The DeGen Bible to Financial Freedom - Vol.33

The market is expecting another rate hike from the FED in a week. SEC vs Binance will be a focal attention point for the next few weeks. Can the Chinese rescue the crypto industry as the US is cracking it?

Week 31 May - 6 Jun 2023

Gary, no one likes you. - Mars Captain

🧠 Observations

- Starfish Finance Entertainment-Fi new game– Coin Flip launching soon! Follow our twitter to get airdrops!

- Last blow, or an expected blow to the bear market. Final round: SEC vs Binance, a.k.a the whole crypto industry. Surely, Captain would love to see more balance of power following the FTX collapse, still there is no good for Binance go south. We have to stay together as an industry. (After all, Starfish is looking forward to be on Binance some day.) Good luck, Gary, and hang on, frens, the SEC is doing a free ad for the whole industry.

- The market is expecting another rate hike from the FED in a week. Together with the SEC case, this landscape will kick off the 2nd half of 2023. Notice that the market did not react as negatively as a large scale FUD should have been. Total market cap dropped 3ish % after the SEC announcement.

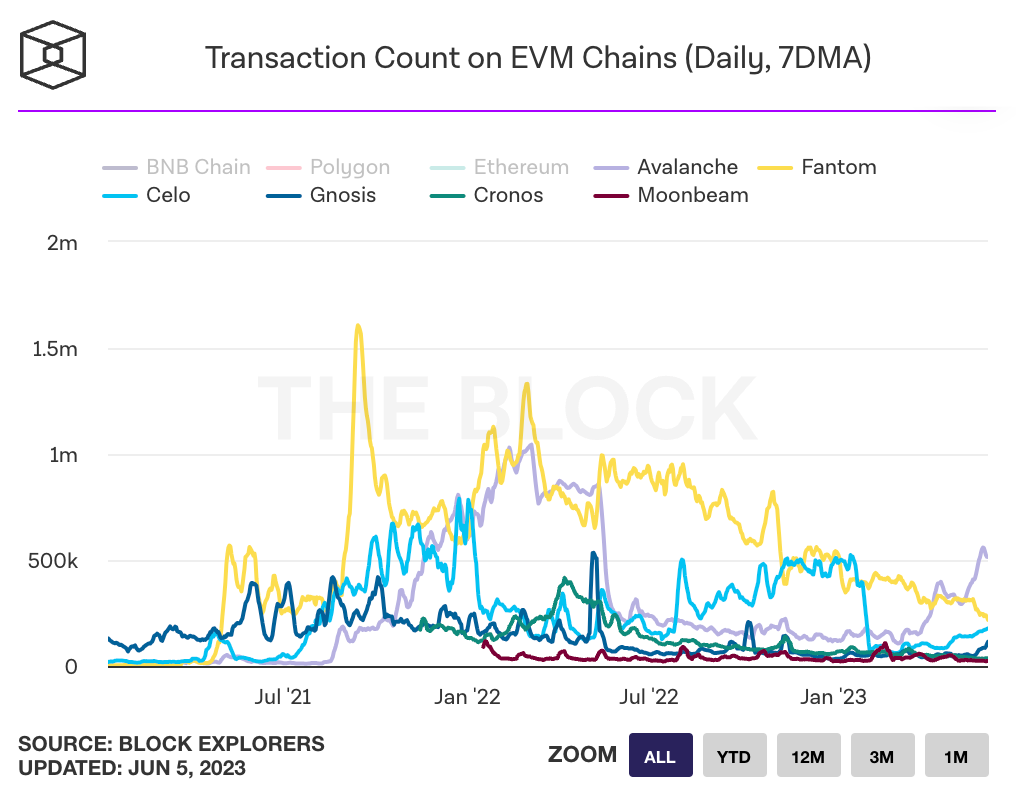

- $BNB is a security as much as $ETH is a security. The SEC should subscribe to SEAN times to follow the industry. $BNB doesn't need Binance to survive, it's a blockchain and it's the 2nd largest EVM ecosystem. Sure, you can always link Binance to it, which is valid. Using this same logic, it doesn't justify that $ETH isn't related to any CEX... Damn, government people's analytics is ______.

