The DeGen Bible to Financial Freedom - Vol. 30

Memeconomy's best signification is its relevancy to the principles of permissionlessness, on-chain transparency, and David against Goliah type of small winning big legends.

Week 1 May- 15 May 2023

Acknowledge your limits, no shame, no guilt, no regrets- Mars Captain

🧠 Observations

- BRC-20, BRC-21, BRC-this, BRC-that, please be reminded that you can't do smart contract on any of these standards, so you shouldn't be comparing them with ERC-20. Plus, Unisat Wallet's launch had immediately multiple bugs. Why would you speculate on a wallet for the storage of a few lines of code a unicorn? (You can launch standards, but it doesn't mean it will become a market or drive adoption, there is no adoption, sorry. Good luck to those who do Unisat wallet or DIY other superior standards. The memory of $BCH and $BSV is still fresh.)

- Memeconomy's best signification is its relevancy to the principles of permissionlessness, on-chain transparency, and David against Goliah type of small winning big legends. Oh, where are advocates saying more regulation is good? Are they busy aping in $PEPE and pause their advocacy? Has Linkedin crypto gurus caught up with the meme rave, or your corporate friends start to pivot to alternative meme investment yet? If not, there is still some time to ride this hype.

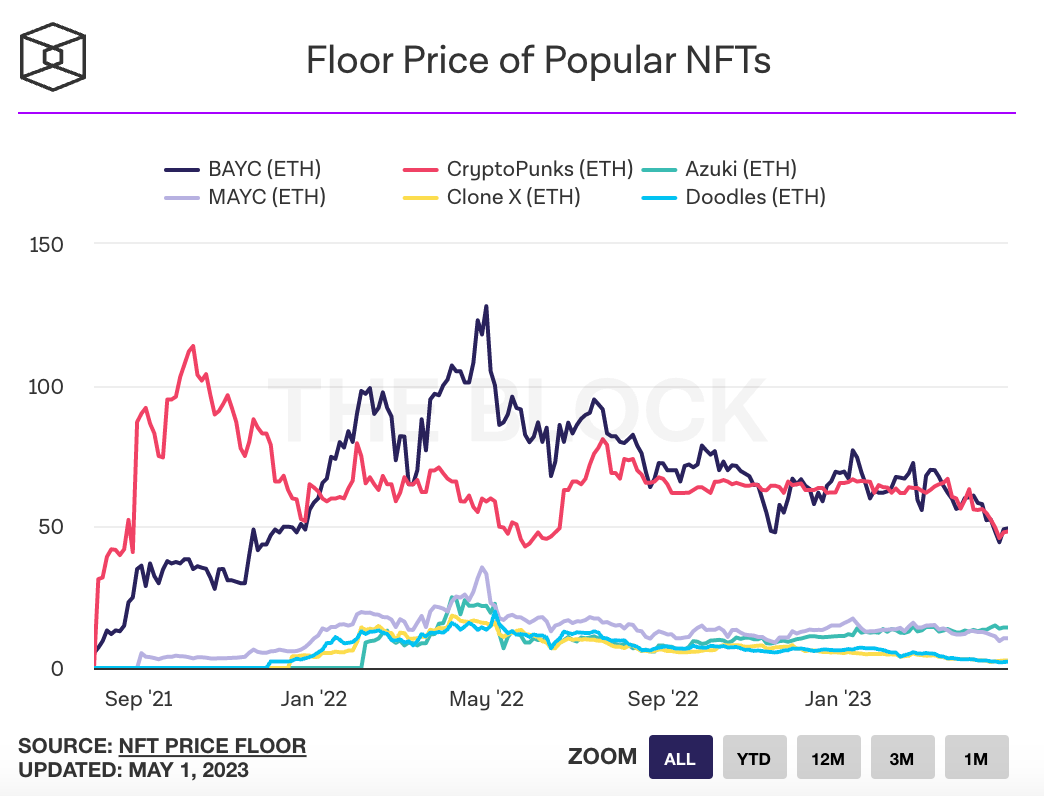

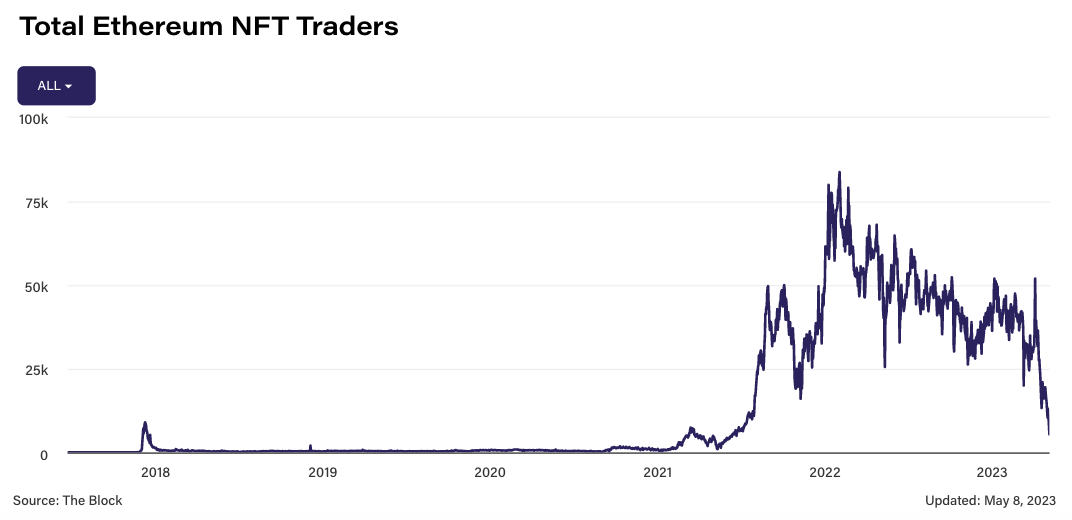

- There seems to have no coming-backs of NFTs, poor JPEGs, RIP 2021-2023 Spring. Except DeFi and stablecoins, not yet a super sound business models in crypto. Buidlers have to DYOR more relentlessly and tirelessly.

💵 Stablecoin & Market Landscape

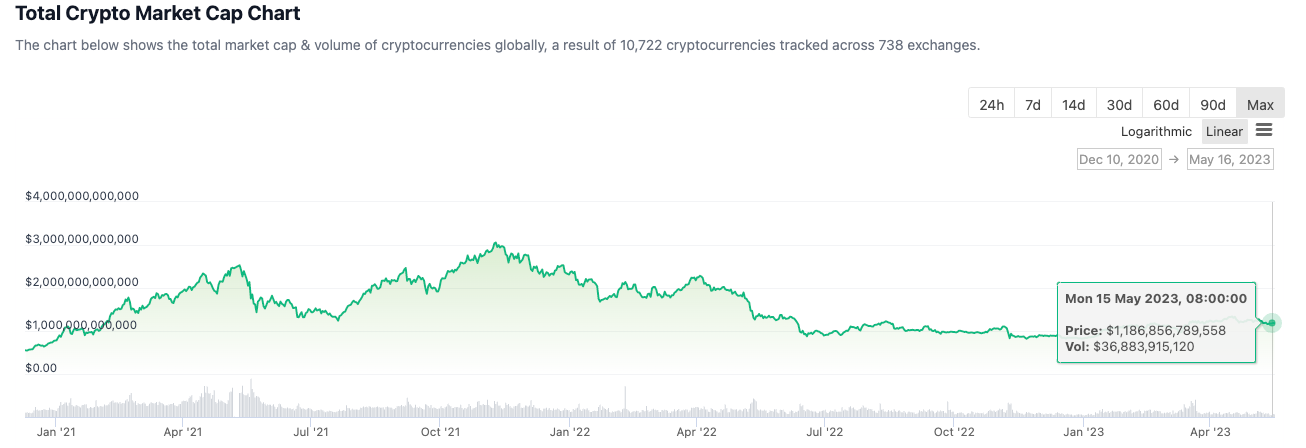

- Stablecoin market share remains high in reference to the total crypto market capitalization. 11.17% of stablecoin (131B) on 1.17T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 11ish% with a 1ishT total MC.

- Now at 1.17T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

- These NFTs need immediate innovation or else they are going to ashes behind the next bull run.

- Founders and teams and whale holders, please think of running a proper project, you don't need to travel on private jets or throw big lavish parties to show that you are important.

- Nothing to comment on, but voilà!

