The DeGen Bible to Financial Freedom - Vol.27

Shanghai upgrade is finished, Ethereum has no more narrative for now. FOMC is around the corner again. Coin Bureau's warning a potential real estate market collapse in the US. Calling whatever crypto web3 as if there is a new economy isn't accurate for our industry.

The DeGen Bible to Financial Freedom - Vol.27

Week 11 Apr - 17 Apr 2023

Happy families are all alike; every unhappy family is unhappy in its own way. - Mars Captain

🧠 Observations

- Shanghai upgrade is finished, Ethereum has no more narrative now. Even Vitalik is not shilling anything on Ethereum development. Who/what will lead the next narrative in the rest of 2023?

- FOMC is around the corner again. Coin Bureau's warning a potential real estate market collapse in the US. Though Captain doesn't think it would happen, it's still a risk not to overlook as crypto will react to all macro market conditions.

- Still connecting the dots between CBBI, stablecoin MC % and other market sentiment data points. It seems likely that this small recovery of he crypto market is reaching the end?

- People should keep their mind clear, Web3 is another word for crypto. Calling whatever crypto web3 as if there is a new economy isn't accurate for our industry. Captain advises every Starfish subscriber to be wary of any government-led initiatives in crypto, or web3. They are not here to help, same as their anti-drug, anti-humantrafficing, anti-this & anti-that is just to_____. 💰💰💰. I let you fill in this blank.

💵 Stablecoin & Market Landscape

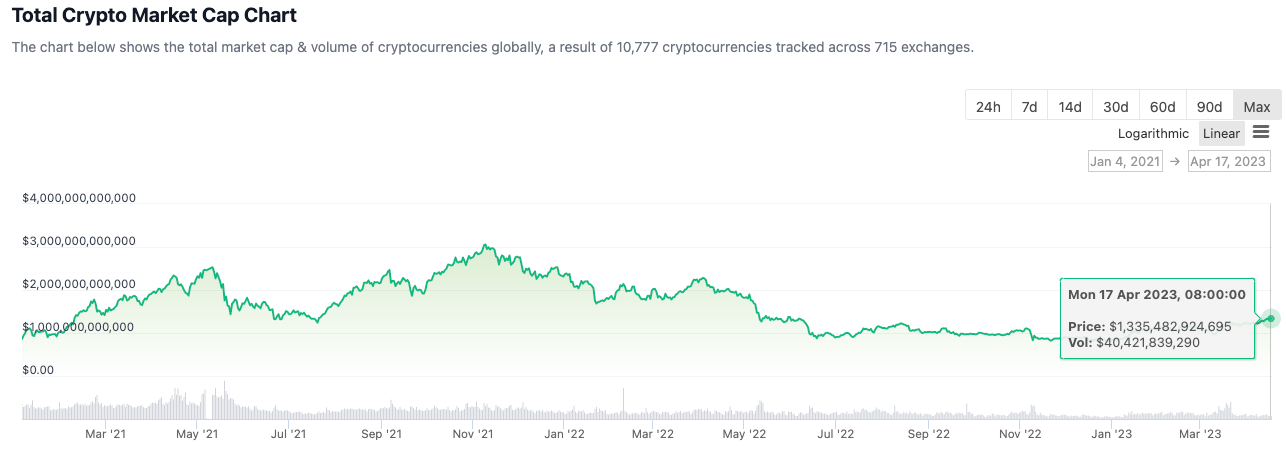

- Stablecoin market share remains high in reference to the total crypto market capitalization. 10.05% of stablecoin (132.4B) on 1.31T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 12ish% with a 1ishT total MC.

- Now at 1.31T. Still hanging around on the T level. Grown 30% since January 2023.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

