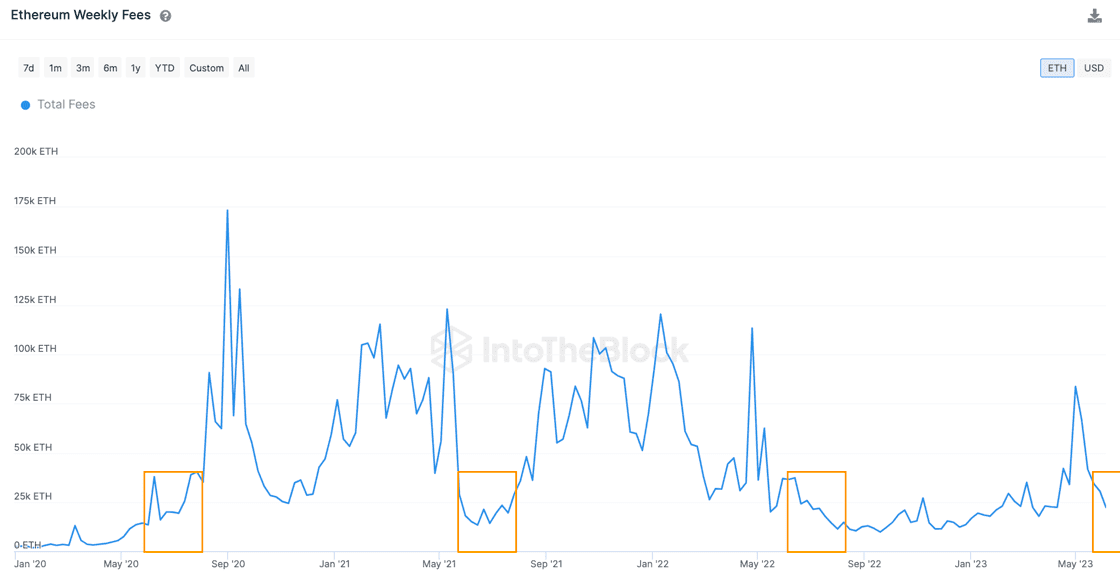

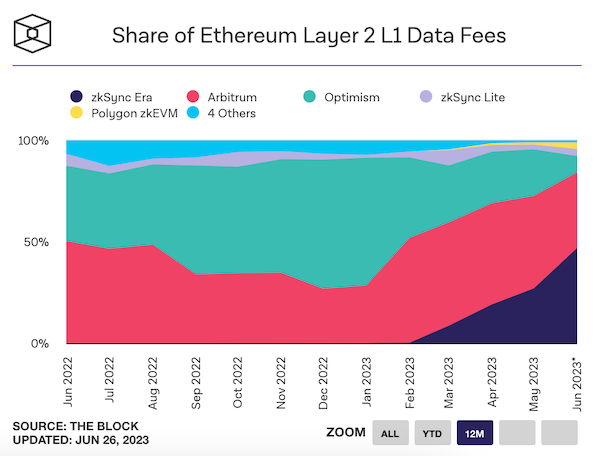

- Looking at the new L2 eating into the pie, we also need to ask the question whether the cake has becoming bigger or remained the same size. In Captain's impression, it has remained the same size.

- So the other side of the story is that Optimism and Arbitrum are losing popularity. (Though maybe temporarily)