- It's always about the US, the FED, the SEC. Did the China FOMO work out? Look, our world is still severely affected by the US hegemony. Sigh.

💵 Stablecoin & Market Landscape

- Stablecoin market share remains high in reference to the total crypto market capitalization. 11.42% of stablecoin (134B) on 1.13T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 12ish% with a 1ishT total MC.

- Now at 1.13T. Still hanging around on the T level. Going steady.

- Binance FUD didn't work. Market has bottomed for a while, No one reacts to FUD.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

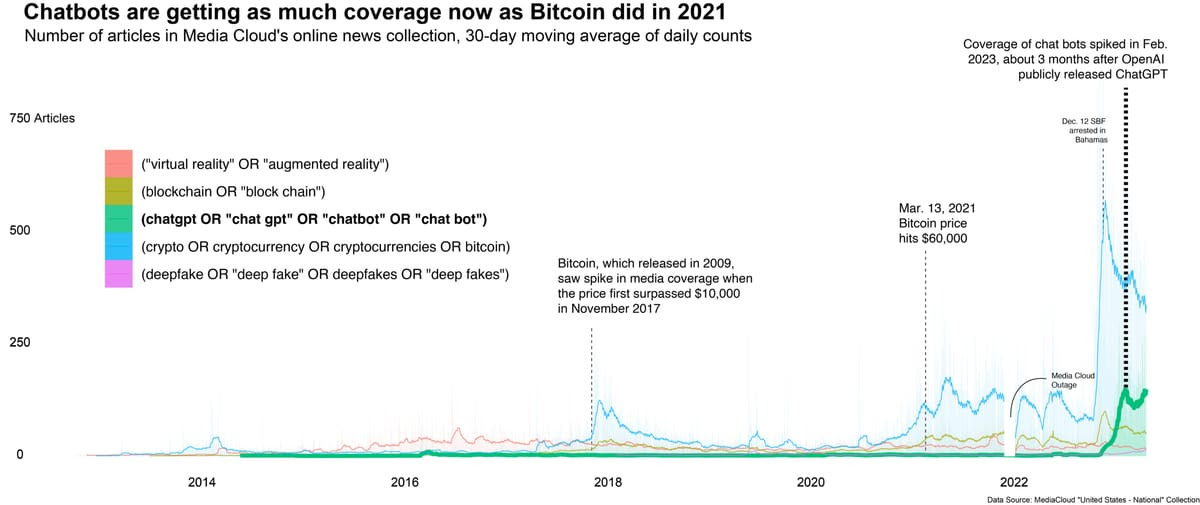

- Ultimately, does Bitcoin/Chatbot build the media coverage or vice versa?

- It's always a chicken and egg problem, things don't happen consecutively but concurrently. That's where the opportunity lies.