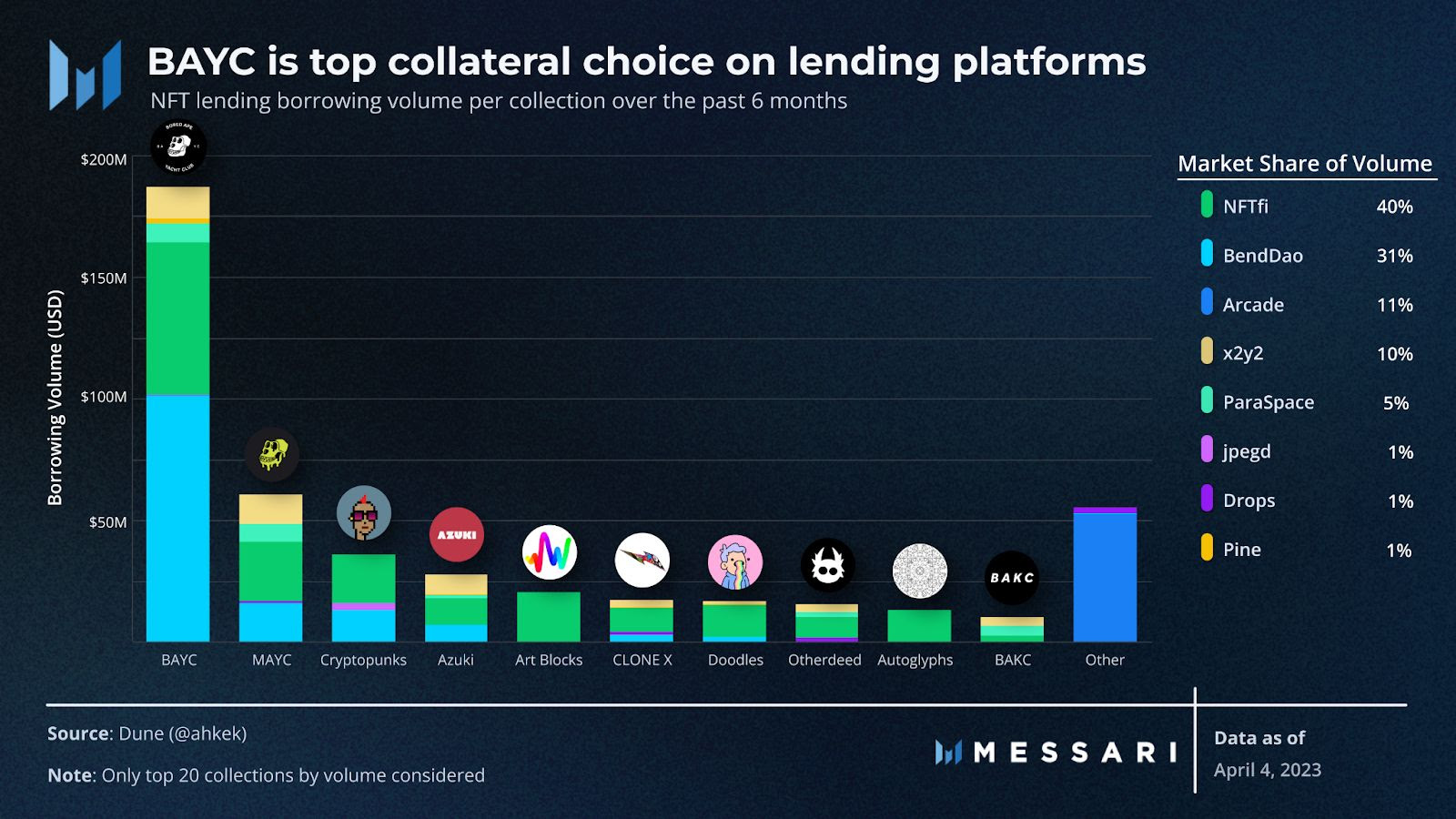

- That's a terrible landscape if that's the development of NFT and Metaverse whatever. Even for a bear market, DeFi's development has been more active than the JPEGs.

