The DeGen Bible to Financial Freedom - Vol.29

Market recovery has topped & been looking for the next narrative to keep it going until the next halving. CEXs to support BRC20, but are they just interested in curbing the fees you trade?

Week 21 Apr - 30 Apr 2023

One year to halving 2024 - Mars Captain

🧠 Observations

- Market recovery has topped & been looking for the next narrative to keep it going until the next halving. Landscape has been not been moving anywhere. Echoes Captain's view in the last 6 weeks. Now, we are looking at another FOMC and First Republic Bank failure.

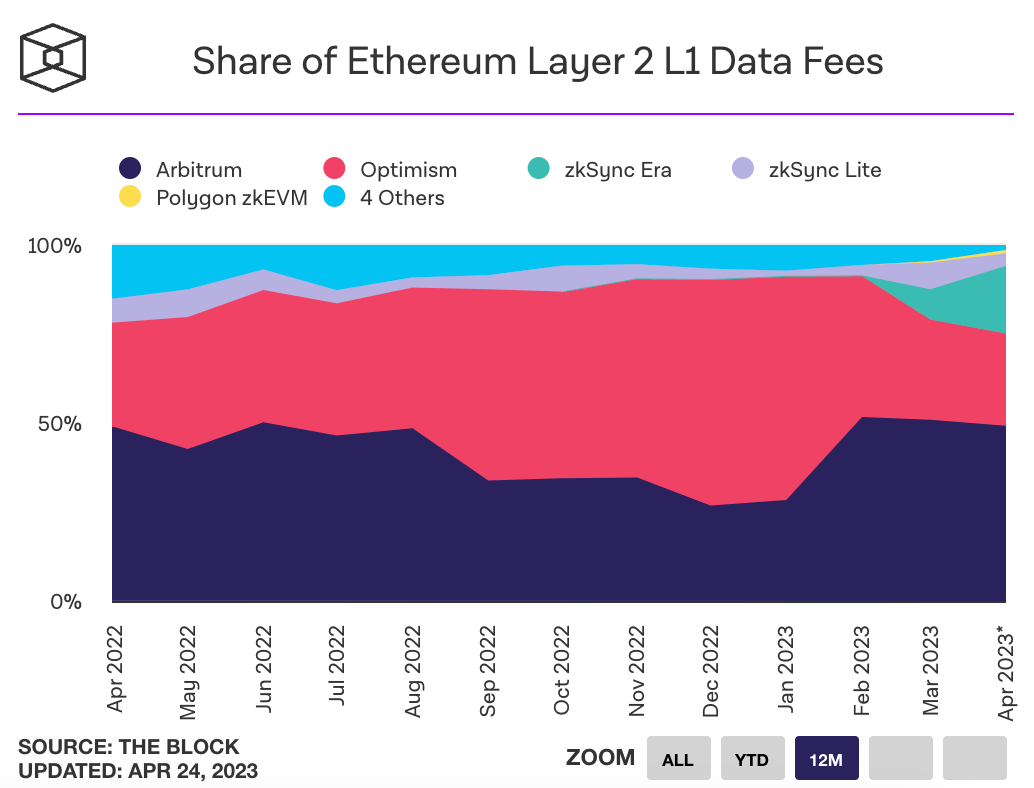

- Now we need to reason on the blue chip Layer 1 gentrification narrative. The thesis was that Ethereum's high gas and slow speed will create this overflow effect on other blockchain ecosystems, as if it is too expensive to live in the Switzerland, you might as well go live in Thailand for cheaper costs and same/higher living standard. The Layer 2 landscape + Etheruem's continuous successful upgrades is unthroning the smaller kings. Are Avalanche, Polkadot, Cosmos, Near, Solana, etc. NGMI in the next bull?

