The DeGen Bible to Financial Freedom - Vol.24

The market has bottomed and entered a stable status. Bitcoin trading, dominance, all metrics look healthy. Plus, narrative of a failing banking system is going strong. Bullish on major Layer 1s and blue chip DeFi projects.

Week 21 Mar - 27 Mar 2023

The point of inflection. Steady, lads! - Mars Captain

🧠 Observations

- Captain believes the market has bottomed and entered a stable status. The first time after the start of Russo-Ukrainian war a year-ish ago.

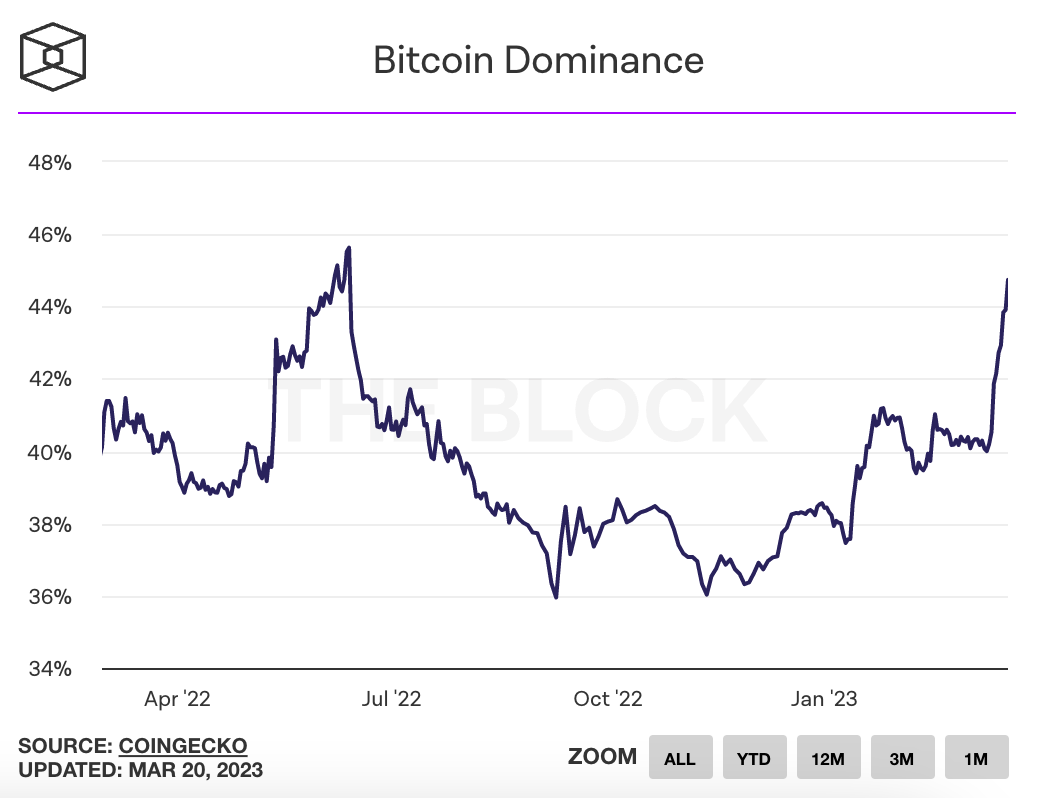

- Bitcoin trading, dominance, all metrics look healthy. Plus, narrative of a failing banking system is going strong. Once you go BTC, you never go back.

- Bullish on major Layer 1s and blue chip DeFi projects. After all, it is by far the ONLY viable business model in crypto. Meme coins would be the second. All NFT and metaverse WOKE stuff can go third. But whatever pro-regulation rubbish advocates and snitches should go south like the banking system. Choose your DYOR friend carefully, like SEAN is a good fren because SEAN is in the first category.