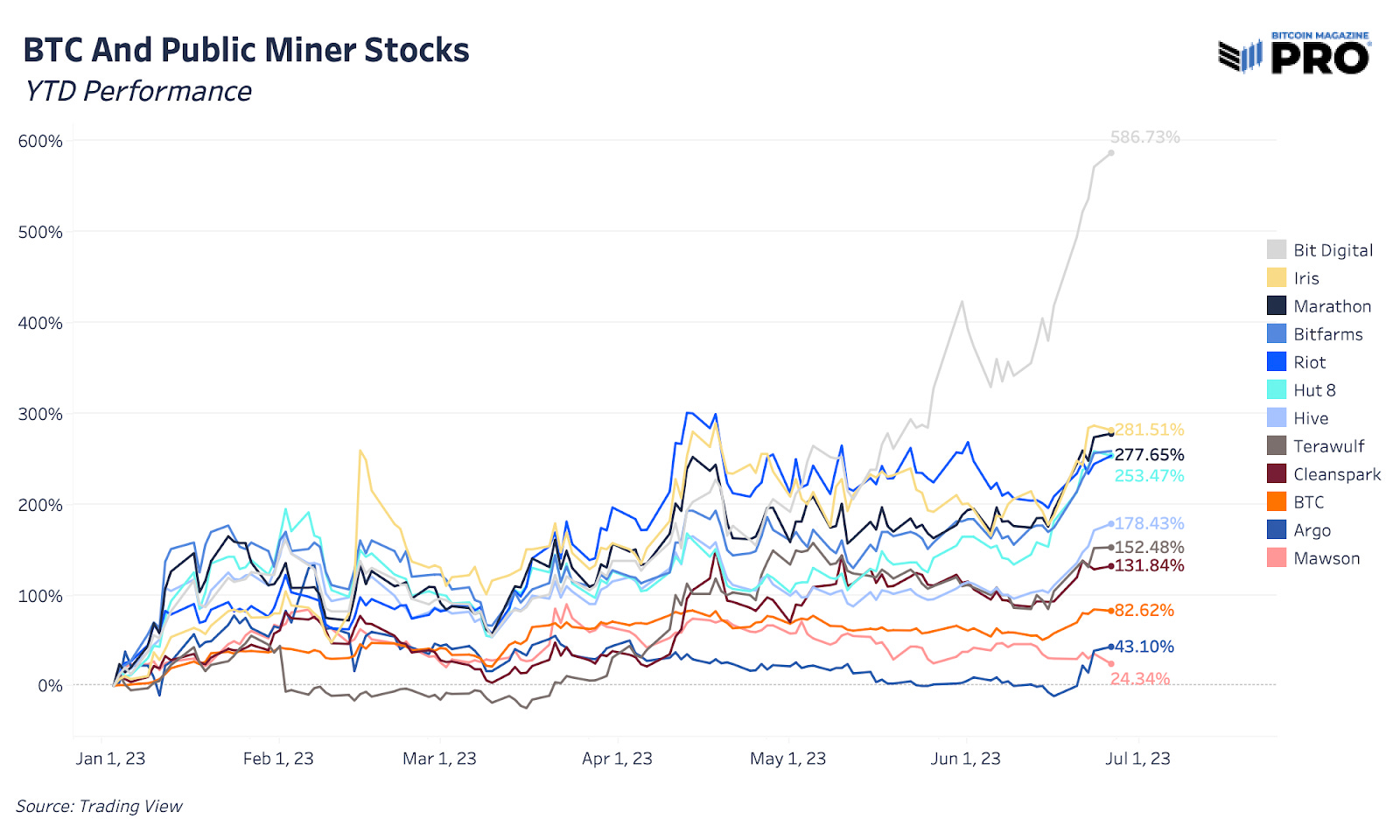

- The miner capitulation a while ago crushed the mining industry. They are quite resilent in a way.

- Tough business and it's time to think ahead for the post-2024 halving landscape.

🔢 Index

Bitcoin Fear and Greed Index is 56. Greed

— Bitcoin Fear and Greed Index (@BitcoinFear) June 30, 2023

Current price: $30,452 pic.twitter.com/7jTfA8gT9c

- Matrixport is still quite bullish on $BTC, but Captain thinks that it needs to do lower before it goes higher. This level is still a bit high for the market situation.

- CBBI is rising to 30ish. This is a very good indicator for the market in general.

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

1/12

— Adam Cochran (adamscochran.eth) (@adamscochran) June 17, 2023

Ok, one last bullish BlackRock tweet to round out the weekend.

People don't realize that BlackRock really made the gold market as we know it today.

Pre-BlackRock it was a $1T market.

Now it's about $13T.

So how did they do it? pic.twitter.com/3ToryIl6f4

Next week, institutions are debating stablecoins vs tokenized bank deposits.

— Ryan Berckmans ryanb.eth🦇🔊 (@ryanberckmans) June 19, 2023

Participants include the Bank of England, JPMorgan, and the Monetary Authority of Singapore.

Very bullish for ETH 😍

I wanted to share thoughts on stablecoins vs tokenized bank deposits and T-Bills🧵 https://t.co/ATI966GDc9

The Azuki team held a call with the community in the discord today.

— Arcanic (@ArcanicNFT) June 30, 2023

Zagabond, Steamboy, and other core members came on to address the situation on Elementals, and give clarity on their next steps.

Here is a mega-thread of everything that was discussed 🧵👇 pic.twitter.com/zQ80JJmmVw

NFTs

Macro econ/ Regulations

Research reports/videos (DYOR)