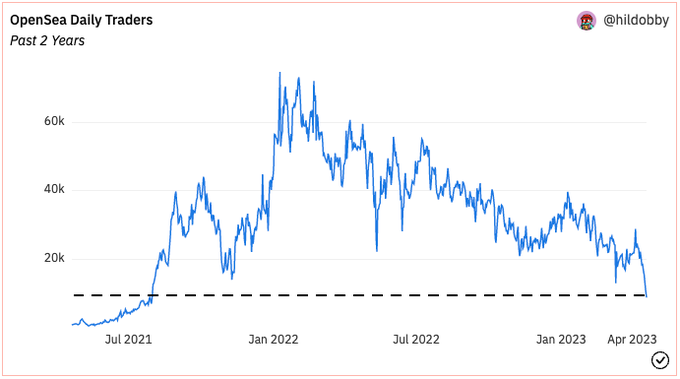

- Sigh, where are the NFTs heading towards? Are people still believing in their JPEG communities?

- Is BRC-20 really a thing? TL:DR, Satoshis are fungible until the ordinal theory, but again, are you sure the CEXs are in this to support or to curb the fees you trade? If it indeed becomes a success, what are all these Ethereum JPEGs gonna do?

💵 Stablecoin & Market Landscape

- Stablecoin market share remains high in reference to the total crypto market capitalization. 10.85% of stablecoin (131.3B) on 1.21T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 10ish% with a 1ishT total MC.

- Now at 1.22T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

- NFTs bring more value as a technology rather than a speculative asset, in Captain's opinion, though I wish that I had a BAYC or Punk, so to speak.

- If we think NFTs were assets and crypto tokens were currencies in the different kingdoms of web3, assets don't attract attention when the currencies are trading against themselves like FX. NFTs have become a parallel market to the crypto tokens, when the tokens are flying up, why shall you be in NFTs, that makes total sense? (Look at $PEPE and $AIDOGE, for examples.)