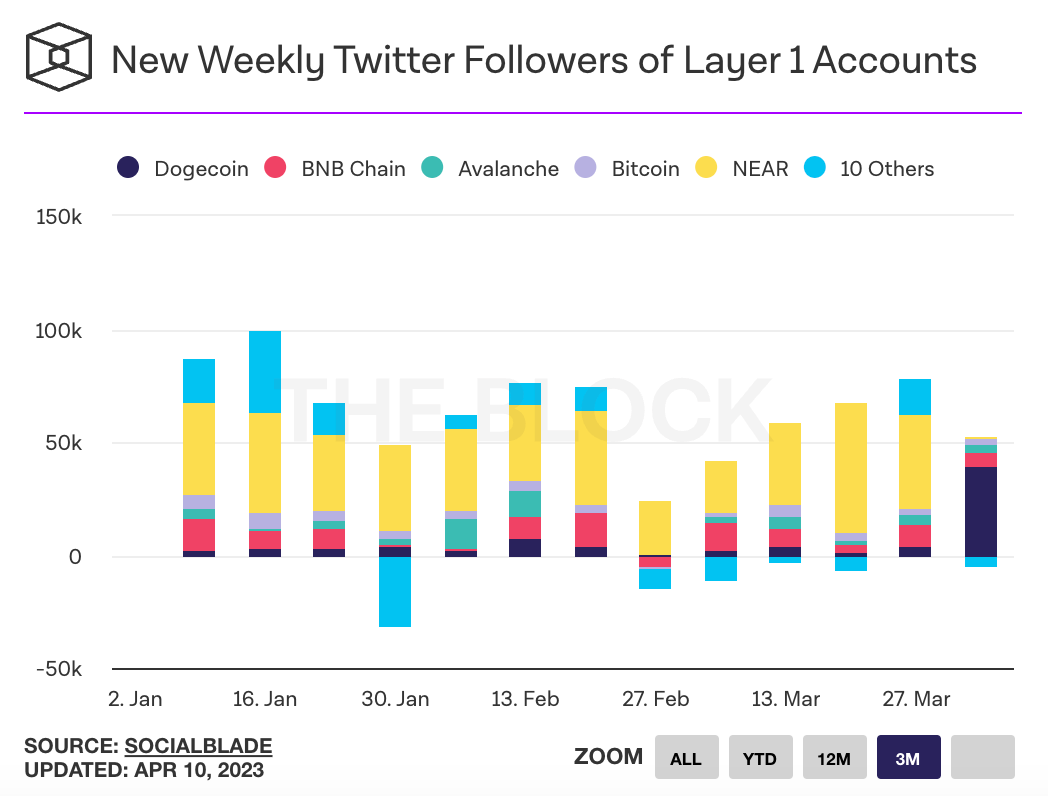

- This infographics says a lot about the world of crypto. You need one Elon Musk to counter all the influence combined elsewhere. This should be classroom material.