💵 Stablecoin & Market Landscape

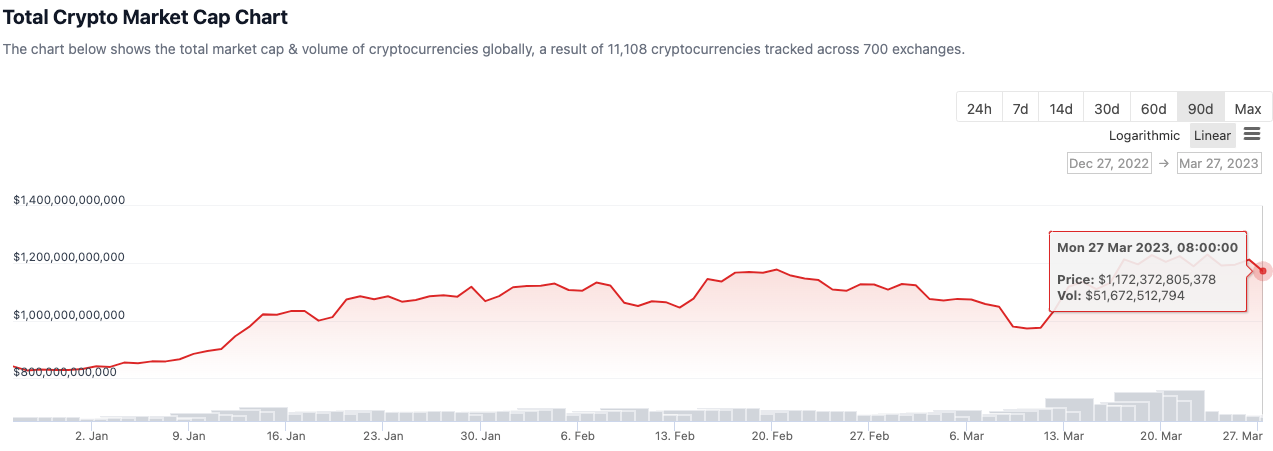

- Stablecoin market share remains high in reference to the total crypto market capitalization. 11.43% of stablecoin (133.7B) on 1.16T crypto market.

Reminder: Mid-NOV 2021, this percentage was around 4ish% with a 3T total MC. Now we are at 12ish% with a 1ishT total MC.

- Now at 1.16T. Still hanging around on the 1T level. Going steady.

Reminder, June and Nov 2022 witnessed a bottom of 800ish B MC vis-a-vis the market’s top in NOV 2021 at 3T.

Infographics

- Bitcoin domainance represents a lot about current market landscape.

- Oops, last time it was pre-the-Merge moment when it rose over 42%. In 3 weeks time, there will be Shanghai upgrade. Does this dominance imply more for Etheruem than Bitcoin?

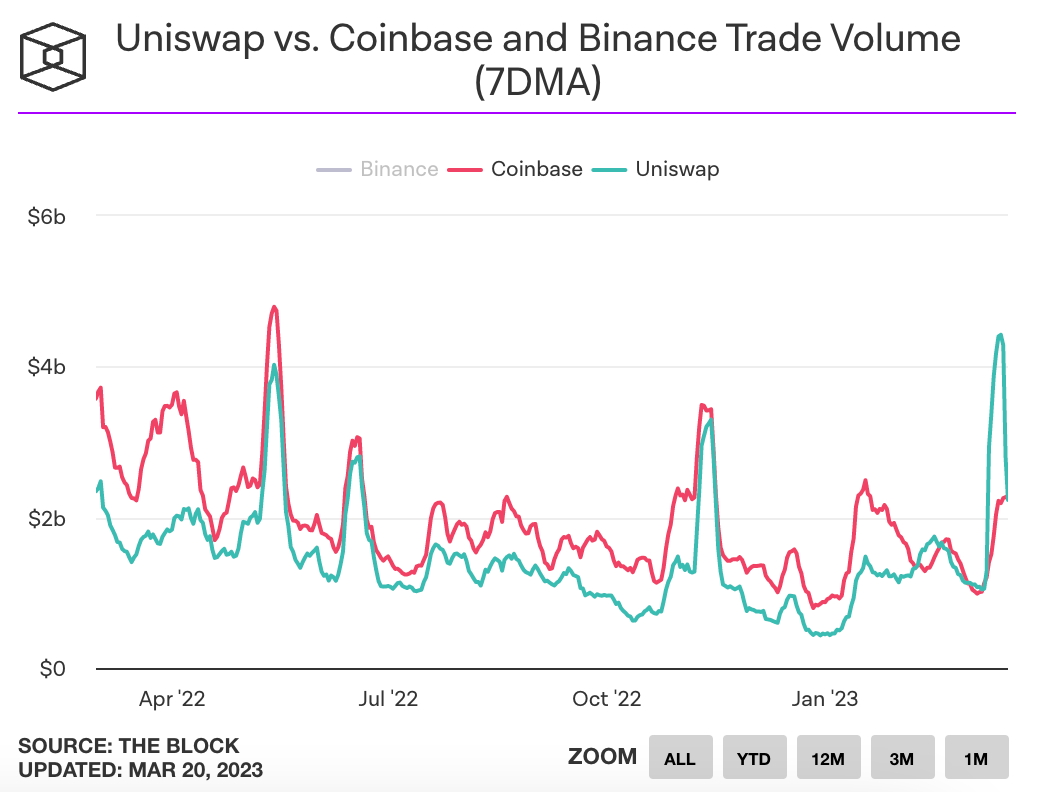

- USDC is the foundation of the DeFi world. So, when the depeg happens, everyone naturally flows to Uniswap to get rid of their USDC.