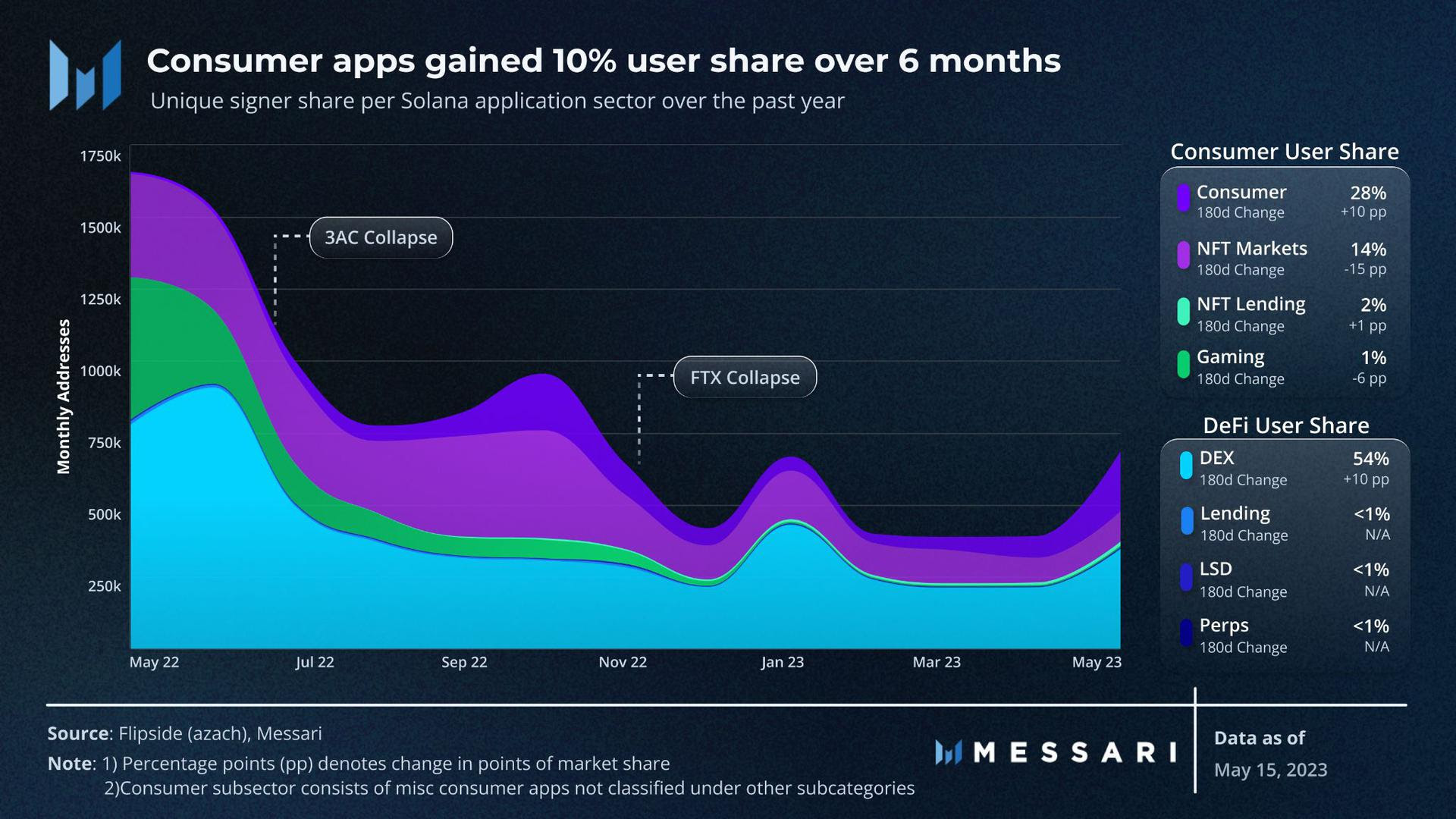

- Captain never liked VC intensive Solana, but since most of the halo effect is gone, it actually shows quite strong resilience and leadership, particularly in regards to going product-market fit. Solana's the only Layer One going on hardware, with the scandalous Helium (HNT), kind of the only projects out there with a good tokenomics model. Good to keep an eye on.