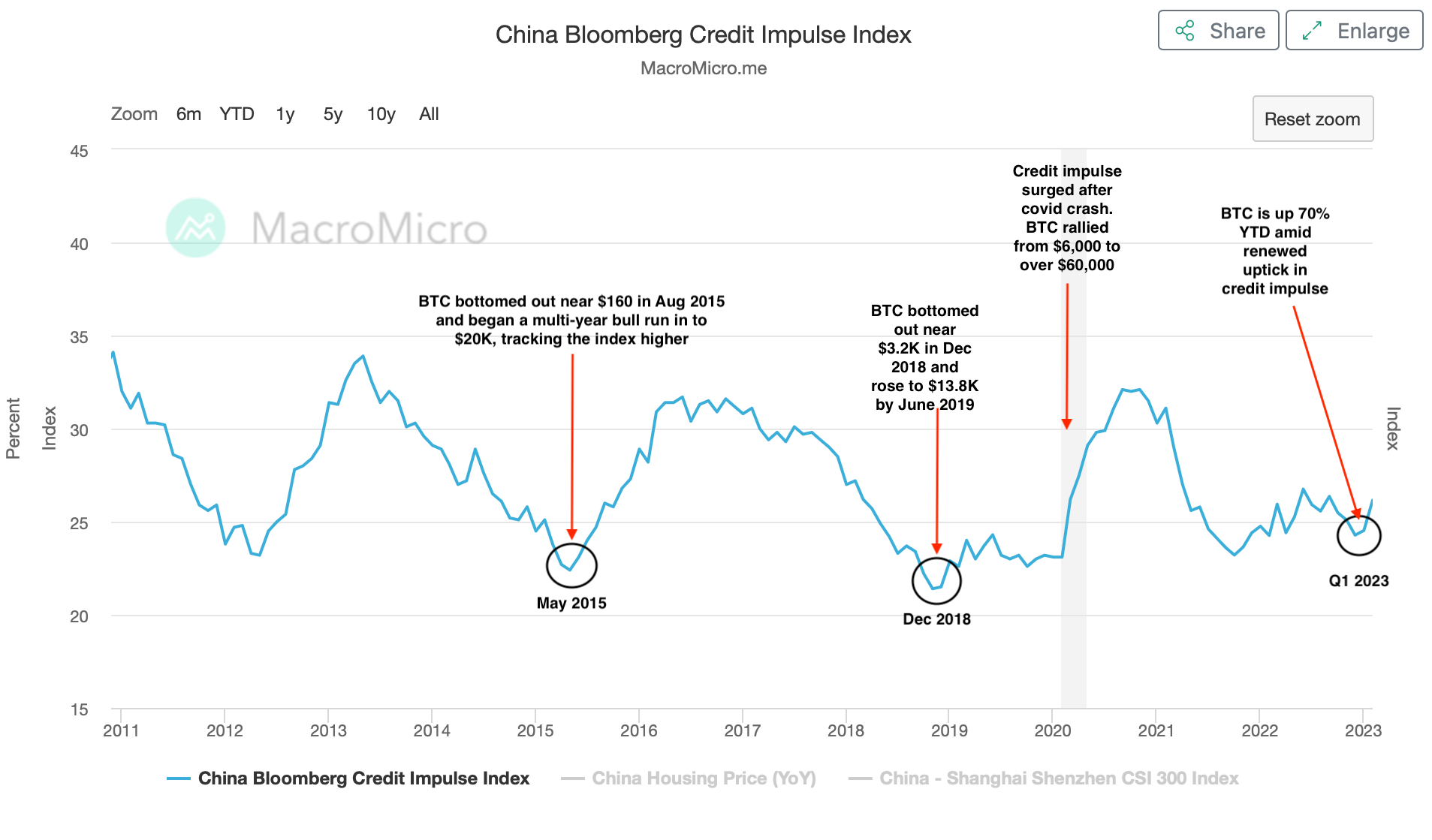

- This might be bullish for Chinese stocks?

- Nah, real crypto OGs are mostly Chinese, this is something for the crypto market.

- Matrixport has been doing pretty good research, mainly focused on BTC, pretty impressive about their pure analysis since Q4 2022. Even the SBF saga didn't undo their prediction. Good work to follow, fishes.