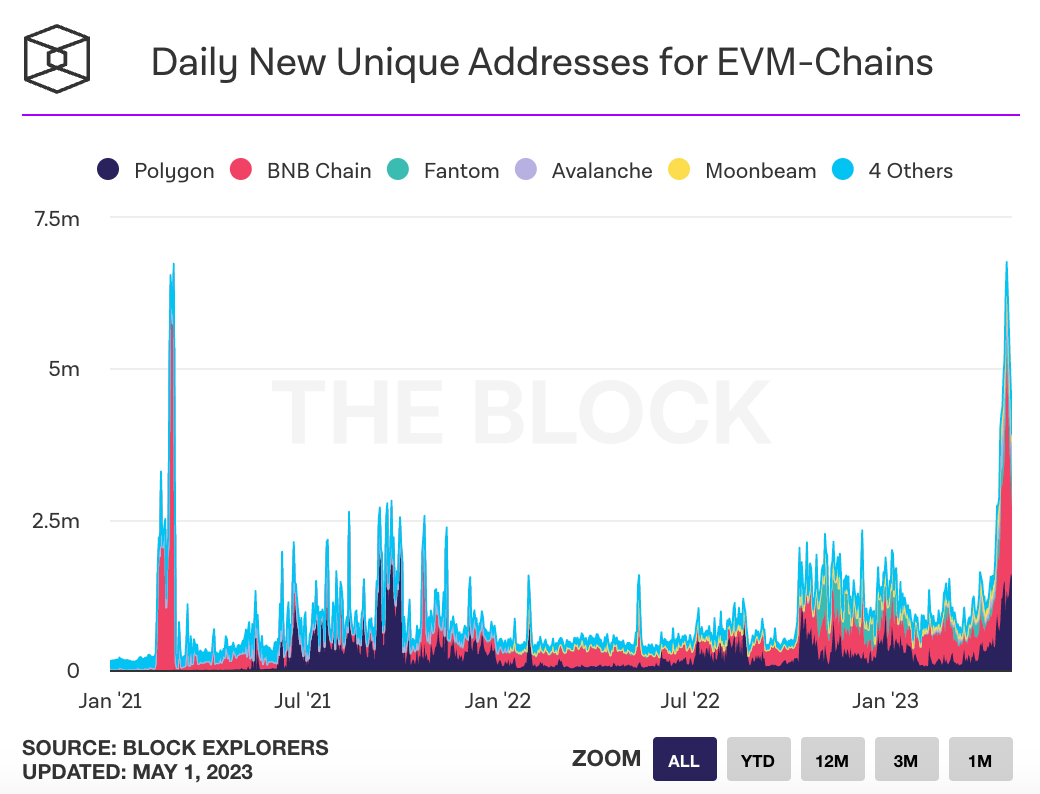

- Someone farming addresses after the Arbitrum saga? What's gonna launch on BNB then?

- BTC magazine has always held crystal clear eyes towards the market. Quote, "It took the last two bitcoin cycles around three years each to return to their previous all-time high. Currently, we’re halfway through that period. Both previous cycles also saw price action that retested market bottoms. It’s best to prepare for a similar scenario playing out, especially considering current macro headwinds. At the least, history would show us that it’s a good time to have patience at this part in the cycle." 💎✋