- Zooming out, Uniswap's trading volume is comparable to Coinbase, meaning DeFi will simply get more and more popularity. The next bull will see some significant upside for blue-chip DeFi protocols.

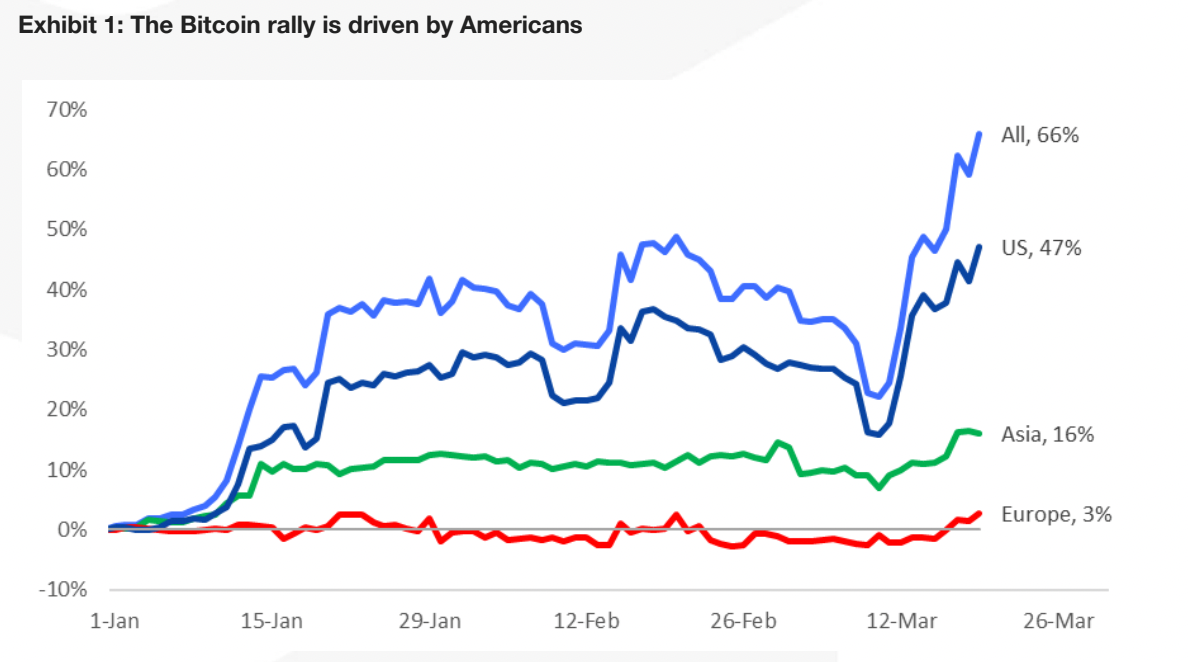

- This is so embarrassing for those who promoted the Chinese retail entry via Hong Kong's seemingly crypto friendly framework. Crypto is still largely an American-driven thing, shall we say? Those who said the Chinese were buying should be unfollowed immediately.

- Again, when we DYDR, we are still doing it with English media. Sorry, ser, please don't FOMO China.