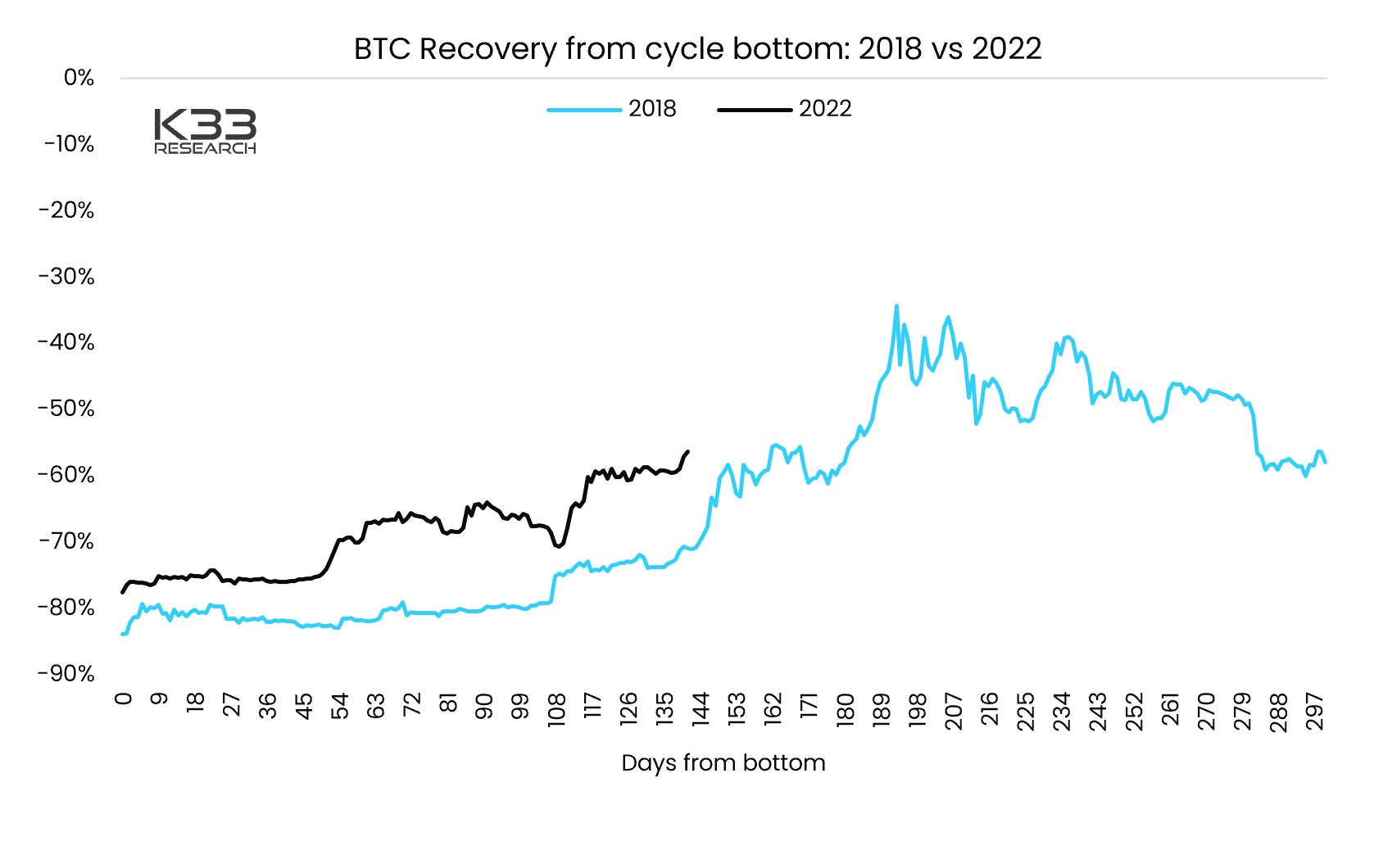

- Quoting K33 research, "BTC’s current drawdown and recovery cycle is remarkably similar to the pattern seen in the 2018-19 bear market in terms of length and trajectory. If history repeats BTC will peak around May 20 at $45,000." 🤔

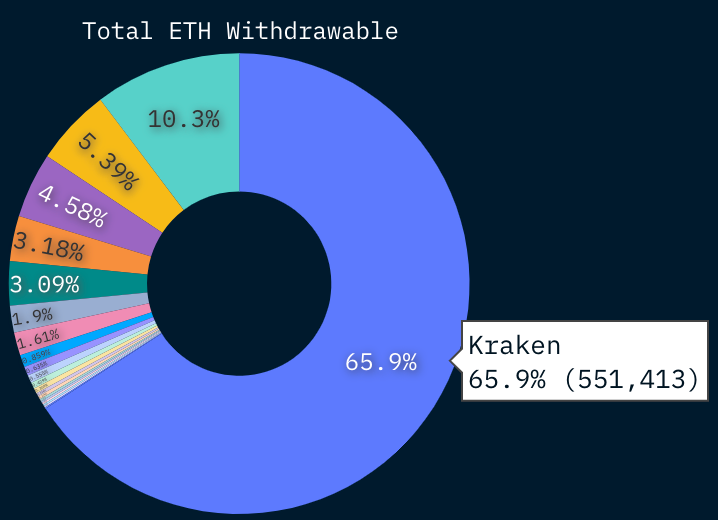

- Kraken got fined by SEC, not just for money, but also they have to stop this staking business. This is such a shame, and when you look at this post-Shanghai upgrade landscape, the SEC really cut a bloody arm off Kraken...

🔢 Index

Bitcoin Fear and Greed Index is 69. Greed

— Bitcoin Fear and Greed Index (@BitcoinFear) April 17, 2023

Current price: $30,312 pic.twitter.com/ffEnOcqyWQ

- It has been in greed for a month, and the price level has become stagnant.

- If we look at the current market as a small bull one without referencing to the 2021's hyper bull, this data point represents a cycle top.

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) April 16, 2023

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 2️⃣9️⃣

🗓 Apr 16th, 2023

The price of #Bitcoin is $30,280 pic.twitter.com/5CQcEA7o1L

- Same as fear index, CBBI has been stagnant, so it's almost 1/2 of the ATH total MC. Same as BTC's price. In this perspective, current cycle top isn't an unconvincing thesis.

📰 Current affairs

Starfish Finance:

BTC

ETH

Layer 1s/ Major DeFi

I've been closely monitoring VC and smart money entities over the last 30 days 🔎

— Thor⚡️Hartvigsen (@ThorHartvigsen) April 10, 2023

Many of these are worth $100m+ 🐳

Here is a full overview of what large whales/investors have been buying/selling recently💰 pic.twitter.com/1sLkh3AqAJ

🌐 Introducing BRC-721 a metadata standard for BTC ordinals aiming to standardize the process of grouping items into collections,

— Otter 🦦 (@otterolie) April 10, 2023

by @poyo_eth @hackernoon

I have made 🧵 on the draft I submitted for reviewhttps://t.co/qhiC3iByqb pic.twitter.com/48v2Qd6o3K

The most overlooked narrative?

— Louis (@lou_markets) April 11, 2023

Wallets

This will be a multi $100B industry (today it’s $1B)

🧵 Here’s a breakdown of the wallet thesis and early leaders in the space. pic.twitter.com/tHXH0Yholr

NFTs

Macro econ/ Regulations

Research reports/videos (DYOR)