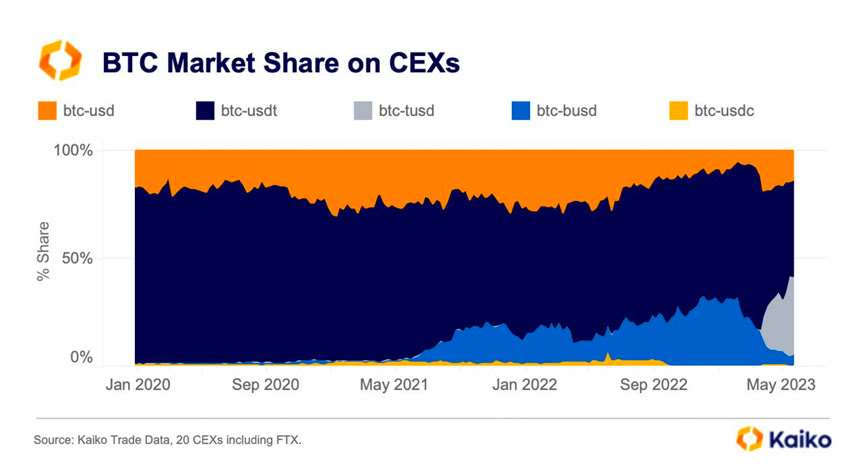

- Ultimately, will the end game be USDT vs TUSD? Both with a T but one at the end the other one at the start. BUSD will sunset, but USDC is the backbone of DeFi, so Circle has been underrepresented in this.

- Avalanche has been quiet, but they are not that bad at all. EURC is going to be deployed on AVAX soon.

🔢 Index

- Dropped 10 points in last 24 hours. The market doesn't seem to care as much as they should

- CBBI hasn't updated yet, but should be steady as it doesn't just measure the emotional side of the market.

📰 Current affairs

Starfish Finance:

Chapter 2— Flip Your Zero to Become A Hero

A flip a day keeps the bill away.

Prediction Market — The First Game of Starfish’s Entertainment-Fi

Play to earn?

Starfish Finance is Live on Arbitrum for its new chapter in Entertainment-Fi

Starfish Finance is listed officially on the Arbitrum portal. https://portal.arbitrum.io/?search=starfish to check out Starfish Finance

Starfish Finance II - Attack of the (Dapp) Clones

Far beyond Earth and millions of miles past the moon, there’s a planet where Decentralized Finance (DeFi) and NFT-Fi meet on an interoperable network. First observed in 2022, the world known as “Starfish Planet” is home to degens, hodlers, frens and a starfish named Sean.

Starfish Finance: A cross-chain DeFi, NFT-finance platform on Astar Network, a Polkadot parachain

Starfish Finance is a pioneer project in the Astar incubation project and the first decentralized finance (DeFi) and nonfungible token (NFT) finance platform on Astar Network.

BTC

BRC-721E Token Standard Converts Ethereum NFTs to Bitcoin NFTs

The new token standard allows traders to burn their ERC-721 NFTs and transfer them to inscriptions on the Bitcoin network.

ETH

Nothing much this week

Layer 1s/ Major DeFi

PancakeSwap Launches Tower Defense Game—With CAKE Token Rewards - Decrypt

The CAKE token plays a big part in the new tower defense game, but the company notes that it is not a play-to-earn scheme.

Stablecoin issuer Tether to mine bitcoin in Uruguay

Stablecoin issuer Tether has entered the bitcoin mining and energy production space in Uruguay in partnership with an unnamed local company.

Binance to Delist Monero, Zcash in 4 European Countries - Decrypt

Citing local laws, Binance will halt trading services for a dozen privacy-centric cryptocurrencies across Europe.

Avalanche hits 1 million monthly active users for the first time

The Avalanche blockchain has crossed 1 million monthly active users for the first time after recent launch of AvaCloud.

Nascent’s Elitzer Says Oracle-Free DeFi is Emerging

Dan Elitzer of venture capital firm Nascent says safer DeFi will minimize governance and oracles.

Tether Market Cap Climbs to All-Time High of $83.2B, Even as Stablecoin Market Sinks

USDT has reached a $83.2 billion market capitalization, recovering all the losses since the implosion of blockchain project Terra more than a year ago.