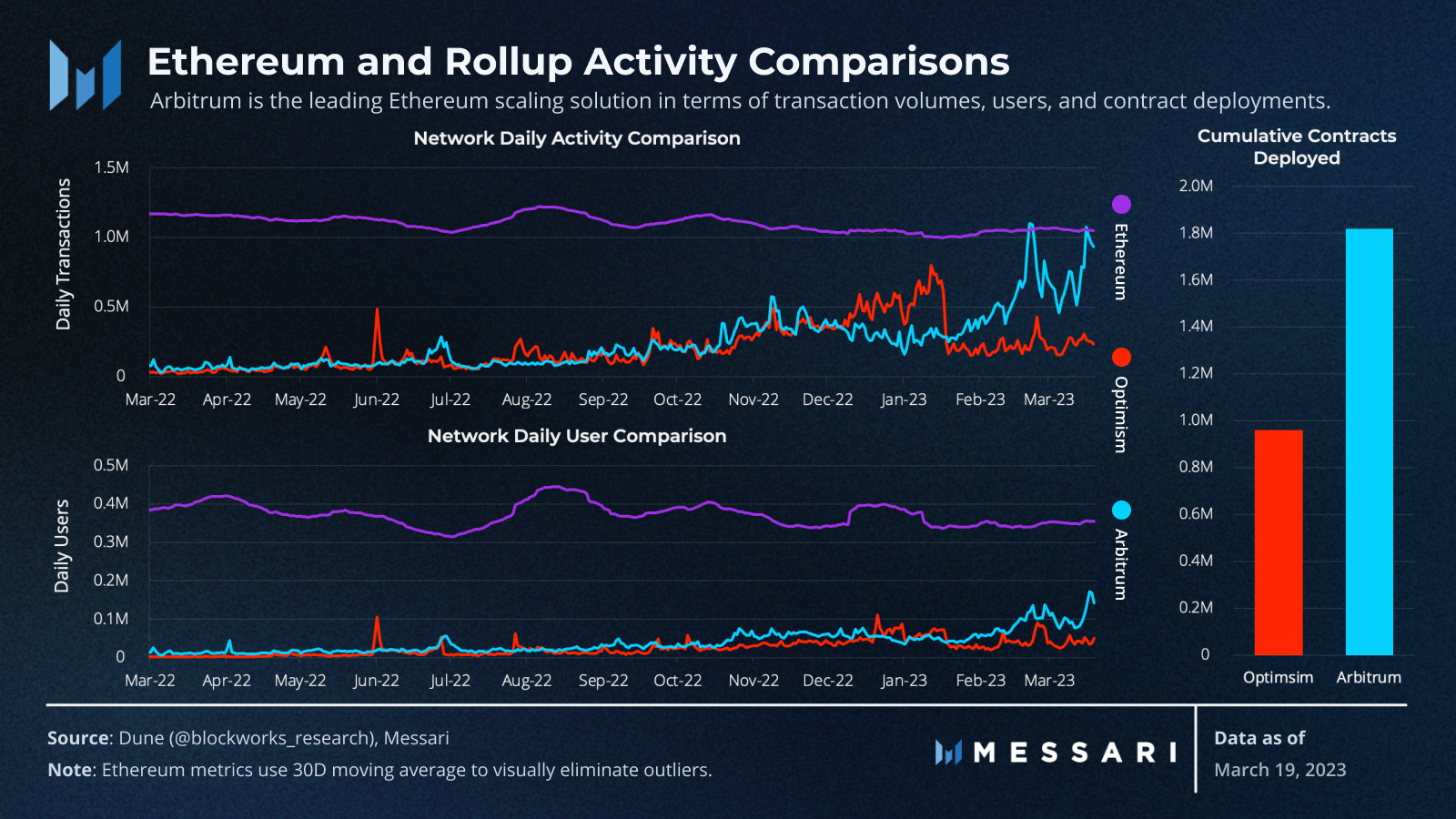

- Arbitrum and Layer 2s are hot. Zooming out, there is still a distance between them and Etheruem, though it's definitely something interesting to look at Arbitrum's ascension. Does it remind you of Polygon's narrative around 2 years ago?

🔢 Index

Bitcoin Fear and Greed Index is 59. Greed

— Bitcoin Fear and Greed Index (@BitcoinFear) March 28, 2023

Current price: $27,138 pic.twitter.com/wsKlug0vqz

- 🤔 BTC pumped almost unilaterally for 1 month. Altcoins haven't got the pump yet. And Fear index holding not bad. Still a bit high, but looking steady now.

Daily #CBBI status update:

— CBBI - ColinTalksCrypto Bitcoin Bull Run Index (@CBBI_daily) March 27, 2023

https://t.co/YpDBHLshNn

𝐂𝐎𝐍𝐅𝐈𝐃𝐄𝐍𝐂𝐄 𝐒𝐂𝐎𝐑𝐄: 2️⃣3️⃣

🗓 Mar 27th, 2023

The price of #Bitcoin is $27,927 pic.twitter.com/iKNdERzzmg

- Very good indicator that BTC is coming back. 7 points higher than last week. At least this is a sign of the bear is dead, though bull hasn't returned.

📰 Current affairs

Starfish Finance (💙,🧡):

BTC

ETH

Layer 1s/ Major DeFi

$BTC is going up but my #Altcoins aren't moving? What gives?

— Altcoin Sherpa (@AltcoinSherpa) March 20, 2023

Thread on where I think we're at in the market cycle and some context of 2020 for you with #Bitcoin and $ETH #Ethereum

Cliffs: If #BTC holds up, $ALTS are going to send strongly (eventually) pic.twitter.com/GxX4RemgPR

Sony has BIG PLANS for #NFTs & their Playstation 5.

— Altcoin Daily (@AltcoinDailyio) March 26, 2023

112 million+ Playstation users soon will get in game items on the blockchain.

Patents reveal this: pic.twitter.com/pX3DqHnoiB

While everyone is excited for $ARB listing, no one is aware of $ML listing.$ML is a BTC side chain token listing on the same day as $ARB.

— Hercules | DeFi (@Hercules_Defi) March 22, 2023

A thread on Mintlayer, a BTC Layer2 chain 🧵 pic.twitter.com/jXbqO2VQKZ

NFTs

Macro econ/ Regulations

Research reports/videos (DYOR)