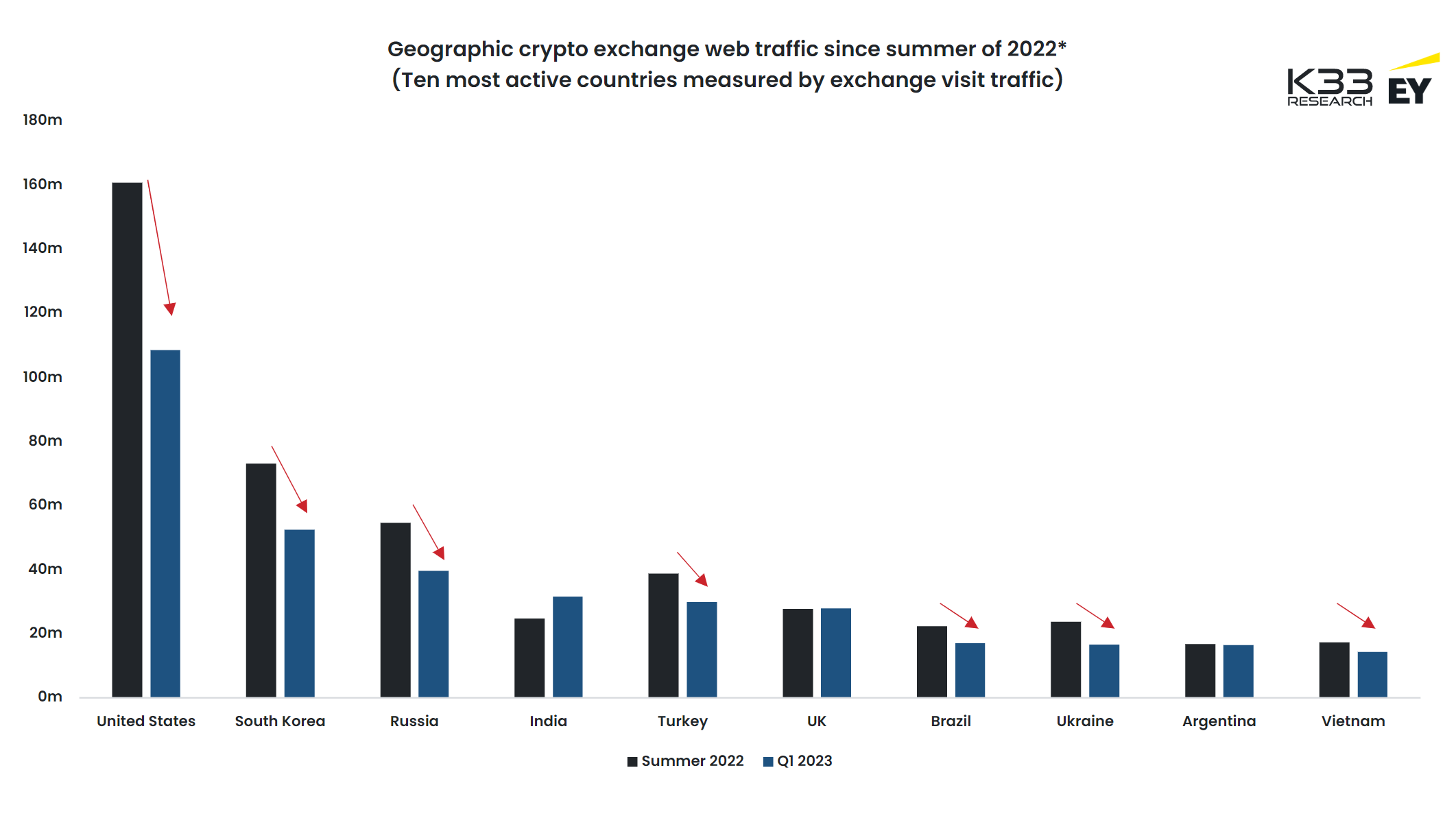

- Turkey, the UK, Argentina, if you bother to learn every geopolitical-monetary stuff. (Wait, the UK, are you serious? Wen has the Grace descended to the underdeveloped peoples? Brexit? Russo-Ukrainian war? Well, why should you have confidence in a "developed" country from Boris to Rishi in just several months. Isn't that a sign of political instability as what the "international world" thinks on the "poor south"? Poor UK, arrivedierci.)

- I mean, if you keep looking for speculative opportunities, here is one. Ethereum has no more narrative apart from cheaper and faster, given that you are still in crypto playing DeFi stuff and flipping NFTs.

- (Captain would be interested in what's next after zksync, PM the Starfish team if you are doing anything beyond cheaper and faster.)