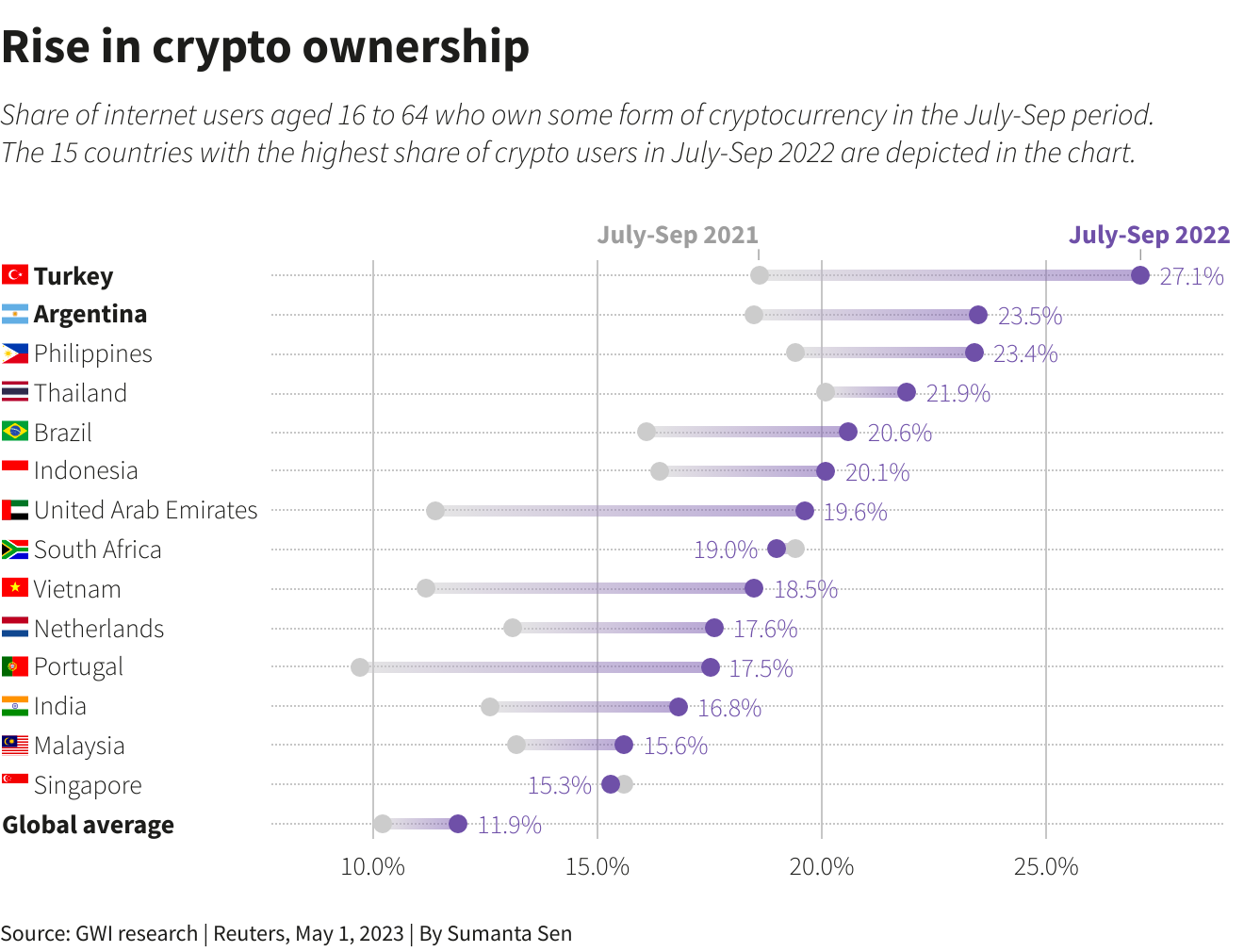

- UAE is the interesting country in this ranking, anyone knows why?