Polygon-Based USDC Can Now Be Sent on Coinbase Wallet With Zero Gas

Coinbase Wallet, one of most popular tools for storing and sending cryptocurrency, makes USDC transactions on Polygon gas-free

Dogecoin Investors’ Class Action Lawsuit Now Accuses Elon Musk of Insider Trading - Decrypt

The amended lawsuit now alleges Elon Musk has engaged in market manipulation and securities fraud related to Dogecoin.

SEC Sues Binance and CEO for Alleged Securities Violations - Decrypt

The SEC has sued Binance Holdings Ltd. and CEO Changpeng Zhao for breaking U.S. rules, a court filing shows.

MakerDAO Votes to Ditch $500M in Paxos Dollar Stablecoin From Reserve Assets

The result is a significant blow for Paxos as MakerDAO currently holds roughly half of USDP’s total supply.

https://twitter.com/delitzer/status/1661755779240841222?s=20

Thread by @IamZeroIka on Thread Reader App

@IamZeroIka: Being early to the right crypto narratives can be very lucrative. And since this world is in continuous evolution, it’s not easy to spot them. Here are 8 narratives that I’m paying attention to, some...…

NFTs

FIFA, Madden Maker EA Sports to Add Nike NFTs to Games - Decrypt

Nike’s Polygon-based .Swoosh gear is coming to future EA Sports games in a blockbuster integration announced Thursday.

Macro econ/ Regulations

Trezor Sales Spike 900% Even as Exploit of “T” Model is Revealed

Trezor is reaping gains from rival Ledger’s blunder

Hong Kong-based First Digital introduces USD stablecoin

The Hong Kong stablecoin is intended to be backed on a one-to-one basis by one U.S. dollar or asset of equivalent fair value.

Proposed 30% Crypto Mining Tax Dropped in US Debt Ceiling Deal

Republican congressman Warren Davidson highlighted the blockage of proposed tax on crypto mining in the US debt ceiling deal

EU officials sign Markets in Crypto-Assets framework into law

Sweden’s minister for rural affairs, Peter Kullgren, and European Parliament President Roberta Metsola signed the Markets in Crypto-Assets regulatory framework into law on May 31.

Brazilian crypto exchange Mercado Bitcoin licensed as payment provider: Report

Crypto exchange Mercado Bitcoin was granted a payment provider license from Brazil’s central bank.

Crypto folks send $1.1 million to NotLarvaLabs founder for ‘nothing in return’

The NotLarvaLabs founder is jumping on a trend where crypto users send tokens to addresses hoping for an airdrop.

Degens Can’t Stop Sending Millions in Ethereum to Random Wallets on Twitter - Decrypt

Tapping into the current meme coin frenzy, a Twitter influencer received over $1 million worth of crypto for literally nothing.

Japan’s New Stablecoin Framework Could Spur US To Act

As Japan takes important step forward on stablecoins, industry participants say, proposed US laws around such crypto assets remain in flux

Research reports/videos (DYOR)

Is Uncollateralized Lending Still A Thing?

Part I: Market Situation Introduction Our new thesis The Open Metaverse Under Attack – Fight Back introduced many encouraging growth paths for the Web3 space. In this article the focus will be on a specific sector with a lot of potential as well. The US market for unsecured personal loans alone reac…

TikTok’s Memecoin Interest | CoinGecko

Crypto TikTok’s interest in #memecoin has peaked amid the 2nd meme coin rally in 2023. Find out which demographics are most interested.

Crypto Research, Data, and Tools

Gain an edge over the crypto market with professional grade data, tools, and research.

Hop Protocol’s ‘Sybil Hunter’ Payout Unveils Powerful New Airdrop Tool - Decrypt

For tracking airdrop farmers last year, Hop Protocol is now coming good on its promise to reward so-called Sybil hunters for their diligence.

The Invention of Scarcity: An Examination of Human Behavior in the Digital Age

Something caught my attention today: “State Champs” trending on Twitter. Thousands of high school teams across the country are celebrating their respe…

Patience Is Beautiful

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)Thanks for reading Crypto Trader Digest! Subscribe for free to receive new posts…