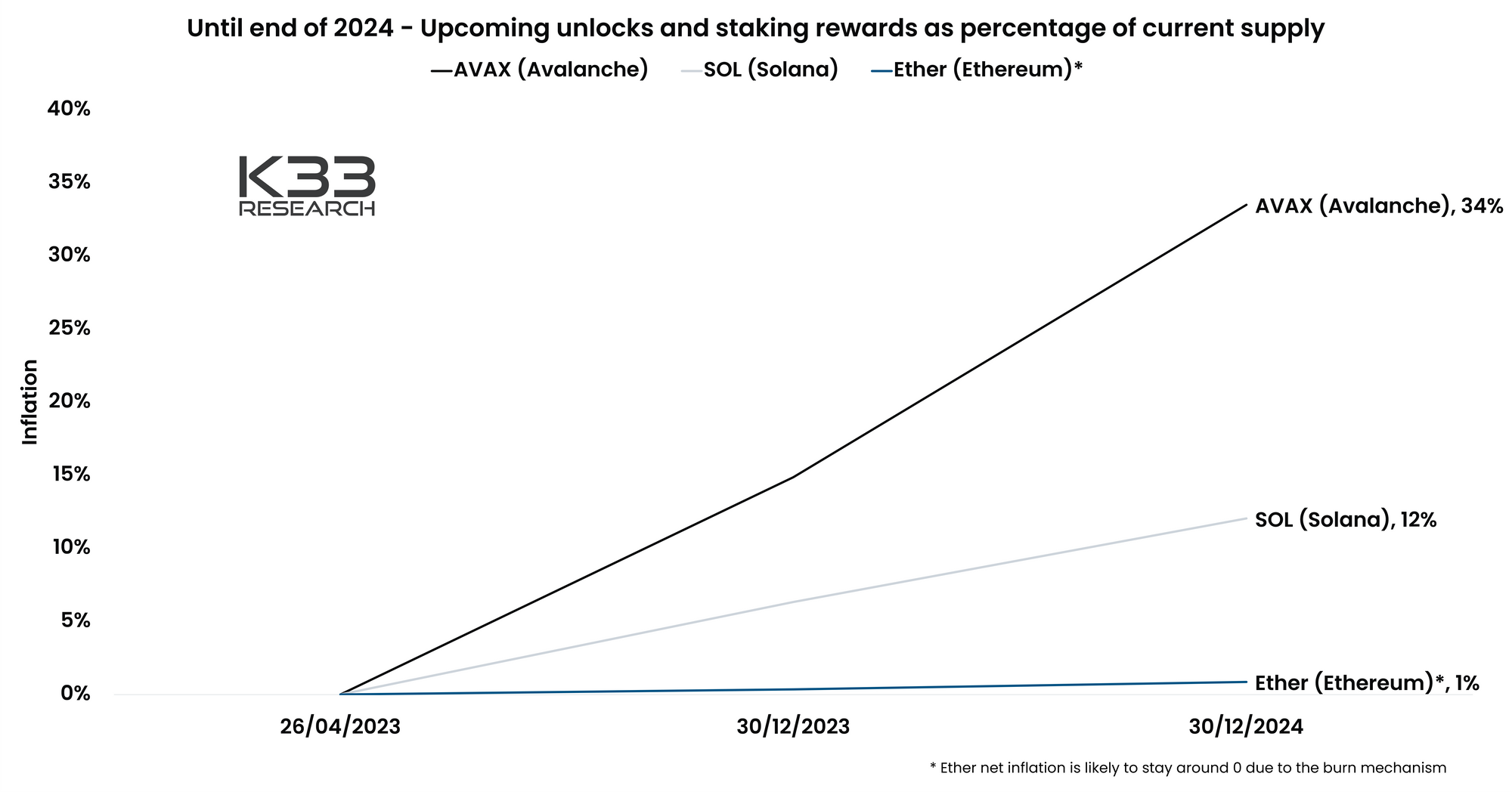

- OK, this one I didn't think of, I will quote K33's original statement: "The amount of AVAX in free-floating circulation will rise sharply from the unlocking of AVAX tokens to early investors/contributors and team members."

- "Any sound investor would realize profits by partly selling their unlocks. The substantial and consistent unlocking of AVAX over the next two years will likely create additional sell pressure on AVAX compared to many other coins."

🔢 Index

Bitcoin Fear and Greed Index is 60 ~ Greed

— Bitcoin Fear and Greed Index (@BitcoinFear) April 30, 2023

Current price: $29,385 pic.twitter.com/fOUCGLlGEa

- Very high prices vis-a-vis the fear index.

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) April 30, 2023

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 2️⃣7️⃣

🗓 Apr 30th, 2023

The price of #Bitcoin is $29,252 pic.twitter.com/tZeABd8INE

- CBBI remains stable. That's the sign of a stable market.

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

1/ On Collecting A Piece Of Art

— 6529 (@punk6529) April 22, 2023

This is the expanded version of "Buy what you like, at a level you can afford, plan to hold forever"

I am going to tell a story I have told before, as context.

I was 22 years old in NYC and was sharing an apartment with 2 other "analysts"

Over the past 1.5 months one person has created 114 meme coin scams.

— ZachXBT (@zachxbt) April 26, 2023

Each time stolen funds from the scam are sent to the exact same deposit address.

0x739c58807B99Cb274f6FD96B10194202b8EEfB47 pic.twitter.com/uwVAiG9WGG

NFTs

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/dlnews/7GE6C3UYN5AAVLNOLLWTXI6SWQ.jpg)

Macro econ/ Regulations

Research reports/videos (DYOR)