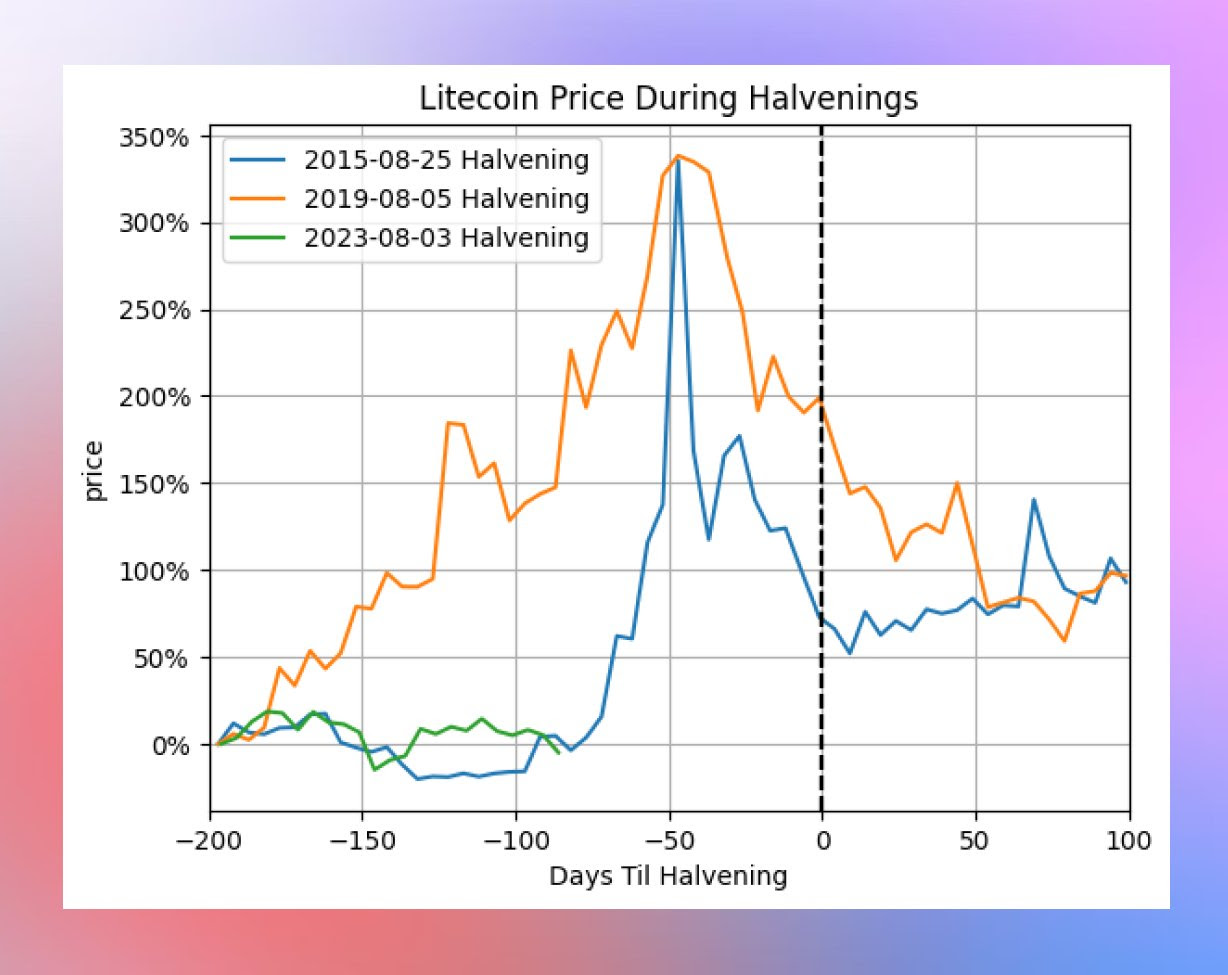

- If $BTC is digital gold, $LTC is digitial silver. MBWB + the highest payment method adoption available makes this legacy coin a solid one, in a way. And its halving is coming soon.

🔢 Index

Bitcoin Fear and Greed Index is 50 - Neutral

— Bitcoin Fear and Greed Index (@BitcoinFear) May 15, 2023

Current price: $27,426 pic.twitter.com/Hi0LFbXa9s

- Has been sideways for around 1 month now. There should have room to drop further, even though price actions might not move. Binance's liquidity depth has been halved and halved in the last month, how bullish are you?

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) May 15, 2023

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 2️⃣7️⃣

🗓 May 15th, 2023

The price of #Bitcoin is $27,023 pic.twitter.com/C64sCUWJDR

- CBBI has been stagnant as well. Boring but looks healthy.

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

I spent my Friday night indexing 482,663 on-chain transactions 😑

— Alex (@thiccythot_) May 6, 2023

As promised, please enjoy my analysis of the parabolic memecoin, PEPE

🧵

- Realized and unrealized PNL of PEPE traders

- How to evaluate price and market cap through the lens of supply and liquidity

1/ pic.twitter.com/elQYXCBGKl

Based on today's Forbes article, Bhutan's Hydro-based Bitcoin mining is

— Daniel Batten (@DSBatten) May 1, 2023

* at least 53 MW/ 1.78 EH (if they bought at the peak)

* Most likely to be 100 MW/ 3.37 EH

( which would be a little under 1% of global hashrate)

Pretty significant.

Calculations enclosed pic.twitter.com/CelsJN2S7Y

The Solidly ve(3,3) Model is making a comeback!

— Nansen Research (@nansen_research) May 3, 2023

This year, it has surged to become the third most-forked protocol and a top DEX model that's raking in impressive fees and revenue 💰

Read on to learn more... pic.twitter.com/9Ry5Z8yQ8u

I JUST BURNED A MILLION TO TELL YOU THEY'RE PRINTING TRILLIONS

— Balaji (@balajis) May 2, 2023

The million dollar bet is now closed out by mutual agreement. I made $1M+ in provable on-chain donations, which you can verify by clicking the links below:

1) $500k to Bitcoin Core development via Chaincode:… pic.twitter.com/J9nwxZAAhD

Missing out on significant or life-changing money creates a psychological stamp that will forever affect your future trading decisions.

— Cold Blooded Shiller (@ColdBloodShill) May 8, 2023

Everyone remembers that entry they had on a coin at "X" price (usually incredibly low) before it runs to "Y" (usually incredibly high)

🧵 pic.twitter.com/xDNA9kddAt

NFTs

Macro econ/ Regulations

/cdn.vox-cdn.com/uploads/chorus_asset/file/24396993/328431170_528558606050894_138216244473781208_n.png)

Research reports/videos (DYOR)